South Australia’s gone from embarrassingly expensive to the cheapest wholesale electricity in just 10 years.

Over the past 12 months wholesale electricity prices have tumbled across Australia. For the nation overall, they’re the lowest they’ve been for nine years. But one state did particularly well and a large part of its success was because it now generates over 60% of its electricity from wind and solar.

South Australia’s average wholesale electricity spot price has been the lowest of all the states so far this financial year. This was despite it being the only state to increase electricity consumption. This is a major change from the days when SA regularly had the nation’s most expensive wholesale electricity.

Two reasons why wholesale electricity prices have fallen so far:

- The COVID-19 related economic slowdown.

- The expansion of renewable generation — including rooftop solar.

While we can expect wholesale electricity prices to rise after COVID is defeated, I doubt we’ll ever see a return to the high prices we had pre-pandemic. The low cost of renewable generation and the falling cost of battery storage will make sure of it.

What Are Wholesale Electricity Prices?

Wholesale electricity prices are what generators are paid for supplying electrical energy to the grid. They’re also the main component of solar feed-in tariffs. There are two ways wholesale prices are set:

- Through long term contracts.

- By the wholesale electricity market.

The wholesale electricity prices we end up paying are a combination of the two. The details of the contracts are secret, so the figures I use in this article are wholesale market spot price averages. They should be close to the actual average wholesale prices.

2020-21 Financial Year So Far

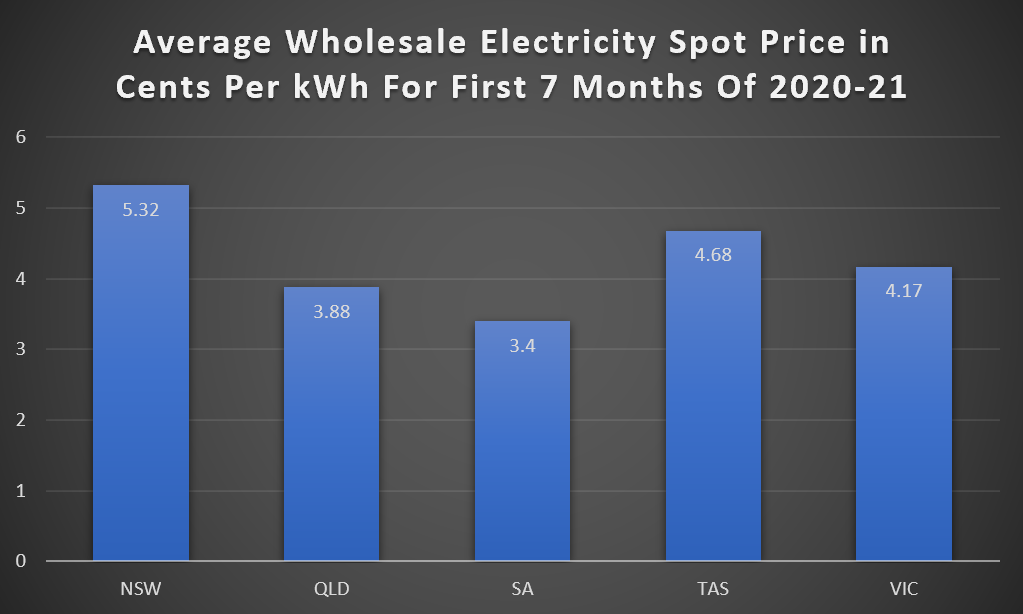

The graph below shows average wholesale spot prices for the first 7 months of this financial year in cents per kilowatt-hour:

As you can see, the lowest priced wholesale electricity is in South Australia, with Queensland taking second place.

The keen-eyed among you may have noticed I omitted the left third of Australia. This isn’t because I hate Western Australia. It’s completely unrelated to my hatred for the hyperthermia state. It’s because information on WA wholesale electricity prices is hard to find. The information I do have suggests wholesale prices are definitely not cheap and it’s likely to be the most expensive state.

Historical Wholesale Prices

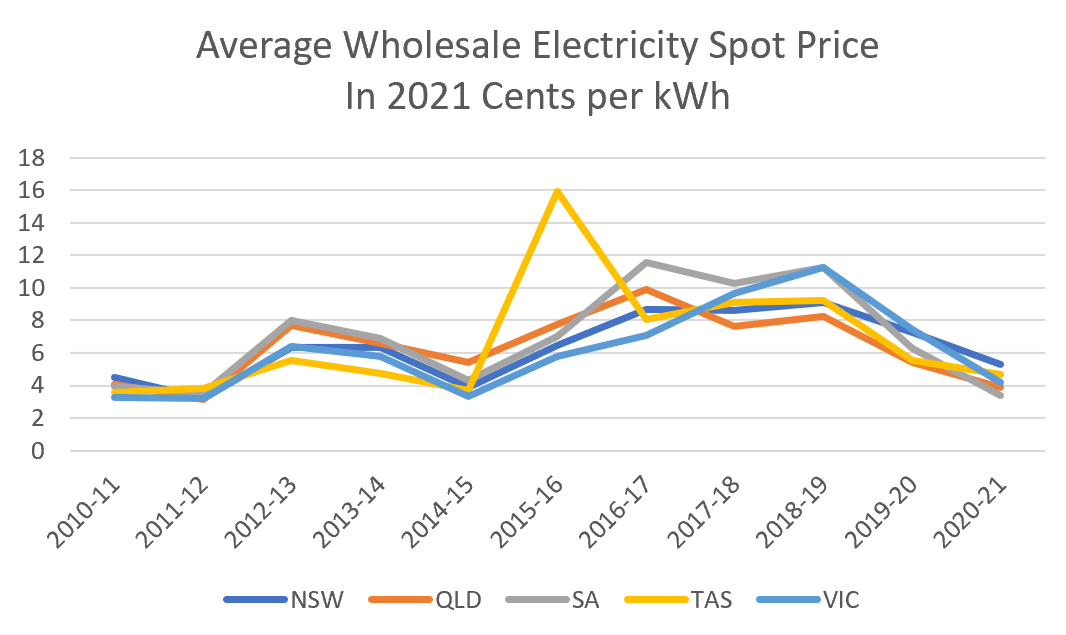

Here’s a line graph showing the average wholesale electricity spot price for all the states, except WA, for the past 10 financial years:

To make myself look useful and hide the fact I sneakily pay a guy in the Philippines $2 an hour to write these articles, I’ve accounted for inflation by converting the average wholesale spot prices for each financial year into today’s money. This is so people can see the real trends in electricity prices and not have inflation mislead them into thinking things are worse than they are.

As you can see, before this financial year, South Australia was generally the state with the most expensive wholesale electricity. We appreciate Tasmania’s effort to make SA look good in 2015 by having a drought at the same time a sea-dingo bit through the Basslink transmission cable, but it didn’t fool anyone.

Yet Another Graph

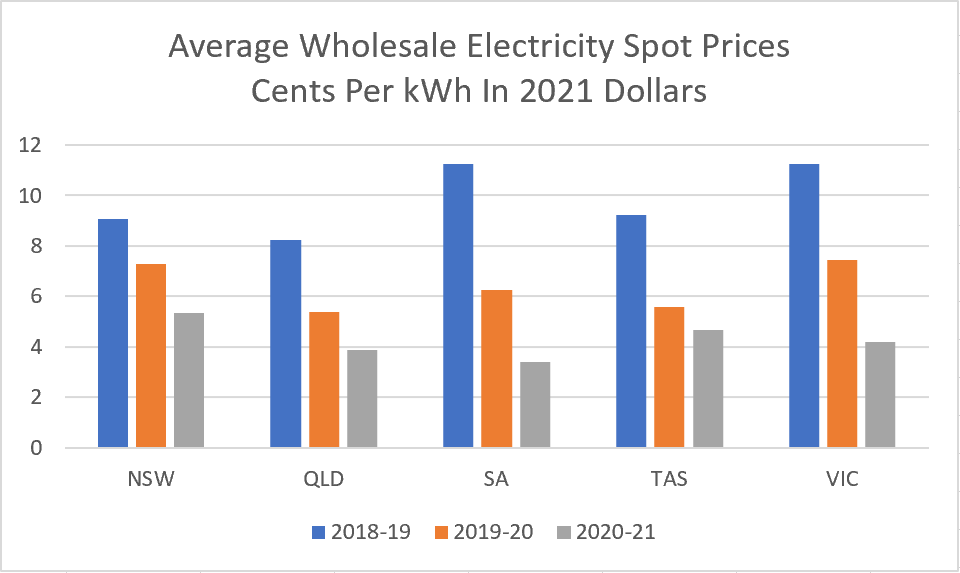

While I’m very fond of the line graph above, I don’t think it conveys how dramatically prices have dropped over the past two and a half years. So I made a bar graph showing average prices over the last three financial years, just to really rub it in:

If I work out the percentage ball in average wholesale spot prices between the first 7 months of 2020-21 and 2018-19, I get the following:

- NSW: 41% decrease

- QLD: 53% decrease

- SA: 70% decrease

- TAS: 49% decrease

- VIC: 63% decrease

As you can see, those are big drops, with South Australia having the largest fall, followed by Victoria, which was the state most affected by COVID.

If we have some intense February heatwaves, it may be enough to significantly increase average wholesale electricity spot prices by the end of the financial year. But as there’s only one month of summer left, I think the average prices will stay close to where they are now. If we have a pleasant autumn, they may fall further.

What Does It Mean For Electricity Bills?

According to the Reserve Bank of Australia, the retail cost of electricity fell 7.5% in 2020 compared to 2019. Here are their three key Consumer Price Index (CPI) points:

The fall in wholesale electricity prices so far this year has not been as much. In July when retail electricity prices change for most Australians I expect to see them drop by about 3%.

Victorians, who get their new retail prices every January, received a significant cut last month and can expect another next year.

The fall in wholesale electricity spot prices in cents per kilowatt-hour since last financial year has been:

- NSW: 1.9 cents

- QLD: 1.5 cents

- SA: 2.8 cents

- TAS: 0.8 cents

- VIC: 3.2 cents

If spot prices alone determined wholesale electricity prices, then the retail cost of electricity per kilowatt-hour would fall by around these amounts. But because contracts are also involved the actual declines may differ. As last year’s cuts in electricity prices were not as large as the falls in wholesale spot prices indicated they would be, it is possible — fingers crossed — some of the price cut was delayed and will be passed on in July – or January for Victorians.

COVID Has Reduced Demand

The main reason for the fall in wholesale electricity prices has been the pandemic related worldwide economic slowdown. In 2020 overall electricity consumption in the five eastern states was down 1.4% from the previous year. But South Australia bucked the trend and instead had a small increase thanks to high residential electricity use over winter. SA was the only state to increase its electricity consumption.

“You think you have it tough with your measly modern pandemic? It’s nothing compared to what we had to put up with. Back in 1890, the Coronavirus was this big!”

Conventional Electricity Generation In The Time Of COVID

Australia’s three main sources of conventional generation are:

- Coal — this, unfortunately, is the big one at 66% of generation.

- Gas — 6.8% of generation.

- Hydroelectricity — 7.2% of generation.

If you see figures higher than these, those are likely to be for grid generation only, which doesn’t include rooftop solar.

Coal: Because most coal used in Australia is “stranded” (unable to be exported), the pandemic has had little effect on coal generation’s operating costs. But faced with lower demand and increasing renewable generation, coal power stations have had no choice other than bid in lower prices to stay alive.

Gas: Unlike domestic coal, the cost of natural gas fell by around half. This helped lower prices in South Australia as it generates more of its electricity from gas than any other state. But it’s decreasing. More than 60% of electricity generated in South Australia is now renewable. This means generation from gas, which used to supply around 70% of the state’s electricity, is now under 40%.

While gas prices are likely to rise after we beat COVID, I doubt we will ever see a return to the high prices we had just two years ago. This is because the very low cost of renewable energy combined with the falling cost of battery storage will soon result in much less demand for natural gas.

Hydro: Due to low rainfall, national hydroelectric generation is the lowest it has been since 2008. This makes the current record low wholesale electricity prices especially important and — provided the rains return — will help keep electricity prices down in the future.

South Australian Renewables Have Lowered Wholesale Prices

Going from the state known for the highest wholesale electricity prices to becoming the lowest is a major change. It’s especially impressive given South Australia was the only state to increase electricity consumption during the pandemic. I’m not certain how much of the price fall was due to lower gas prices and how much to increased renewable generation, but I’m confident renewables played a big part. This is because current gas prices are still higher than they were six years ago before the completion of east coast LNG export facilities forced them up to international levels.

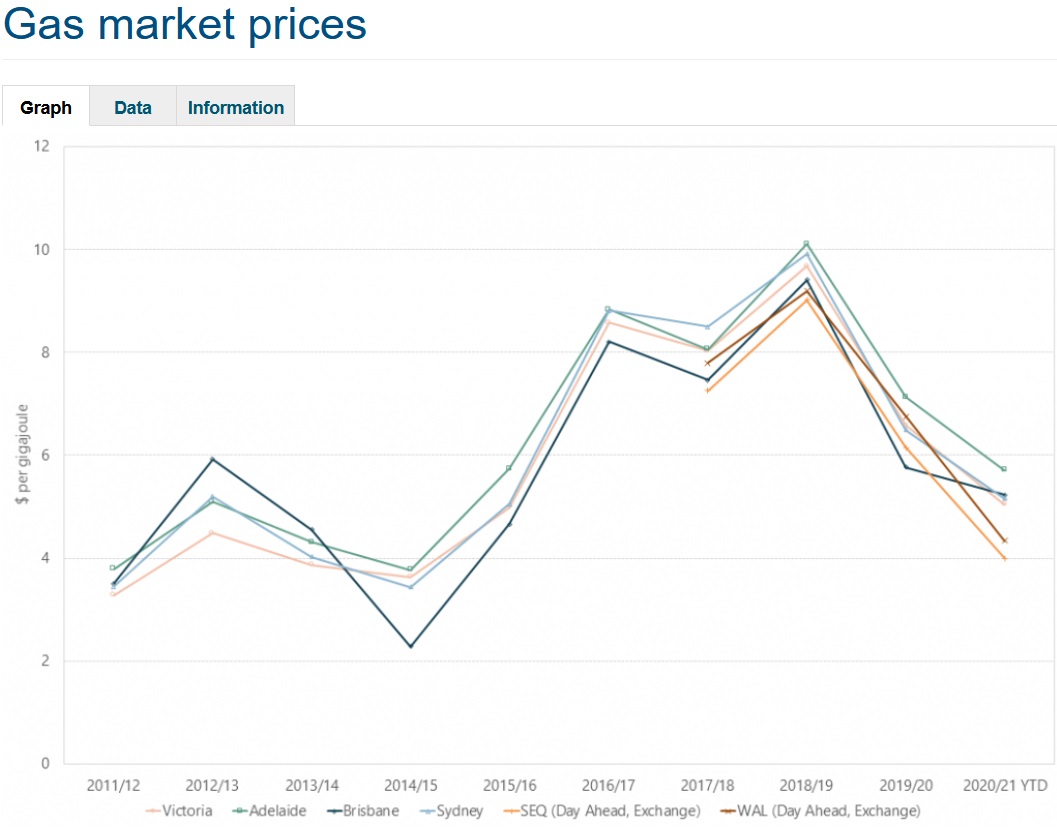

Image Credit: Australian Energy Regulator

For over a decade, South Australia has benefited from renewables pushing down wholesale electricity prices, but much of the benefit was obscured by rising natural gas prices. Pointing out wholesale electricity prices would be higher without renewables did not impress anti-renewable trolls – online or in the Federal Government.

Sure, some of them will still attempt to deny it. Eventually, they’ll give up and change the subject. Expect to soon hear troglodyte MPs insisting the real reason we must risk climate catastrophe is that Greta Thunberg isn’t polite — or some similar nonsense.

RSS - Posts

RSS - Posts

To the average punter its the price on your household account that matters and for those who are still without solar ( unit dwellers etc and those paying off a solar system with a loan).

Have you factored in replacement costs of the grid scale batteries and panels when the present ones begin to fail.

Though a considerable cost, properly-chosen battery-banks are more than competitively priced and WILL reduce in price ~ just as panels and other components have. (I paid $13.80 per Watt for my original ~2nd-hand ~ panels; now new ones sell for down to 20 cents a Watt!) Of course, if you want to go to trendy but hugely-overpriced retailers you can pay as much as your imagination allows. I think the term is ‘masochist’. A lead-acid battery-bank that’ll do the job can be had for $4k or a bit less, and, depending upon use/waste can last about 5 years. Over that period the ‘service to property’ charge alone for grid power (for two years) will cost you more.The kicker is that the price of such suitable batteries will continue to reduce in price, but grid-prices/trendy oolala ‘walls’ will all increase in price. A lot!

The fact that more VRE is lowering average wholesale prices is really doing some deniers’ heads in

And yes, now they have Sealioned onto “bUt rETaiL”

Are you able to include WA figures into this (and similar) reports?

(Yes, I live in Perth WA).

I’m afraid WA likes to keep that sort of information close to its chest — probably because it’s embarrassing. But if I come across a good up-to-date source I promise to write about the details of WA electricity.

Never mind the wholessale price as those things can even go negative, but what is the retail price in SA?

The retail price varies according to the retailer

If you really want to understand how retail rates are caluclated

https://www.aemc.gov.au/sites/default/files/2020-12/2020%20Residential%20Electricity%20Price%20Trends%20report%20-%2015122020.pdf

Terrific information and I agree the bar graph really displayed the differences starkly for me. Love the added GIF of monster coronavirus and your wit presenting what could have been boring facts.

ACT?

And a lot of people will understand, its the retail price that matters.

Over Christmas 2019, Victoria quietly brought two turbines back online after factory refurbishment, one of them in Germany. Not only did this reduce the emissions of those turbines but it increased the typical weekday contribution of brown coal generation from 3700 to 4500 MWh/h. Two summers have since avoided blackouts in Victoria of the kind suffered in January 2019.

I make this point not to disparage wind and solar with battery backup, but to ensure that a least cost pathway to cleaner energy does not fail to realise that basic maintenance of existing turbines is the key to ensuring reliability until those sources are able to cover four day heatwaves and overcast days. Public perceptions of unreliable renewables need to be thwarted. In NSW, AGL needs to adequately maintain the Liddell turbines for several more years, or sell to someone who will. Liddell brilliantly delivered coal reductions by retro fitting solar pre heating of lake water some years ago. All good for a cleaner future.

So if generation costs are decreasing and solar feed-in tariffs are increasing, why did Origin in SA reduce their rate on 1 Jul 2018 from 11c to 10c and keep it at the same rate since then?

Seems like the wholesale price reductions make little or no difference to retail customers, just let the retailers make more profit.

When wholesale electricity prices drop, solar feed-in tariffs also tend to drop as they are currently the main component of solar feed-in tariffs.

I was wrong – they reduced the tariff to 8c on 1 Jul 2020, so it looks like they are just reducing rebates instead of actually reducing the end price the consumer pays.

I have analysed my bills for 2019 and 2020.

If I had used the same amount of electricity in 2020 as I did in 2019 I would have saved total of $54.60 for the year (about 15 c/day), which is nowhere near the savings being spruiked by Governments and many proponents of ‘cheaper’ electricity.

The supposed ‘savings’ are being eaten away by reducing severely the minimum amount of usage on the lowest tariff and also reducing solar feed-in amounts.

This just means. that the retailers are making more profit and the customer is still not getting the benefits they should.

Predictions of “savings” are calculated on a representative customer with average consumption for each region

Solar owners would not be captured and low energy users will also never realise the savings touted

Those who export more than they import will obviously be negatively affected by dropping FiTs

I can’t figure out the wholesale generation cost from black coal is some 20% lower in Qld than NSW. What does Qld do? Is the coal cheaper to dig up? Are the power stations that more efficient? Is the Qld coal blacker than NSW coal? What the hell is it?

We have what is known as an “Energy only electricity market”

Supply and demand. QLD has more than enough generation and is a virtually permanent exporter to NSW

Also QLD has government owned generators who don’t NEED to make profit

My God RodM

Your not suggesting a state owned enterprise might be more cheaply run than a privately run one?

You heretic!

Tasmania and WA suggest it is not quite that clear cut but even the ACCC admitted recently that privatisation might not have been a great idea after all

A good explainer here if the privatisation debacle

https://documents.uow.edu.au/~sharonb/jape.html

I had to smile when I read that the CPI for the past was 0.9%. Clearly the writer believes the spiel from a government which has caused massive inflation whilst claiming all but zero inflation.

Think about what food costs now and what it cost 10 years ago. Tripled?

Think about real estate? Doubled and then some more?

Cost of contractors, accountants, lawyers and professional people in general? At least doubled.

Think about buying things at places like Bunnings. Their increases have been in the stratosphere.

And there’s more as well as some items which have risen at a lower rate.

You can’t get annual CPI increases of 1-3% on the above sort of figures.

Not possible. It may be time to start telling the real story about why people have money and it buys so little rather than the lies of a discredited government which behaves as though it can say & do as it likes.

Inflation has averaged 2% per year this century according to the Consumer Price Index. If someone’s income had increased by an average of 3% per year they would have seen their purchasing power gradually improve by around 22%. But if inflation had secretly been double the CPI at 4% then that person would have seen their purchasing power fall by 18%. I know what my income has been over the past 20 years and I haven’t seen my real purchasing power erode due to inflation. Some things, such as the cost of hair cuts, increase faster than inflation because there has been no real productivity increase in that area, but in other areas there have been declines and so it evens out. I know from my personal experience the CPI — while not a perfect measure — has been roughly correct. I think you have been misled by the human prospensity to spit the dummy when hit by price increases while overlooking prices don’t increase despite inflation.