There has been much gnashing of teeth and rending of garments over the so-called “Sun Tax”. But initial analysis from SolarQuotes based on real-world data indicates the impact will cost less than a carton of beer a year for most solar power system owners affected by it.

While two-way pricing on solar exports introduced by some electricity distributors has been incorrectly named a “sun tax”, the label has stuck. Two-way pricing takes a carrot and stick approach – charges (basically a feed-in tariff reduction) between 10am and 3pm to encourage more solar energy self-consumption, and rewards (a feed-in tariff boost) for exporting to the grid when it needs it most late in the afternoons through to late evenings.

Sun tax hype is pushing some solar system owners to consider a home battery.

“There are lots of good reasons to justify buying a home battery in 2024,” says SolarQuotes founder Finn Peacock. “Avoiding the ‘Sun Tax’ is not one of them.”

SQ Sun Tax Calculator – Initial Analysis

SolarQuotes recently launched an easy-to-use Sun Tax calculator; explained in detail here. Since that time, it’s had enough use for us to start getting an idea of how much two-way tariffs will impact system owners if they are subjected to it. Currently it’s just based on Ausgrid’s (NSW) two-way pricing structure1, which is:

- 10am to 3pm = Feed-in Tariff (FiT) reduced by 1.2c / kWh

- 4pm to 9pm = FiT increased by 2.3c / kWh

- Charge-free monthly export threshold of 192kWh – 212 kWh, depending on the month2

… and assumes an electricity retailer passes the charge/reward rates on in full.

Average cost impact over a year – peanuts

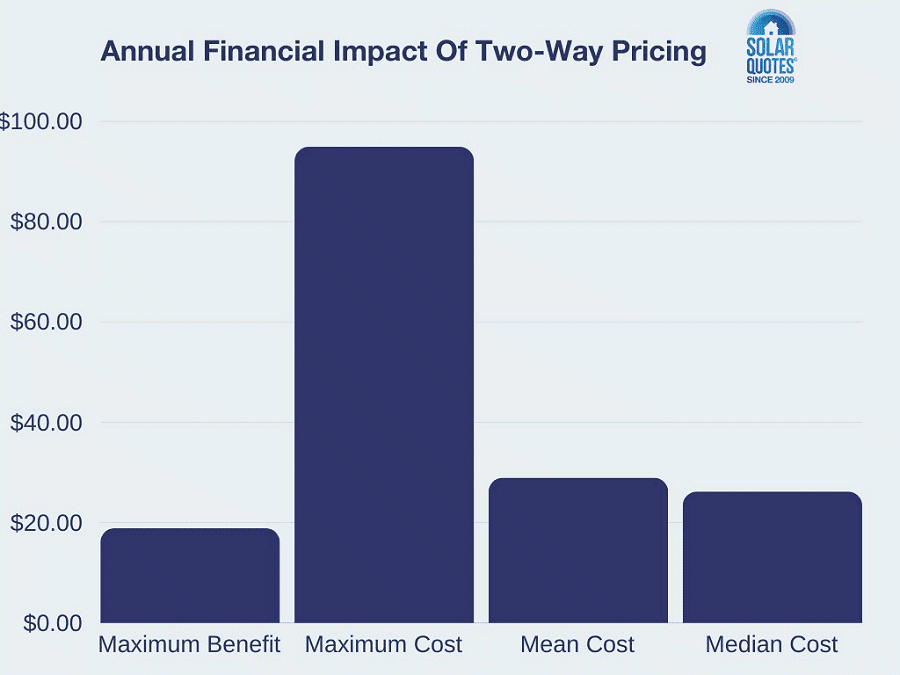

Around 58% of people who used the calculator live in NSW. But here’s how the numbers look (charges minus rewards) if Ausgrid’s two-way pricing applied across Australia; based on 122 records:

- Maximum Benefit: $18.88

- Maximum Cost: $94.92

- Mean Cost $28.96

- Median Cost: $26.19

So, the average cost impact on a bill – or total feed-in tariff reduction (however you want to look at it) – was $28.96 over a year, or around 8c a day.

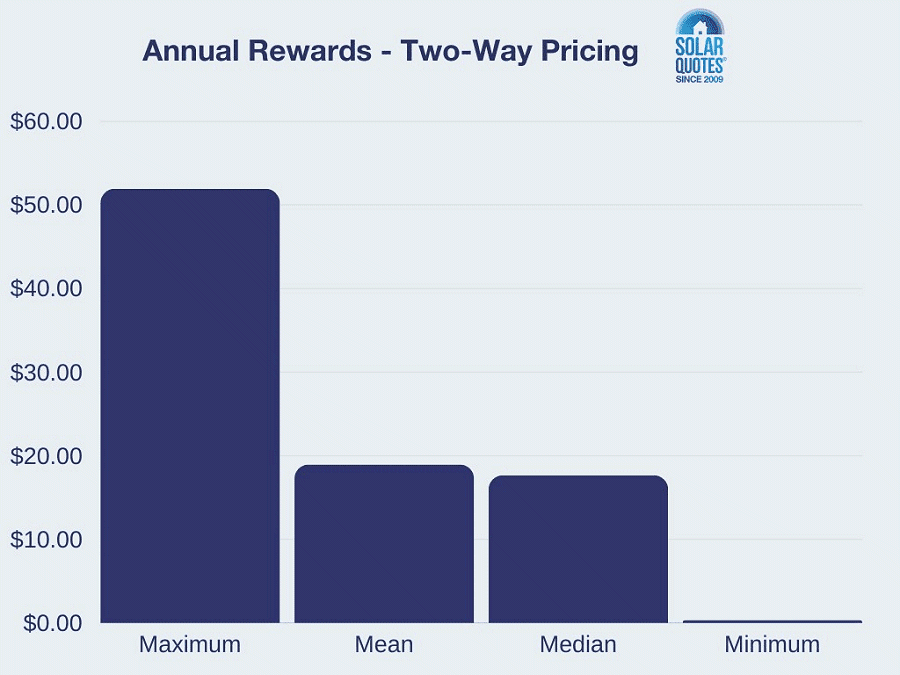

Just looking at the rewards aspect, again over a year:

- Maximum: $51.93

- Mean: $18.96

- Median: $17.66

- Minimum: $0.34

The average system capacity across the dataset was a bit over 9.2kW. The user with the maximum cost ($94.92) piqued our interest, so we dug deeper. It was a 15kW system owner in South Australia on an 8.5c feed-in tariff. Some further details on that instance:

- Feed in tariff credit over 12 months: $1,605.55

- After two-way pricing: $1,510.63

- Total Charges: $133.99

- Total Rewards: $39.06

- Total Annual Feed-In Tariff Impact: -$94.92

Even in this outlier instance, if the owner was to buy a battery purely out of a misplaced “sun tax” fear, payback (for example) on a Tesla Powerwall would take around 112 years based solely on the current charge component. Powerwall’s a great battery, but the chances of one lasting that long are somewhere between Buckley’s and none.

Of course, there are other benefits from batteries, particularly in this age of less than stellar feed-in tariffs. But this just illustrates that two-way pricing shouldn’t be the primary motivator for acquiring one. For system owners who are considering a solar battery, here’s a list of other common mistakes to avoid.

Crunching Numbers Is Crucial

The results above are based on a small data set – we encourage Australia solar owners to give the Sun Tax calculator a whirl so we (and you) can gain a better understanding of two-way tariff potential impacts.

And before you take the plunge on a battery purchase, try the SQ “add battery” calculator to determine how much home energy storage might save you and the estimated simple payback period.

RSS - Posts

RSS - Posts

I think you’ve missed that in NSW (Sydney at least) many retailers have just chosen to drop their FiT from 7c to 5c or even 4c.

So for me the impact has been a touch over $300 a year, according to energy made easy on my last 12 months of usage.

Bob Moore.

I note with interest the comments above. Synergy in WA advised that if you upgrade then you loose the “7cents/unit” and get 0.02cents per unit from 9pm to 3pm the next day for power generated and exported into the grid. Did I say upgrade. My first system was installed 13yrs ago and received good benefits.

My original system was 2 KW, which is not available or every installer is reluctant to install. Yes 3 is bigger than 2 even if I used the smallest system available. NOW this is the kicker– 3pm to 9pm you get 10cents per unit. The sun goes down in the summer in Perth at 6.45pm. the benefit to the user is for only 2.45hrs. I questioned what happens to the 2.15 hrs of the day for 10c a unit. Synergy customer service advice was ” Use the benefits of daylight saving to get a better return” The person gets paid to give advice.” WA DOES NOT HAD DAYLIGHT”. He must be one of the bright ones working for Synergy Power.

Same here in Brisbane:

From Oct 1, feedin rates drop from 15c/kwh up to 15kwh to 10c up to just 12kwh. While anything over drops from 6.6c to 4.6c

That’s way more than the “Sun Tax” Finn has calculated!

If it achieves so little, then why do it?

The answer is of course that the numbers will change over the years, forcing those with solar to spend big on a battery

‘A carton of beer’, now $60 in regional SA and rising.

Please get a new AI image generator for your thumbnails, these are getting old fast. There are lots of options out there.

Can’t we turn our solar feed of at 10am every day

Sheldon you can get export limited systems but the cost of retrofitting is likely to be a lot more than you’ll save in any reasonable timeframe.

Anthony,

What about if you do have a battery. E.g. a Tesla Powerwall allows you to ‘Go Off-Grid.’ You could do this until 3pm / start of peak each day.

It’s not the numbers , at least not for now, it’s the betrayal by governments who force fed us a product with political noise and tax funded incentives but did not tell us this was coming . And solar is a multi year investment, this trend to penalise the consumer will get worse, the tariffs will be moving I suspect yearly and not in the favour of those of us tricked by governments into going into debt and drawing down savings, to install these systems . Confidence has been undermined, it’s economics 101, undermined confidence equals lower demand

Once again, paranoia reigns supreme, it seems to me. No government is deliberately deceiving anyone. If you thought about it, as lots and lots of people installed solar and the overall market started to absorb both supply and demand changes, it was obvious that the previous high feed in tariffs (in my previous house in Canberra I was receiving 55c a kwh for gross generation on a 20 year contract.

I never expected anything that good when I moved to the Mid-north Coast and my feed in rates have dropped over time. In my new house I get 12c a kwh up to 5kw per phase on a 9.2kw/7.1kw Fronius 3 phase inverter with a good plan from ENGINE which gives me an additional discount for NRMA my feed ins are paid at 12c/kwh – 6c kwh if I exceed the 5kw limit.

In 6 years since it has paid for itself so whatever I get from output and any feed in tariffs is a bonus, even when my use increases in future. However, my large system cost no more than my 2kw system many years ago. So there is no comparison between then and now.

I have no complaints and when I shift to an EV I will be able to charge during the day. Not a problem even if Engie adopt this type of variable tariff.

Well argued Patrick!

Peter, the real abrogation occurred decades ago when the government’s collectively sold off their power generation and distribution networks.

We went from a system which prioritised reliability to one motivated by return on investment for shareholders. They are best served by having supply shortages rather than excess.

If government’s had not added incentives for households to take up roof top solar we would be well behind now. I looked at solar back in the early 2000’s and it was tens of thousands of dollars for a tiny system. Now a quality system is around the $1000 per kWh. What has now happened is inevitable and puts paid to those who recently were advocating for the largest system you could afford as opposed to matching your needs.

The next big complaint will be from early adopters of battery vehicles when the government introduces a km tax to make up for the loss in fuel exercise.

Ian – I agree with your point about selling the power generation and distribution assets leading to a shift in investment and utilisation priorities by the new private owners. In particular the introduction of competition into these markets also led to the pricing competition limiting funds for investment and creating short term approaches to generation and network development. This was at a time of significant increase in power demand due to significantly increasing population, housing growth, industrial expansion and more intensive electricity use both domestically and in industry.

However, prior to that time the governments, mainly the states, had not been keeping up with long term investment in generation and distribution and were faced with the problems of how to fund the investments they knew were needed. So most sold them off and washed their hands of the problems. Politically, they would have faced major problems funding the needed investments particularly if they were to take a forward looking approach.

As to anyone buying an EV then complaining about the imposition of some kind of usage charge to offset fuel excise in the future, I have little sympathy as the issue is well known and already openly discussed. It is another problem that will have to be solved, and soon. I will buy an EV in the next few years and absolutely expect to pay some sort of charge to replace the excise on the fuel I no longer use. And while I am not eligible, I suggest the current FBT exemption should also tail off as EVs become a larger share of the new car market. I think the reasons are pretty obvious.

I concur with all your points. And you are correct in that EV owners should not complain as some type of tax was always on the horizon, however, as shown in this debate, and on several Facebook posts, there will be much complaining

The BIG issue is that “Fuel Excise” has not been used on roads and infrastructure bridges and such. I believe only about 45% was handed down to states to use and then the states further diluted the spend.

As part of the Tesla Owners Club of Australia – we did a submission to the Fed government about “Fuel Efficiency standards’ .. My view and it turned out to be true … political hot potato .. so SUV are exempt.

The “Fuel Excise” is a very poorly targeted general tax but easy to collect and unavoidable … that is why governments love it.

Remember, the Federal Government also funds the national highways. And I am not aware, but happy to be corrected, that fuel excise was only meant to be spent on roads.

The whole road funding issue is far more complex anyway than “this being raised and spent only on that”.

Nevertheless we have strayed a long way from the original post about the so called “Sun Tax”. So perhaps we can get back to that.

No matter how much anyone winges FIT will reduce to nothing as renewables eventually completely dominate the grid, EVs will end up displacing ICE vehicles including in road transport and the tax system will have to be adjusted to ensure sufficient taxes are raised (remember, we are a relatively low taxing country compared to other OECD countries yet for the amounts we raise in tax our spending is comparatively efficient) to pay for the increasing demand for services of our demanding and aging country.

It really is as simple as that.

Bravo Patrick,

Well put.

People don’t seem to realise that in Scandinavian countries, you pay half your income as tax, and it gives you the right to thump the counter and recieve better services. It’ll be interesting to see if feed in tariffs recover a bit as more storage comes on to the network and more EVs are taken up.

Ian, the comment: “The next big complaint will be from early adopters of battery vehicles when the government introduces a km tax to make up for the loss in fuel exercise.” is a bit behind the times. Such a tax was introduced by the profligate and deeply indebted Victorian state government a few years ago, but had to be rescinded when two people took them to court, and it was found unlawful.

The grid, if available, is still the cheapest battery, and rooftop feed-in is being indulged when there is only a FiT reduction during solar overproduction, as commercial generators pay (are “fined”) for unwanted midday feed-in.

Last I looked, lithium ore prices have dropped by a factor of 6 since the 2022 peak, as mines pop up everywhere, but a little bit of looking is needed to find reduced retail battery prices. They’re becoming a grid-scale commodity now, retail cheapness is building if you look hard enough.

The 350 MW/700 MWh Joel Joel grid battery was govt approved in 9 weeks, and will be dwarfed by the next one coming through the pipe, i.e bigger and faster up every month. Global energy transition spending: Us$1T last year, over US$2T this year, struggling toward the US$5T/yr needed for only +1.5 degC. We won’t make it, and that will be uncomfortable – at times very, as extremes amplify more quickly than the average.

And the slow learners who haven’t seen the need for haste these last decades will in the 2030s bewail the delayed action. But they will reap much cheaper batteries. 😉

I can only consider any charge to export my power is the beginning of the ” thin edge of the wedge” As this sets the precedent and of course no guarantees it can’t be increased in the future. Which experience will tell anyone that it is very likely.

Exposure to the wholesale prices changes the value proposition of a home battery. The ROI can become attractive but you are at sea along with the gentailers.

The current very stable prices are not making me any money at the moment. But I can charge the car every day for nothing (and get paid to charge sometimes). Feed-in has been -4 to -8 cents every day with a supply price of -2 to 2 cents.

My 5kWp of PV solar is well balanced with my home battery (now that I’ve upgraded it from 9kWh to 15kWh). I don’t need to curtail solar much at all as most of the PV generation goes into my battery while the feed-in is negative and I’m at home most of the time so I can soak up the overflow in my car or with the pool pump or dish washer etc etc.

I use my own energy management system (EMHASS) that also controls other deferrable loads in the house like pool pump and EV charging. So it’s all automated.

With the 9kWh battery (and the experimental Ausgrid two way tariff of -3 and +26) this led to a $230 credit electricity bill for the last 12 months (compared to $1000 PA debit on the sonnen VPP and $3000 PA with no PV or battery at all).

With spot trading my 2018 $20k system has a 7 year ROI.

But the profits were made when the feed-in tariff hit +$18 per kWh in unstable times which occurred every month or two. Looking forward to more high prices especially now with 15kWh to sell.

After making $230 for the year I coughed up another $3300 to upgrade my battery from 9 to 15 kWh as I could see the negative feed-in and even negative supply tariffs continuing with the ever growing solar systems being built.

The complexity of my energy management system is beyond most households so that is a major barrier to homes spot trading on the NEM. You have to have a system that uses complex maths to predict the daily energy flows and manage the big consumers of energy in the home automatically.

However this is what has to be concurred if V2G is to be a success.

This article from AFR won’t help. https://www.afr.com/policy/energy-and-climate/homeowners-rush-to-buy-batteries-to-avoid-sun-tax-20240821-p5k447

A lawyer (smile) is protecting his financial future by spending thousands on a battery to save thousands in “sun tax”. It is disappointing how skewed the Press can be

The sooner V2G comes the better

The BIG effect is not about $ but the effect it will have to significantly reduce Solar panel installations.. and the transition to renewables. It couldn’t have been better planned to stick the “knife” into people’s ambition to install sooar

All Ausgrid needs to do to absorb the majority of excess solar is move the ‘ripple’ timing for off-peak Controlled Load hot water to 10am-3pm.

This “Sun Tax” is just another way to rip-off consumers, how long before the “stick” charge is greater than the total FIT?

Also why does the “carrot” reward start at 4pm and not 3pm? (Ausgrid TOU peak rate starts at 3pm-9pm)

Ausgrid are just pushing for consumers to purchase home batteries, so that they don’t have to fund and supply community batteries.

Another free ride for the Generators, Distributors and Retailers just like consumer funded rooftop PV.

Yep on the hot water.an obvious solution

I receive 44c pkh plus 5cents pkh from the retailer on my 30 kW install in Qld. Will I be affected by this idea? In good faith I invested heavily initially at the exhort of the Qld Govt to make this investment. I would feel very let down if the contracted return was diminished after a subsequent change of rules

I am beginning to believe that perhaps the best way forward for home owners ers to take the upper hand agai St rising costs from government and power companies…. turn our solar OFF….

Electricity has become an open market yet home owners are not paid markets rates and now this insane talk of a tax if we supply too much….

Power to the People…. if, as a collective we turn our solar off at determined times… see how they go trying to dictate the terms !!

Power to the People.

You can get wholesale rates if you want. There are a number of suppliers that expose the wholesale market. That’s how I get my power bill into the black. Charge during the day and sell in the evening. But you only make money when network instability leads to spikes in the tariffs. Like $18 per kWh for an hour or two each month. Take a look at Amber Electric.

Interesting thought Dean, how can this be accomplished and would it work?

Hi Bob,

While I’m no Ghandi, Mandella nor Cory Aquino (People Power),

it does seem with todays social media network, organising a mass ‘statement’ should put some power in the hands of the people.

If, we, as a collective, decide to turn off our solar (there is a big switch on your PV Invertor), this will limit (stop) the supply of power back to the grid.

For me, 1 week, is a good start; that should not effect anyone’s finances but will show power suppliers, WE, the people, have a say. Perhaps 1 month of our PV’s turned off would let them know that they really need to think their plans through.

If, the power companies and government regulators think they can just keep charging more for electricity for profit and green washing, by taking advantage of the working class, while not spending on future infrastructure because of their inept budgeting skills, they need to be reminded that WE, the people, can put power in our own hands,

Putting power back in the peoples hands will remind them that:

1) Elected officials are put in their role to do the best for the people who elected them

2) Giving control of what we all believe is an absolute necessity, to corporations with profit over principle, is not something the Australian people will stand for.

None of our public utilities should be sold off to organisations who focus on profit over supply to your people. Sadly, this has been seen as a failure in many nations. And yes, I take on board lack of competition breeds complacency and inefficiencies, but, allowing the core of your nations strength to be driven by profiteering is not the answer.

What happens when this current push of relying on rooftop solar sees the decline of the solar panels?? Mine are 13 years old. Who pays for the replacement of the panels on my roof, your roof?? Some can afford it, some cant and some simply wont. Then what?

Shut down coal, avoid nuclear all while our roof top solar panels continue to age – where do we stand??

In the DARK !

Hi Dean,

My Dad has always wondered if you could organise a run on one of the big 4 banks to “teach them a lesson” but if you want to do the same for the energy network then there’s a good chance you’ll do some damage and everyone will pay for that.

Our power has to be exercised with letters to your local member and electing ones that aren’t beholden to vested interests.

Hi Anthony,

I do agree. Violence is never the answer. But sometime one needs to push back.

I’m sure you are familiar with the idiom – ‘never argue with and idiot’… or stupidity.

I feel that this current ‘green washing’ move by government policy and power company profits is not the long term answer. I feel that writing letters and arguing with them, is not going to change their points of view.

The human race is going to need more and more electricity especially as we continue to move into this new electronic age. Putting in place short term solutions for a quick ‘green’ solution is not the answer.

And don’t get me started on the contradiction of Australia turning off it’s coal fired power stations while we still sell coal to India and China by the boat load !! We are paying a premium for electricity, yet we own all the coal??

Yes, our per capita foot print is high, but we Australian’s are few compared to our coal customers who are not really concerned about their footprint when finding your next meal is more of a priority, which I completely understand.

The planet is changing, and regardless of whether we are responsible or it is part of a natural process, we must ensure we are not left in a worse state.

As a people, we need to ensure that our elected officials are acting for the best interests of the people, now and into the future. And if that means pushing back firmly, then, that is what we need to do.

I see very little long term planning occurring in the energy sector.

Don’t get me wrong, I applaud green energy and support it whole heartedly, but I don’t want to see it mismanaged by profiteering corporations apply pressure on governments for their own short term interests and not the interests of the people and the future.

Writing letters is nice, shooting people is bad.

There is a middle ground and it is time for the power to be in the hands of the people.

Power to the People – at a reasonable price with a plan for longevity.

Dean

I couldn’t have a more different opinion to you. Why? Because my three phase 9.2kw solar (no battery as it makes no financial sense) has paid for itself after 5 years and I searched out the best plan which means I pay nothing for electricity. I keep much of my usage to during the day when the system was pumping out plenty of kws. None of this was hard or expensive to do. Whenever adding anything new, I think about how to fit it into this pattern eg a new water heater is resistive on a timer. And I don’t skimp on usage as I don’t need to – I heat and cool the house to be comfortable.

From now on, whatever the FIT I will still be ahead and always have plenty of power. Any short term grid outage is just a minor inconvenience and far, far better than when I grew up in Adelaide. Remember gas and electricity failures, strikes etc which were reasonably common. I certainly do. Life didn’t collapse then and doesn’t now.

So where is the problem you speak of?

Battery does pay for itself. I was getting paid $3 per kWh last night (I’m on the wholesale tariffs) and dumping my battery to the grid to take advantage of that spike and charging the car through the day yesterday and running the dishwasher and washing machine etc and paying nothing for it as the supply tariff was $0 through the day.

I used to pay $2600 a year for electricity and $100 a week for petrol, $700 for gas through winter. Now I pay nothing for electricity and petrol (in fact I was in credit $230 last financial year). Still pay for gas but not $700 for heating as I use hvac now.

Thats well over $3k a year savings and my solar and battery were installed 5 years ago for $20k. I recon I’ll get a reasonable ROI in 7 years.

Hi Robert,

Thanks for the real world example. It’s so important that people speak up and offer first hand evidence that this energy transition isn’t just a sales scam, it’s a triple bottom line winner for all concerned.

Except the energy companies, poor petals, they’re finding it harder to farm us and harvest profits at will. Again it’s important to refute the Fear Uncertainty and Doubt that the incumbent fossil burners are so keen to sow. FUD is the tactic used by big tobacco to fight off the health messages which damage their business. FUD is increasingly the tool of choice for those pushing needless and economically irrational nuclear energy.

Feels good to take all this money and stick it back in your own pocket, instead of going to the petrol station and setting fire to it.

Cheers

Before this “sun tax” was imposed I elected to go on to the trial “sun tax” (AKA two way tariff).

The current two way tariff is:

10am – 3pm subtract 1.2c/kWh from the FiT (and ST)

4pm – 9pm add 2.3c/kWh to the FiT (and ST)

The previous trial was something like

10am – 2pm 2c

2pm – 8pm 26.58c

Now that was protrude good. But you end up making most of the money on exports when the tariffs go up to $19/kWh on really hot evenings or when there’s an outage in generation somewhere. That’s when you pay for the entire month on one night.

Now when V2G comes in everybody should be doing this spot teasing to flatten the duck curve out and make electricity cheap for everybody.

maybe we have to start mining btc with the excess energy after all.cost of a rig anyone ?

The only one that winners here are solar installer and electricity company.

Sold a lemon now will need to pay for more to fix that lemon or shut it down.

Installer now spruiking battery. They will never pay for itself even with subsidies.

Electricity company now buying our solar for 1.4c/kW current price later we will be paying for the privilege of senting to back to the grid. To sell it back to us when we need it at night for 25 times as much (32c/kw).

I will be shutting down my lemon (solar panel when that happens)

Likely this is the ploy make you pay for home solar battery. Later they will expect use to share your storage capacity and we can draw from them to feed

the grid when it is need.

No longer will be a mugg. If I put in battery will disconnect from the grid. They can buy from me at 30c/kw.

Hi Peter,

Solar isn’t a lemon. It’s actually the cheapest electricity ever generated. Making good use of it means using it when it’s available. And that’s about educating the consumer to shift their consumption into the daytime. Nobody complained that off peak energy was cheap overnight, they devised water heaters that would use it. Well, now the “off peak” is in the middle of the day and it’s free.

Unless you have some very understanding neighbours and an appetite for pouring diesel into a generator that wails through winter evenings, going off grid is madness.

Like roads, sewers and Medicare, the grid is a public good and nothing positive will come from abandoning it. You’ll pay more for a larger solar system and batteries, that will spend a lot of time doing very little. Everyone else will pay more for the grid which doesn’t have ans many customers to defray the fixed costs.

If you want cheaper grid electricity then you need to vote for those with an appetite to either properly tax or renationalise the assets, and treat them as a public service, not a cash cow.

https://www.solarquotes.com.au/blog/stealing-electricity/

I agree, I needed (past tense) educating, no one told me I would ever pay to export solar when I installed it. So there’s the education gap but it’s too late.

The Green Party’s version of a ‘property tax’ ( ie anyone who owns their home has to pay a %levy based on its net realisable market value that’s reviewed every) is simply unworkable, and will ultimately lead to social devastation on a grand scale.

Many pensioners do own their residences that they live in outright. That’s simply because they avoided outlays on such things as – overseas trips, buying brand new cars that decline in value by about 30% when a new model is released, don’t go to luxury restraints unless its a very significant family occasion, grow their own veges etc etc. over most of their lifetime.

Most have limited income, but manage to get by without being much of a burden on society.

Quite simply, to add a levy based on a fluctuating value of their home – that they already pay rates,,maintenance and repair costs, insurance etc on – is akin to making them also pay rent to a landlord on top of all those existing expenses..

Many won’t have the cash flow to do so, after paying both the above and their energy costs..

Those so affected will EITHER have to go into expensive retirement villages or aged persons homes etc until their savings run out altogether because of the rip-off level of charges , OR live on the street aa a homeless person. You probably talking around 2 – 4 million people being affected,

It’s a totally nonsense proposal, Most have no intention of selling their home, regardless of its value, simply because they have long established relationships with neighbours, close friends who live nearby, Many also provide unpaid volunteer assistance to various charitable services.

Simplistic stupidity squared.

.

Hi Des,

Did you realise that tax concessions in superannuation are a very effective way to reduce tax paid. ie a tax problem is a nice problem to have so if you put extra money into super you can drop your tax from the top marginal rate to 30c (for memory)

Anyway it’s the top 5% who claim about $45billion in tax concessions on super, which is about the same amount of money needed to fund the *entire* aged pension.

Franking credits, where you get paid a cash refund on tax you never paid in the first place costs billions more.

Meanwhile Australian housing is some if the most expensive in the world because we’ve allowed speculators to decouple the utility value of having a roof over your head and instead they’re robbing everyone by driving the monetary value of realestate to double every seven years as productivity falls & wages stagnate.

Current policies are simply unsustainable.

That;s fine, and I’m well aware of the more current tax benefits relating to superannuation that apply today. However…once you reach an above pension age, you progressively have to reduce your financial risk profile as you age further.

That’s because if there is some kind of share market price collapse ( or sharp decline) then the odds of the market bouncing back within your remaining life span steadily reduce..

I’m not saying pensioners shouldn’t have some % of listed shares in their overall investment portfolio, But I’ve been around long enough to see more than one steep decline in share prices, and of course total losses of capital due to investment in the more exotic products around today.(NFTs, bitcoin type products, options on futures, inadequately hedged foreign currencies etc)

The relative proportions of listed shares in a portfolio should ideally reflect your age, the types of companies you invest in, (eg Woolworths vs a just launched enterprise with no prior history) & the level of risk you are personally comfortable with.

Commonsense suggests to me that what you invest in at (say) ages 25, 40, 50, 60+ and the associated risk profiles at such time points, needs to be at least given some consideration.

But that;s only an opinion on my part, and should in no way be taken as any kind of investment advice that should be followed.by anyone..

Feel perfectly free to invest in USSR rouble and UK equities if you want to.

Alleged ‘speculators’ get blamed for everything. However, what underpins the current high house prices is largely due to a ‘supply; issue which is steadily affecting a growing number of potential home owners.

If anything, the number of ‘speculators’ has already been considerably reduced by personal bankruptcies and forced sales because many such people thought low interest rates would last forever.

Quite apart from individual speculators, some large property developer firms who are also in a sense ‘speculators’ of a somewhat different and usually far more expert kind, have already gone bust or significantly reduced their scope of operations..

.

Hi Des,

Australia’s housing affordability is diabolical. Electricity prices aren’t helping and neither are the sheer number of renters who can’t access solar because the landlord isn’t interesting in installing it.

It needs long term planning, like the 20 year premium feed in tariff schemes introduced around 2008 for solar power. However housing is beset by short termism and governments are gun-shy about doing anything because scare campaigns on something as simple as grandfathering negative gearing will win or lose elections.

We’re reaping the rewards of 40 years of greed, privatisation & mean spirted cuts.

Tesla & South Australian Housing Trust made progress putting solar and batteries onto houses for low income houses & making a VPP out of the whole fleet, providing great benefits to the electricity grid and everyone in the state. Government needs to do this on a much larger scale.

In the 10 years after WWII, state housing authorities built almost 100,000 dwellings – about 1 in 7 of all houses built during that period. The NSW Housing Commission alone built almost 38,000 dwellings, 18% of all housing built in NSW.

In 1956, Menzies took 30% of commonwealth funds from public housing to subsidize private home ownership.

Public housing completions declined to about 9% of all dwellings.

State authorities began selling off much of the public housing stock, sometimes selling more than they built in a year.

1970s onwards:

Conservative governments turned against public housing, focus shifted from housing workers & families to people on social welfare or unemployed.

Construction of new public housing is currently at its lowest rate in 40 years.

Existing public housing stock is severely underfunded.

The average Sydney local government area lost 30% of its public housing between 2006 and 2021.

Public housing now accounts for only 67% (298,000 dwellings) of social housing in Australia, down from 84% (341,000 dwellings) in 2006.

Some numbers from our system. August 2013 we had a 5KVa solar system installed to our home, cost $5,990 fitted, it payed itself off in 5 years. 2019 we had a tesla 2 Powerwall installed, cost $15,000 South Australia Government rebate $6,000 total cost fitted and commissioned $9,000. These are our readings taken 19/12/24… Solar input 34.9MWh, Home usage 30.2 MWh, Grid usage Imported 6.5MWh, Exported 9.6MWh, Battery discharge 10.2MWh, Charged 11.8MWh. Total savings over 60 months $11,280, 78% self sufficient.

Not bad Alan, not bad!

Make sure you tell everyone in the comments section of any nuclear energy plan.

https://www.amber.com.au/

I’m curious whether the SQ brains trust thinks that with more grid-level storage coming online, the FIT trend downwards may actually reverse, if the owners of the big batteries are looking for spare capacity to fill them with?

Call Nick,

Grid level storage is coming on thick and fast at the moment and the speed is only picking up as the price of batteries falls. Right now the arbitrage is when prices go negative in the middle of the day because coal has to stay online 24/7. As we see more coal retire then the operators of grid scale batteries are already eating into the profits of expensive gas peakers. At the moment, it’s the price of gas that dictates the final price of all electricity in any 5 minute bid window.

Personally, I’d like to see an avoided cost model where feed in tariffs are based on delivering the electricity at the bottom end of the network. However, I’ve seen evidence where entire suburbs are running district substations backwards, so the electricity networks are becoming truly bidirectional.

Half the cost of electricity goes to your retailer.

I think we will see some interesting trends in FIT payments over time as coal exits the grid, storage of renewables increases and diversifies further – “batteries” come in various forms including pumped hydro and others – and then eventually gas retreats as a peaking and continuous supply.

None of this means that our solar was a waste of money as its initial cost will be paid for in the early years and then down the track it will still be saving people money by not having to pay for incoming electricity.

In my view this kerfuffle about the absurdly called “sun tax” is just hysteria and as this article shows, the impact is minimal and far outweighed by the benefits of installed solar.

This forum is full of solutions to mitigate , thanks to all those thinkers, I no doubt will end up spending vast sums of aud which will go offshore to a Chinese company for an ev with a smart charger But nothing anyone has said detracts from the fact that I was lied to by omission , I would not have installed solar regardless of whether it’s 1 dollar or 1000 dollars pa feed in tariff, if I knew it was coming. And many potential new customers will no doubt feel the same and now not install solar , regardless of the dollar value of the impost.

Hi Peter,

The 44c premium feed in tariff schemes were introduced with a 20 year life because in 2008 solar was at least $5/watt just for panels. A 1kW system retailed for $12,000 so people wanted surety for their investment.

Those early adopters have been paid off quite well but the industry & policy makers didn’t envisage just how fast the price of solar would fall.

It’s not unlike the uptake of any other technology. Cars, radio, TV, mobile phones.

You remember Kodak? They were perfectly profitable in 2000 & went broke in 2012… but nobody stopped taking photos.

I’d commend you to watch this…

https://m.youtube.com/watch?v=2b3ttqYDwF0

I installed solar in 2023, just last year, August. I’m not disputing the reasoning behind fit. It’s just that No one told me about fit but all the parties involved, particularly the government fed and state must have known only 12 months ago. This blatant lack of disclosure leaves a very sour taste and I will be very wary with any further solar projects , not because of what’s in a spreadsheet but because of a palpable distrust I now have , what’s the next surprise , how much will it cost me, will it make my solar investment less viable , the stock market falters during periods of grave uncertainty, so do I.

While

I like the two way tariffs as they tilt the export value in favour of battery owners and I’ve had a battery for 5 years.

I don’t like the demand tariff, especially when it starts at 3PM when the sun is high in the sky and the supply tariff is so low?

Just doesn’t make sense. Ausgrid will take the highest consumption peak of the month within the demand tariff window (something like 3pm to 8pm) and multiply that by some arbitrary figure and add that to the bill as well.

Not a problem except it starts at 3pm when the supply tariff is like 3cents and all you want to do is charge the EV.

Why penalise people for consuming energy when it’s cheap. That’s like shaking your hand and slapping you at the same time.

It does not matter what the charge is for exporting excess solar power back into the grid, It is not the point, being charged to feed electricity back into the grid is nothing more than profiteering by the energy providers.

It would appear to me they are just coming up with ideas to stop paying you for your energy one way or another soon there will not be any feed-in

Just be aware that the 2 way charge is a charge from the DNSP to the Retailer. The retailer is the entity that bills you and decides what to pay you for your feed in.

Sorry Anthony, but I must disagree on your take on franking credits.

The principle they are based on is that company profits ought not be taxed twice.

One way this could be done is for dividends to be treated as a business expense to be taxed only in the hands of the recipient at their marginal rate.

In practice, it is actually done differently so that that portion of the profits to be paid as dividends is taxed at the company rate, so the shareholder gets, currently, 30% lower dividends, plus a tax credit (franking credit) for the tax already paid. The franking credit is added to the taxpayer’s income and the whole then taxed at the marginal rate but with a tax credit for the tax already paid.

Hi Brian,

As far as I was aware there’s only 4 countries that offer franking credits and of those, John Howard was the only one on earth who thought it would be a good idea to give cash refunds on tax that’s never paid in the first instance. ie if you’re retired you get cheques from the ATO. It’s the same kind of economic genius/wanton vandalism that saw our LNG sold off on long term contracts that aren’t indexed to inflation or the oil price.

Qatar exports nearly as much gas and they make TWENTY FIVE TIMES more revenue than we do.

Australians are being stiffed from every direction. While we cant afford proper school funding, apparently it’s ok to pay franking credits because a “tax problem” is something no individual shareholder should have to bear.

We export 82% of Australian gas, there’s more gas used to liquefy gas for export than we use in the entire domestic electricity generating fleet… and because without a reservation we pay international market price for gas, and the electricity market is arguably broken, it’s gas generators that set the price of electricity.

We shouldn’t complain though, expensive gas drives more interest in solar, which speeds the much needed energy transition.

I’ve owned a 2012 electric motor scooter (from USA), and recently purchased an Australian made electric motor scooter. The old one needed to have its batteries replaced, but then it died of other causes, so I’ve got a set (or two actually – the old AND the new) of batteries which are still useable. I also have 6.6 kW of rooftop solar and 11kWh of SLA batteries. If I was being subject to the sun tax, my thought would be to attach my new batteries to my house batteries (the old ones have been on for a year or so via a BMS) and use those batteries to store sunlight solely to push the power back to the grid for the 10c or whatever. I think this would achieve two things – it would reduce the amount of power I send to the grid off-peak, and give a return on the batteries I’ve already paid for. Anybody who replaces the batteries in their EV might be able to do the same. Just a thought.

In mid-November I moved onto the final stage of recycling my scooter batteries. I purchased an MPPT controller (EAsun) and a couple of 120 watt 12 volt solar panels to replace the ones installed in 2004 in my initial (experimental?) off-grid backup. Approaching Christmas I’ve been able to effectively go off-grid for the house by opening the circuit breaker on my power-board, and from 16 Nov I’ve had 19 days where I’ve imported no power from the grid, whilst still exporting in both peak and off-peak hours. In Western Australia’s very sunny summer, all my batteries are fully charged before midday. My next power bill is due within a week. Be interesting to compare to 12 months ago.