I have a 6kW (24 panel) solar system on my roof.

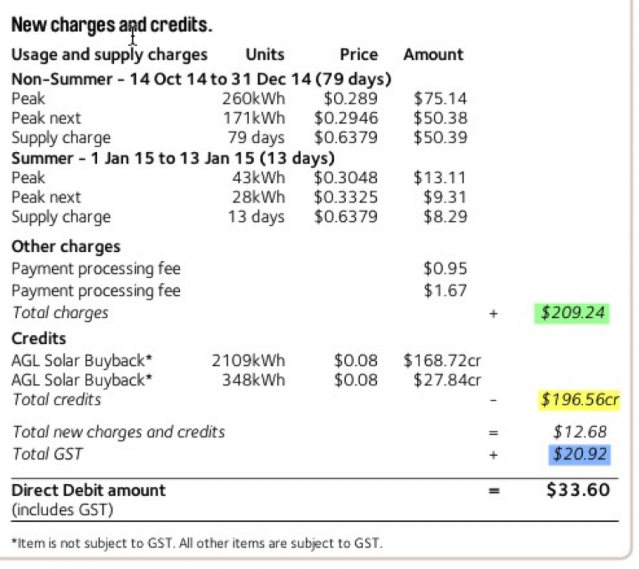

My last quarterly electricity bill is here. The good news is that it was for only $33.60.

The interesting thing is the breakdown of the $33.60. If you look at the bottom of the bill, I paid $12.68 in electricity charges but a whopping $20.92 in GST (highlighted in blue on the bill).

You don’t have to be great at maths to know that 10% of $12.68 is $1.27 not $20.92

So how does AGL get away with charging $20 GST on a $33 bill?

AGL have to follow rules set down by the ATO for collecting GST. Here’s how those rules apply:

A solar owner will export some solar electricity to the grid if, at any time, they are generating more electricity than they can use in their home.

In my case I exported 2,457 units of electricity at an agreed rate of $0.08 per unit. This means AGL have to pay me $196.56 for that electricity (highlighted in yellow on the bill)

At night solar owners will import any electricity they need from the grid. They have to pay the regular rates for this electricity. In my case I used 502 units at about $0.30 each. I also have to pay a fixed supply charge for 90 days. Add those 2 charges together and I owe AGL $209.24.

It would be nice if AGL subtracted what they owe me from what I owe them ($12.68) and charged me GST on that. But the ATO won’t let them.

The ATO’s logic is that, if AGL sells me something, then they have to charge GST on the full value. The credit is subtracted only after they have charged GST on the full value of the goods or services supplied. Hence the $20.92 GST on a $12.68 charge!

But there are substantial other savings in this bill that the ATO can’t tax me on!

An interesting thing about solar owners’ electricity bills is that most of their savings are not printed on the bill. To measure them you have to do your own detective work.

These are the savings that you get by ‘self consuming’ your own solar electricity.

Any of your solar electricity that you use in your home means that you don’t have to buy that electricity from the grid. If you are not buying anything then the ATO can’t add GST to it!

For example: using an energy monitor I worked out that I was self-consuming 10 units per day of my own solar electricity. This saves me $3.20 per day – or $300 per quarter. That’s $300 in quarterly savings that no one can tax me on.

RSS - Posts

RSS - Posts

It only takes a minute or so to work out the answer to your question. If you add the electricity which you purchased, to the electricity which you sold to AGL, then it comes to a bit over $200. You have to remit 10% of that figure to the ATO as GST., Because you are not using an ABN, AGL has to collect the GST from you for the electricity which they purchased from you, and remit it. They are simply doing your paperwork for you. And you are doing more than your fair share at producing renewable energy. Congratulations.

( wouldn’t it be magic, if we could purchase a couple of 10 kW LI battery packs to store the excess electricity? Then use it when needed, eliminating the transaction with AGL?

I bought batteries and electric companies say I cannot go off grid and have been charging me full price for the electricity from my batteries. I get 41cents credit for each bill . they also take the government rebates as payment for electricity. So batteries are a waste of money

We’re not aware of any electricity plans that work like that – if you’d like to work out what’s going on get in touch with us here and we can look into it.

I’d be a bit careful how far I pushed this one if I were you Finn, particularly if the ATO reads it. If you’re supplying solar power to AGL, then that’s presumably a taxable supply and you should be collecting GST and remitting it to the ATO. If you’re supplying as much solar as you say you are, it could be a pretty big bill!

Hi Davyd,

Thanks for your concern!

This blog post is not complaining. It is saying that AGL are calculating the GST I have to pay them correctly, despite it looking odd on the bill.

As my primary business is not electricity generation, I’m fairly sure that I don’t have to claim the $400 or so a year in credits I get from AGL as taxable income.

I’m happy for the ATO to read this and provide clarification!

Finn

If you were, logic would follow that you could claim the system itself as an income tax deduction. Which I imagine the ATO is not inclined to offer.

You don’t use much power Finn, you must live like a hermit in a cave.

I am retired and your quarterly bill sometimes resembles my monthly bill.

My quarter goes from $450.00 to $600.00 and I pay 21.97 cents a KWH then it goes to 22.17 so your tariffs had me wondering why they are so high?I don’t have different tariffs depending on time of year mine is just one flat tariff with hot water coming in at 8 cents a KWH which has always been the small part of my bill plus I get a 16% discount from AGL…I noticed no such discount on your bill ( I thought everyone was on a discount ).

I run two computers and two big screen TV’s and a 7:1 channel sound system hooked up to a amp, plus one load of dishes a day for 3 people and a washing machine every third day and the heat pump dryer every third day when I do the washing.

When my wife does it she hangs it on the line outside.All my lights are low energy bulbs.

My big expense is the air conditioner a ducted system pumping out 6KW so my big bills are summer and winter.

Still though my supply charge is $22.00 a month so no avoiding that one

I live in absolute comfort all year round with 3 kids and a partner. We run our business from the house too and have a 8kW Sauna.

Of course then you would be able to claim depreciation and perhaps get an investment allowance.

Its a mind field. I had an ABN and a photographic business but produced little income over the years so the tax department wrote to me removed the ABN and declared it was a hobby.

Hi Finn, Well you know the country is broke and we have to be milked as much

as possible. My calculation: $209.24 of power has been sold to you and there is 10% GST on that, i.e. 209.24 x .1 = $20.924 and since we round up or down as the case may be, your AGL GST tax bill should have been $20.93 and you can complain to AGL about one cent rebate.

There is only one solution, use all of your power yourself, not easy without storage. I read my meters 8 am and 5 pm, my daytime usage is 1/4 of my night time usage, and the sun don’t shine at night. If I have a 5 kW system, then I will be selling 3/4 of my generation to Ergon for a pittance. Do people realize that if they have a usage of say 28 kW/day then they probably only need a system to produce say 7 kW/day unless they are home all day running air con, fans, washers, lights etc.

Hi John,

OK – I’ll get my best lawyers onto that 1c they owe me!

Yes – it makes economic sense to size your system to cover daytime loads only – but bear in mind that a nice big system means your daytime use is more likely to be covered on overcast days and in winter, and all the excess you send back in summer may still be making a small profit, depending on what you paid for the system.

Also in a couple of years when batteries make much more sense, you’ll have plenty of capacity to charge them up, all year round.

Best Regards,

Finn

you may actually be returning the power to AGL so I doubt it would attract a GST as the GST has been charged for the full amount of power that was sold to you by AGL. its a tricky situation, maybe the government will read this and decide to impose a GST and grab a few more billion off solar owners to balance their budget.

Hi Finn,

Is this a residential address, without and ABN and not registered for GST?

If so the ATO has a current ruling on the solar systems. All income is not taxed.

Authorization Ruling number 92788 , so I am unsure how AGL can claim a GST credit or deduction. I am aware Gst is different to income.

Colin states

“Because you are not using an ABN, AGL has to collect the GST from you for the electricity which they purchased from you, and remit it.”

I disagree in the above statement or instance. It dosent happen in an Ergon network, where I am.

I agree you must pay the GST on the energy purchased. The energy sold back is GST free at a residential address, if you are not registered for GST or an ABN.

Ruling 92788

The scheme commences on:

1 July 2007

Relevant facts and circumstances

You have a solar electric system on the roof of your principal residence.

You are not registered for GST

You intend to expand your current system.

Under the legislation, the electricity retailer will be required to credit you 50.05 cents/kwh for the electricity exported to the grid.

Your purpose for installing your current system was to offset the cost of electricity now and in the future, and to contribute to

greenhouse emission reductions.

Your reasons for wishing to expand your system are to offset 100% of the electricity consumed in your home and to generate

income from a green source.

Relevant legislative provisions

Income Tax Assessment Act 1997 Section 8-1.

Income Tax Assessment Act 1997 Section 6-5.

Income Tax Assessment Act 1997 Section 6-10.

Unless this has changed ?

Terry

Do you have anything further to help identify the Authorization Ruling Number 92788. I am trying to lay hands on a copy but can not find anything further. Does the document have any other identifying numbers etc?

Over and above my last comment.

I agree you should still pay the $20.92 in GST as it is on the energy you purchased. Has nothing to do upon further investigation on the energy sold back.

.

I agree with Terry Davis, Don’t whine Finn, pay it and be happy that there is no

GST on the SUN, yet!

Look we need schools, hospitals, roads etc., for heaven sake the government has to find the money somewhere. Just ask the government not to waste it.

I am a battling pensioner with 4 young children and no bank account with money. If you are loaded, then don’t worry about parting with a little dough.

john Nielsen, Silkwood.

It’s interesting how a piece of information, intended to provide clarity to people who may be asking the very same question, can result in such a convoluted response!

John N, with respect, you have completely missed the point; I don’t believe Finn was ‘whining’, he was explaining why AGL had to charge GST on the total power purchased.

It has nothing directly to do with raising revenue for infrastructure, or about pensioners,having money or not having money. It’s simply about the rules governing GST under the Federal Financial Regulations Act 2009.

Thanks for the advice you provide Finn; extremely helpful indeed.

Thank you Fiona! No I was not whining (for a change!). I was simply answering a question that I get a lot of emails about. Namely “Why am I charged GST on electricity that I have not been charged for?”.

I personally think the retailers are behaving correctly in this instance.

To all and anyone I have offended, I sincerely apologize. It is our democratic right to express our opinions and I do so often, however I don’t se that I have the right to attach anyone personally. I have leant a lot from this forum, and if I need a spanking, I’ll take it.

john nielsen

Hi Finn,

The utility grid should have been sold off while there still might have been a purchaser. Just because I drive past the Pizza shop on my way home doesn’t mean that I have to stop and purchase a Pizza. Just because a private owned utility grid passes in front of my property doesn’t mean that I must purchase power from them, does it? But when the government owns the grid, well, that is another storey and believe me, they are meeting right now to find out how they can screw those defecting the grid. So even if you are disconnected from the grid, they will be searching for a legal way to bill you.

In the beginning you were allowed 5 kw or more, and paid about 44 cents FIT. Now they are doing all things possible to stop you from having solar installed, why? because they are going broke. Can the government go broke? Well paying 91 million a day in interest on our debt, isn’t that heading for broke?

I would suggest to the grid: let us be connected to the grid with as much solar as we like, charge us for any power we use, but don’t pay us for any power we send to the grid. Someone with a high day time usage might need a 6 kw system, and thus would be balancing the consumption as to send as little as possible if any to the grid but what is sent to the grid is given away free, and thus the power generators can scale down their output accordingly. The person with the 6 kw system might also plan for some night time power and could need only a very small battery bank, not necessarily enough to carry thought the night, as it might be cheaper to purchase some night time power from the grid. I think both the grid and the consumer could win that way but if the grid philosophy as it is now continues, there will, in the not so distant future, be a major defection from the grid. What will happen to people in rented houses and units?

john nielsen

Hi Finn,

Your 6 kW system exported 2457 kWh over 92 days?? That is on top of the self consumed power??

That is a lot isn’t it? How many sun hours do you get in your area?

Yes – those numbers are correct. My 6kW system can easily generate > 35kWh on a summer’s day.

Top quality panels with a genuine positive power tolerance. Good microinverters. North facing. And the 15 degree tilt favours summer generation. Although the winter numbers are very good too.

I’m in Adelaide.

Hope That Helps,

Finn

That’s true my 5KW produces 30KW per day but I can’t use it because when I switch my air on at 12 or 1 or 2 I have a short fall of 1.5KW to run the air .Outside that peak it gets worse so even though in the morning I am exporting to the grid I am actually importing once the air goes on .

Surely it’s better to import 1.5kW than import 5kW?

In WA you are not allowed to have a battery storage system and be connected to the grid. Legislation to change that is still a way off. It is an artificial constriction of the market and prevents any citizen dodging the GST.

You can have battery storage off grid, when it has nothing to do with the state owned power providers.

Now Alinta is owned by overseas, mostly Hong Kong based, investment companies it will be interesting to see if the governments attitude will change. or will they continue to pander to overseas commercial interests at the expense of their own citizens.

Greg

If we consider owning solar panels as a business that generates money and the owner had an ABN, then wouldn’t it be correct for the owner to charge the electricity company 10% GST for the amount of the buyback? And if the amount earnt at the end of the financial year is a profit for the solar power owner, wouldn’t the ATO only then have to expect any tax to be paid? Wouldn’t that be the fair solution. As things are, the gst is being charged unfairly on the said amount and the ATO is profiting unfairly from it.

Just a couple of flaws in your reasoning Nick, but in general terms what you are saying is spot on. You would have to have an ABN AND be registered for GST, enabling you to claim input tax credits (GST on what you have purchased) and pay GST on what you have supplied (sold). Any profits made would also involve you in paying income tax at the end of the year, and the GST situation would be monthly, quarterly or perhaps annually. The ATO is not profiting from the GST – they are only the collection body, the GST is a state based tax collected by the feds (through the ATO) and distributed back to the states. Here in Victoria, our pollies are always whinging about the share of GST we get back from what is raised in Victoria – I think currently 93 or 94 cents in every dollar. The balance subsidises other states. The whole position is a can of worms and I too am having trouble checking the accounts from Red Energy.