How much deposit can solar installers request – and does compulsory insurance apply? Find out in our state-by-state (and territory) guide.

In this blog post, I reveal the maximum deposit solar installers can legally ask for. This information wasn’t easy to obtain. I began by searching the websites of state and territory government departments and—for the most part—failed. This may come as a shock to you, but the internet doesn’t always contain accurate information.

This left me with no choice other than to pick up a phone and call a large number of government departments. Now I’ve survived that experience, I’ll not only tell you what they said but I’ll also rate their hold music from 1 to 10.

If you just want a quick summary and aren’t interested in the details of deposits or the mental torture I went through to get them, skip to the end of the article.

Deposit Limits Are Based On Full Contract Prices

Maximum deposit limits in states and territories are based on the full contract price of solar systems. This is the price before it’s reduced by STCs.

If the letters “STCs” confuse you, don’t worry. They simply stand for “Small-scale Technology Certificates” that are part of the solar rebate, which isn’t really a rebate but a financial incentive, and its real name is the Small-scale Renewable Energy Scheme or SRES, which is a SRESiously difficult acronym to remember.

Now you’re no longer confused, I’ll give an example of how it works:

If you get a quote for a 10 kilowatt solar system that costs $9,000, this will be the price after the value of STCs is subtracted. For most Australians, in 2024, the STCs on a 10 kilowatt solar system will lower its price by about $3,450. Assuming that is the reduction, the full contract price of the 10kW solar system would be $9,000 plus $3,450 which comes to a total of $12,450. Because any legal maximum deposit will be based on this full price, if the maximum is 20%, the installer could legally ask for up to $2,490 as a deposit.

A 10% Deposit After Rebate Is Common

While installers can often legally ask for more, the most common deposit for solar is 10% of the system’s price after STCs reduce it. So, if the customer is paying $9,000 for a system with a full contract price of $12,450, the usual deposit would be $900.

Requesting a deposit of 10% of what the customer pays is a rule of thumb for installers rather than an actual rule, but it is very common and what we recommend. If your installer asks for a higher deposit than this, it doesn’t mean they are doing anything wrong, but you may want to ask them why it’s more than the usual amount.

Some not unreasonable reasons to ask for a larger than normal deposit include:

- You live beyond a black stump

- You’ve requested hardware the installer doesn’t normally stock

- The roof is high enough off the ground to require additional safety equipment, cherry picker rental, etc.

Image credit: Jet Solar Pty Ltd

Compulsory Building Insurance For Solar In NSW & Maybe WA

When I called the government departments, I asked if solar installations were covered by compulsory building insurance. I found out that it rarely applies.

The clear exception is NSW, where a solar installation must be covered by Home Building Compensation Cover if the total cost is $20,000 or more.

The unclear exception is Western Australia where a solar installation over $20,000 may require compulsory Home Indemnity Insurance — or it may not. I asked for hard and fast guidelines, but they only told me things that were floppy and slow. If you get a system in WA that is $20,000 or more before the price is adjusted by STCs, you’ll have to talk to your installer about it.

QLD – 20% Maximum Deposit

The first government department I called was the Queensland Building and Construction Commission (QBCC). They told me installing solar counts as building work but it’s not covered by compulsory insurance under the Queensland Home Warranty scheme. They also let me know the maximum deposit an installer can legally ask for is 20% of the full price of a solar system.

Hold Music Rating: After listening to an automated message I pressed a number and was put straight through to a human. I didn’t even get to hear their hold music. For this, I rate the QBCC miracle/10.

NSW – 10% Maximum Deposit, Insurance If $20,000+

According to the NSW Home Building Amendment ACT 2014, the maximum deposit allowed is 10%.

The NSW Government Department of Fair Trading states the same 10% maximum on this page on contracts, and again on this page specifically about solar.

If the total cost of labour and materials exceeds $20,000 before the value of STCs are subtracted from the price, then the installer must provide you with a certificate of cover under the Home Building Compensation scheme.

Hold Music Rating: Because NSW was the only state that had all the relevant information clearly laid out online, I didn’t have to call anyone at all. For this reason, I’ll give them a rating of ultra-miracle/10.

SA – No Limit Under $12,000

I called the SA Consumer and Business Services and was told solar isn’t covered by building indemnity insurance. They also told me about the state’s deposit limits, which are:

- No limit under $12,000

- Maximum of $1,000 deposit from $12,000 to $20,000

- Deposit limit of 5% for amounts over $20,000

Hold Music Rating: I called at 3:05pm and they answered at 4:15pm. Fortunately, it was on the same day, so I was only on hold for 1 hour and 10 minutes. In South Australia, it was chime time, and that’s what I listened to all the while I was on hold. I was given the option of having them call me back, but I was enraptured. Around the 1 hour mark, I hallucinated I was in a forest of chiming crystals played by fairies. I snapped back to reality when the phone was answered, but they put me on hold again after two minutes. Insanity/10.

Tasmania – No deposit limit

I called Tasmania’s Consumer Building and Occupational Services and was told there’s no maximum deposit for solar, so deposit amounts are negotiated. There’s no compulsory building insurance scheme because Tasmania got rid of it, but one may be reintroduced in the future.

Hold Music Rating: I was on hold for six minutes, but I can’t even remember what the music was like because my mind was blown by their pre-recorded message, “Please be advised that advice given in this call is only general in nature.” What? If I can’t get a precise answer on government policy from a government department, who the hell does know? Can I just make it up myself? Should I get Tasmanians to vote on it? Confusion/10.

Victoria – No deposit limit

First, I called the Victorian Managed Insurance Authority (VMIA) to find out if solar counts as building work covered under Domestic Building Insurance. They said it wasn’t. The next step was to contact Consumer Affairs Victoria to find out if there was a deposit limit, and they said there isn’t. The deposit amount is negotiated between the solar installer and the customer.

Hold Music Rating: The VMIA put me on hold for six minutes, and this white boy found their music funky. But it only played for 10 seconds before being interrupted by a message, so I didn’t have time to bust out my best dance moves. For this reason, I can only rate it 2/10. Consumer Affairs Victoria put me on hold for 8 minutes. Their music was chill and played for 30-second stretches, but didn’t possess adequate levels of funk. 4/10.

Western Australia – Maybe 6.5% for $7,500 & up, maybe 20%

In WA, if a solar system’s total contract price is under $7,500, there’s no maximum deposit limit; the amount is negotiated.

If the amount is between $7,500 and $500,000, then the maximum deposit limit is 6.5%—probably. Two people at the WA Department of Energy, Mines, Industry Regulation and Safety told me this. But while they thought this was the maximum deposit limit for solar installations, neither was 100% sure.

The figure they gave is what normally applies for building work, but I was told that cabinet makers are an exception and they can ask for a maximum deposit of 20% because most of their work is done offsite. When I pointed out that solar installation was similar because the hardware is made offsite, I was told it was possible they could have the same limit as cabinet makers. But giving a definite answer was apparently as far beyond their power as plucking the sun from the sky.

Most solar systems installed in WA without batteries have a total contract price of under $7,500 and so don’t have a maximum deposit limit. On this page, the WA Commissioner for Consumer Protection recommends paying no more than about a 10% deposit for home renovation or maintenance work under this amount.

Image credit: PSW Energy

Hold Music Rating: While they weren’t good at giving definite answers, they were good at answering the phone, so I was never on hold for long. But the first time I called the hold music was so bland it was like something the mirror-universe Rick Astley would write to accompany his song, Always Going To Give You Up. Negative several billion/10.

ACT – No deposit limit

I called the ACT Planning Department and was told there’s no maximum deposit limit. So it’s negotiable, but hopefully, you’ll just be asked for 10% of the purchase price.

Hold Music Rating: I wasn’t put on hold! I called first thing in the morning, so it wasn’t quite a miracle, but I’ll still rate it as God is on my side/10.

NT – No deposit limit

The Northern Territory’s Consumer Affairs told me there’s no maximum deposit limit.

Hold Music Rating: I was put on hold for just 3 seconds! It was over so fast, I have no idea what they played. I know it was contrapuntal music, but what isn’t these days? That’s all kids these days have listened to since the Renaissance. I rate this damn! I’m on a roll!/10.

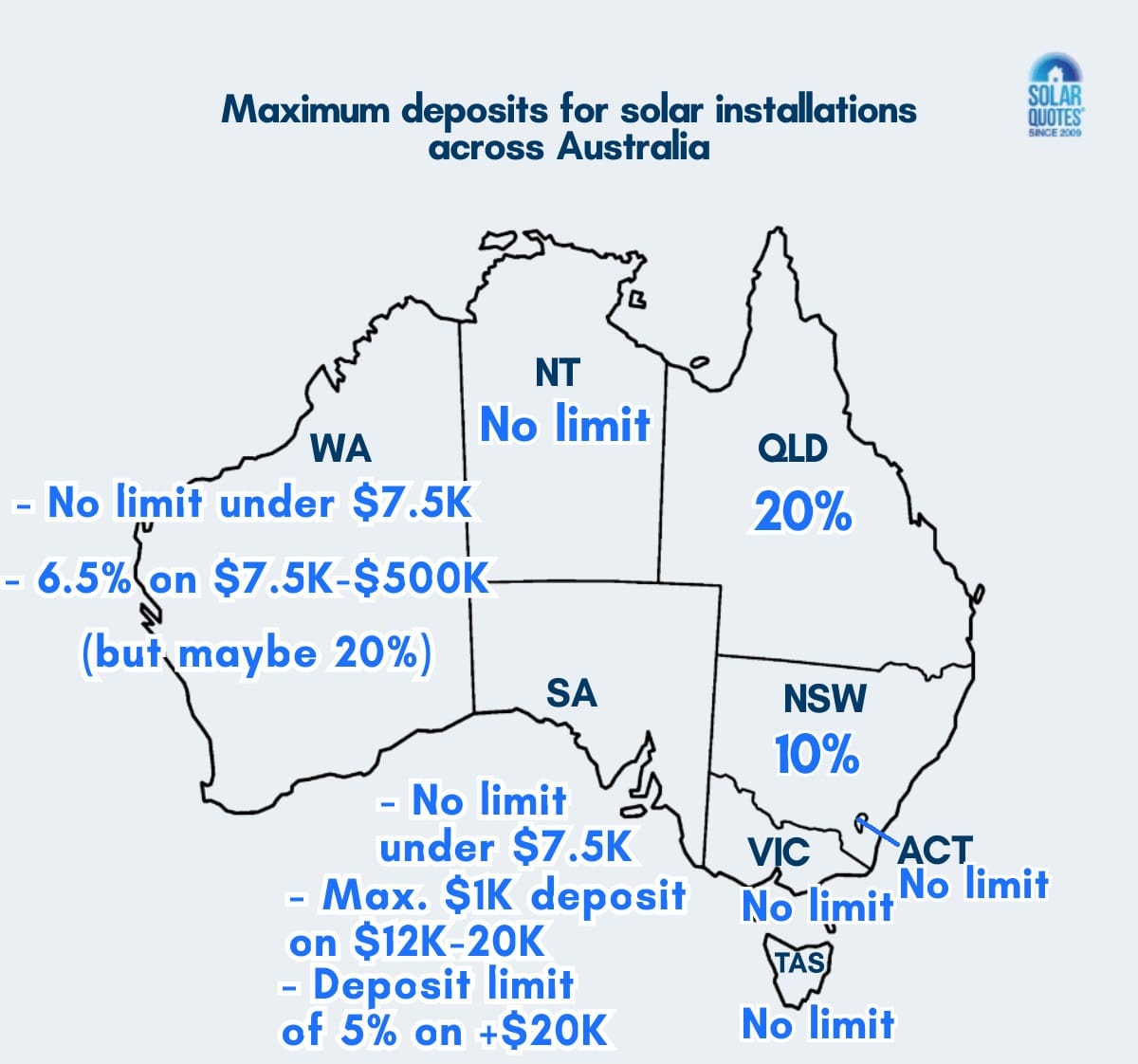

Maximum Deposit Summary

Putting all the maximum deposit limits for full contract prices into a list gives:

- QLD: 20%

- NSW: 10%

- SA: No limit under $12,000. Maximum $1,000 deposit from $12,000-$20,000. Deposit limit of 5% if over $20,000.

- TAS: No deposit limit

- VIC: No deposit limit

- WA: No deposit limit under $7,500. Probably 6.5% for amounts from $7,500 to $500,000 – but maybe 20%.

- ACT: No deposit limit

- NT: No deposit limit

Compulsory Insurance Summary

The state where compulsory insurance can definitely apply and the state where it may apply are:

- NSW: Home Building Compensation cover is required if the total cost is $20,000 or more

- WA: Home Indemnity Insurance MAY be required if the total cost is over $20,000

Hold Music Summary

If all government departments were required to play a continuous loop of Waltzing Matilda or Wollongong the Brave as their hold music, it would be an overall improvement.

RSS - Posts

RSS - Posts

Aunty Jack for the win. Used to know it word for word. “Girt by sea, on one side”.

thanks as always for the interesting interestingly-put information – what about if its for a business customer? presumably all just deposit-by-negotiation and no home building insurance.

Thanks Ronald, a very informative and humorous article! I love the wait time in SA where I live. What do they do all the time? Perhaps the functionary had to finish washing the dog (whilst working from home) before s/he could answer the phone.

Following is re NSW. If you had a system installed, then had the same company add extra panels and a battery to a system they had just finished installing, would they be allowed to charge 25% deposit for the installation of the battery and extra panels?

Would just addition of a battery allow a 25% deposit? What about a full system that included a battery?

Shorter version, does the inclusion of a battery in works magically exempt the installer from deposit rules in NSW?

While I love Aunty Jack, there is a song by Denis Leary that might be a better fit for that hold music?

As far as I am aware, 10% is the maximum deposit allowed in NSW for batteries or other home improvements. Here’s a NSW info page on contracts:

https://www.fairtrading.nsw.gov.au/housing-and-property/building-and-renovating/preparing-to-build-and-renovate/contracts

And I think I can guess which Denis Leary song you’re referring to…

Thanks Ronald. That’s what I thought. Just because there is a battery involved doesn’t mean the rules don’t apply.

I would suggest a general email to all NSW SQ installers to remind them of the requirements of this act regarding deposits is needed. Same regarding insurance. At least one of them charges a higher deposit for installs including a battery.

A very interesting and informative tale.

There in lies an endemic problem with rules.

When the government makes the rules but doesn’t know what they are, it always ends up in grief for the taxpayers.

Rules like these should be Australia wide so that are easy to understand and abide by.

Similarly if road rules were uniform across the states and territories, it would likely reduce the road toll.

Anyway, in my cynical mind I’m convinced the government likes to make simple things complicated, so it keeps the money rolling in somewhere and somehow.

If things were uniform, imagine how much money would be saved.

As for being on hold for so long, well that seems to be the norm these days. What makes it worse is that people don’t respect that the callers time is just as important !

If you want the information buddy, you’ll stay on hold until I’ve finished my tea break and I’m good and ready to answer the phone !

My dream is that one day customers will again be treated as customers, rather than being treated as an inconvenience.

Coupled with getting black and white answers to questions such as yours will make everyone’s life simpler.

It is a fascinating article, however, the music reviews are insufficient to induce me to make any phone calls!

While it is good that the rules have been laid out, it would be nice to know the particular legislation or regulation for each state – ‘I read it on a website’ is not quite as convincing as being able to quote the relevant legislation.

Please Andrew,

Go right ahead and list the legislation for us, it’ll save a lot of time and effort we’ve have to spend rehabilitating Ronald after this article 😉

If 20% is the maximum deposit that can be asked for in Queensland, then in my recent 3 quotes obtained through Solar Quotes in South East Queensland, one of the suppliers was obviously gaming the system.

Their paperwork said they required a $500 deposit when the contract was signed, then a further 50% of contract price when they ordered the components (obviously before they would start work on site).

Obviously that knocked them straight out of the assessment process as far as i was concerned anyway. No way was i taking the risk of losing 50%, plus $500 of my money, if they disappeared overnight.

Hi Jack,

Most likely ignorance of the rules (which are quite hard to find) rather than gaming the system – but please let us know the details at [email protected] and we’ll check it out.

Finn

Done!

Hi, Queensland solar installer here. While the QBCC are correct that to just retail solar and subcontract the install it counts as building work. However as electrical contractors we are only governed by the Electrical Safety Office, no QBCC licence required for installations so not bound by their regulations for deposits. Cheers.

What about demanding full price before beginning work.

I paid $500. deposit.

When they gave an estimated time of commencement of work, about 6 to 8 weeks out, they wanted the rest, I stalled. The way I’ve worked with contractors in past is to pay them a deposit on signing, another payment when materials turn up on site. I then paid them the remainder minus $3000.00. Usually I pay the rest on completion of job.

The start date was moved forward but wouldn’t start until they were paid the balance. I paid.

It was installed on the 30th July..

It’s still not finished.

It wasn’t working when they left. They tried to convince me it was.

There’s still more to this story.

When it’s actually finished I’ll finish the story.

PS. I’ve spent 50 odd years in the electric game around the world and never seen anything like this. Reminds me of the insulation fiasco

Hi Mike,

Please let us know the upshot and be sure to leave reviews as you see fit, via this link. https://www.solarquotes.com.au/solar-reviews/

I can’t help but also point out the campaign which led Australians to automatically associate the term “pink batts” with failure is really a triumph of propaganda.

There were 4 workplace deaths, 3 of which were using products that had already been banned because of the risk.

Under the scheme, the insulation industry was an order of magnitude safer, house fires per hundred installation fell significantly.

Houses were insulated and will forever be cheaper to run and more comfortable to live in.

As a stimulus measure, speed was of the essence, the opening tranches shovelled money out the door quickly to keep the economy moving.

Waste was reduced as it progressed. Investment in plant, machinery, businesses and training rose significantly.

The tragedy being that these small businesses were hung out to dry when the scheme became politically untenable.

Thanks for the postscript … not often we’re given a decent summary of the ‘pink batts’ Murdoch et al op.