Wholesale electricity prices increased across most of Australia this financial year. Retail electricity prices should soon follow.

- If you are a Queenslander, expect a big hike in your electricity prices and solar feed-in tariff in July.

- If you live in SA or NSW expect smaller increases.

- There should be little change in Tasmania, while Victoria is set for a decrease.

A regional Queensland price hike and a Victorian solar feed-in tariff reduction have already been announced.

Compared to the previous financial year, the National Electricity Market (NEM) — every state except Western Australia — has seen the following changes in average wholesale electricity market spot prices:

- QLD up 5.3 cents per kWh

- SA up 0.9 cents per kWh

- NSW up 0.6 cents per kWh

- TAS no change

- VIC down 0.4 cents per kWh

The financial year still has three and a half months left, so this could change, especially with Russia invading Ukraine. Australian natural gas prices could rise and push up wholesale electricity prices1.

Western Australian wholesale electricity spot prices are secret. Still, their Premier has promised electricity bills will only rise at the inflation rate for the next two and a half years. I’m not expecting an increase in WA’s unfairly low solar feed-in tariff — not even to keep it in line with inflation.

I also don’t have information for the territories, but changes in the ACT are likely to be similar to NSW.

Below I’ll go over…

- Why the increase in spot prices was less than I expected for most states.

- Why spot prices aren’t the only thing that determines wholesale electricity prices.

- Why Queensland’s increase has been so high.

- Changes in other NEM states and how they may affect electricity prices and solar feed-in tariffs.

I’ll even speculate on what might happen over the next few years. But don’t rely on me getting it right because prediction is hard — especially about the future.

If you only care about what electricity prices will do in your corner of Australia – feel free to jump straight to your state or territory.

If you are interested in the whole of Australia, keep reading.

Summer Breeze & Summer Disease

Late last year, the worldwide economic recovery increased demand for Australian exports and pushed up electricity prices.

I was expecting across the board increases, but two factors prevented this:

- The COVID surge reduced economic activity.

- The summer was mild.

COVID Reduced Demand

I didn’t think COVID would get as bad as it did. I knew our leadership was incompetent, but I assumed they wouldn’t just let it rip when vaccines and public health measures were available that could have prevented most of the suffering.

In South Australia, we went from four COVID deaths in December to around 220 now. If any of the politicians responsible are reading this, I’ll mention it knocked $84 million off the state’s Christmas spending. Perhaps that news might bring a tear to your eye. The reduction in economic activity reduced the electricity demand.

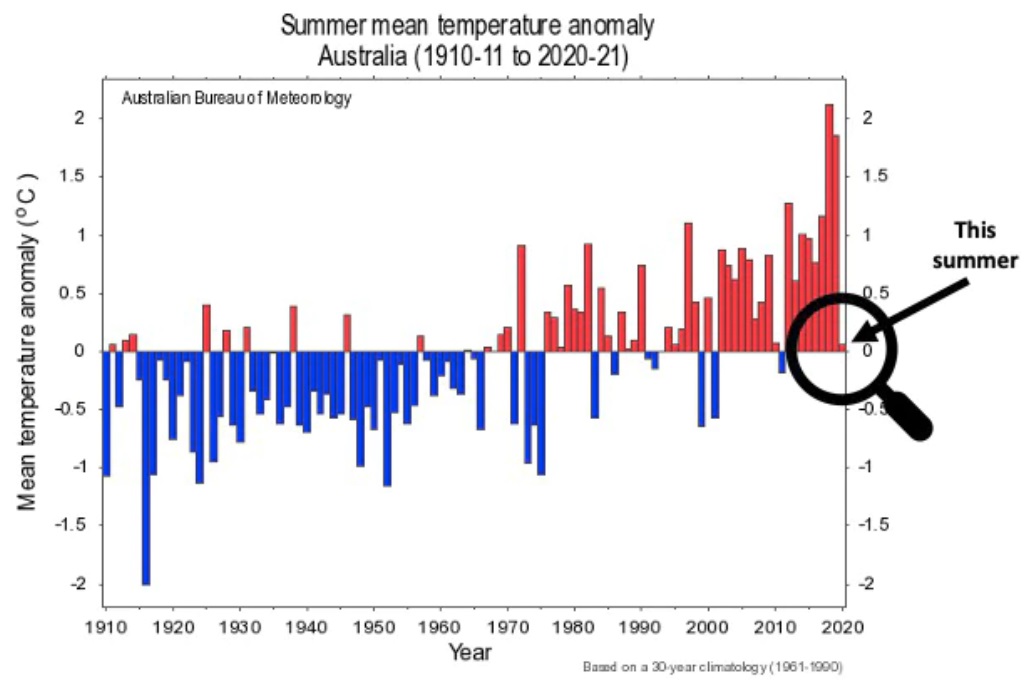

A Cool Summer

Australia had a cool summer thanks to the La Niña climate pattern. We had the coolest summer in nine years. While it sounds much cooler than normal, it was still slightly warmer than the 110-year average. When I was born2 it would have been an average summer, but it’s now a nine-year low thanks to global warming.

The flooding in Queensland and NSW is likely to reduce electricity demand.

From the CSIRO’s Climate Change in Australia page.

How Wholesale Spot Prices Affect Retail Prices

An increase in the average wholesale electricity spot price of one cent per kilowatt-hour from the year before does not mean households will pay exactly one cent more per kilowatt-hour on their retail tariff. This is because…

- The wholesale cost of electricity is only part of electricity bills.

- Contracts set the price for a great deal of generation rather than the wholesale market.

Wholesale electricity prices are only around one-quarter of typical household electricity bills. Other major components are long-distance transmission, local distribution, and retailing costs. If these change, it can cause electricity prices to rise or fall even if wholesale prices stay the same.

Another reason spot prices aren’t a perfect indicator of what will happen with electricity prices is that only some wholesale electricity is traded on the market. The rest is set through contracts, the details of which are kept hidden. Contract prices usually average a little lower than spot prices, but sometimes they are way off. These kinds of mistakes will keep happening until psychics stop working on hotlines for $3 a minute and go where the real money is.

Solar Power Reduces Daytime Prices

Solar panels provide power when the sun is up. If you didn’t know this, the word “solar” should have been a big hint. The more solar generating capacity is built, the lower daytime electricity prices will be. As the cost of electricity falls during the day, it will reduce solar feed-in tariffs. This process will have up and downs, but the overall downward trend will be gradual for three main reasons:

- Because they can’t switch on and off easily, once daytime electricity prices fall too low, a coal power station that’s no longer economical to operate will be forced to permanently shut down. This will — temporarily — raise prices.

- Lower electricity prices during the day mean more consumption gets shifted to the day, slowing the rate daytime prices fall.

- Massive amounts of battery capacity are planned and being built. By buying electricity when its price is low and selling when it’s high, they will help even out extremes and slow the fall in daytime prices.

I don’t expect solar feed-in tariffs to become very low for a decade or more, and I don’t expect them to ever disappear.

Inflation

After falling below 2% for six years in a row, Australian inflation is now back up to around 3%. While this still seems low to someone alive in the 70s3 it is enough to have a noticeable effect on electricity bills. Inflation can make it appear the cost of grid electricity is increasing even if, in real terms, it’s holding steady or even falling.

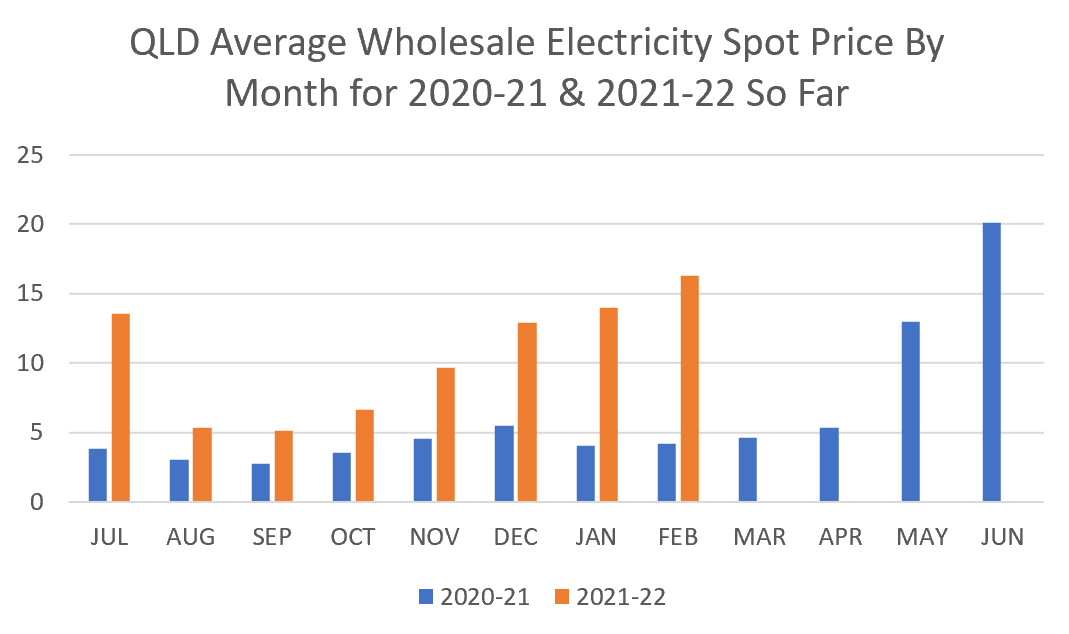

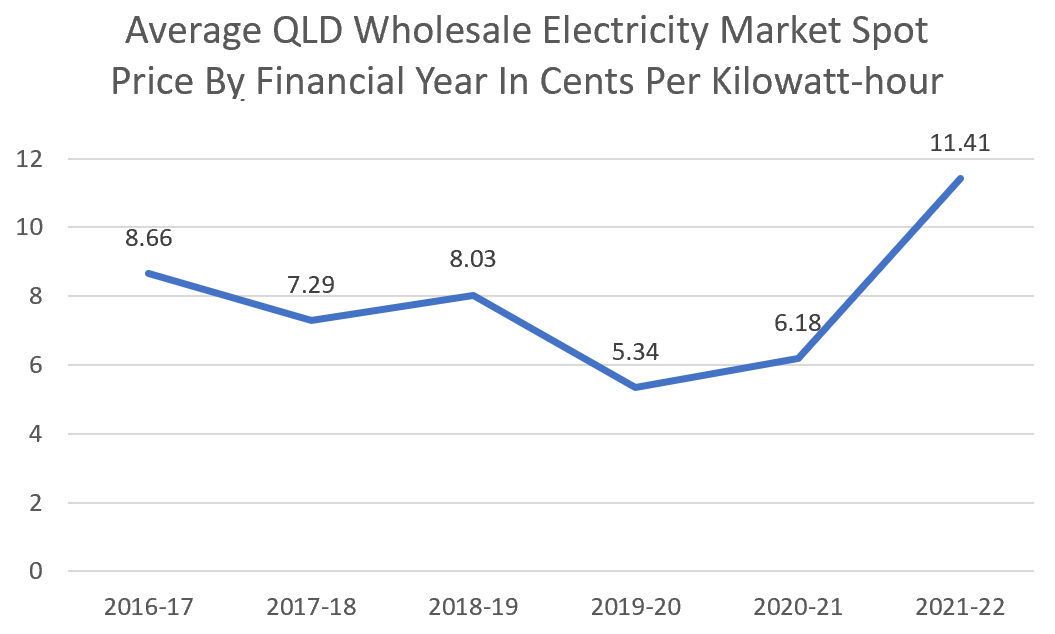

QLD Prices Will Jump

As a large state with a moderate amount of industry, Queensland has fairly consistent average wholesale electricity spot prices. Year on year changes are usually under a couple of cents, as this graph using information nabbed from the AEMO shows:

This financial year has been exceptional, with an average 5.3 cents higher than the previous year. The two main reasons for this large increase were:

- Queensland’s summer wasn’t as cool as the rest of the country.

- An explosion at the black coal Callide Power Station.

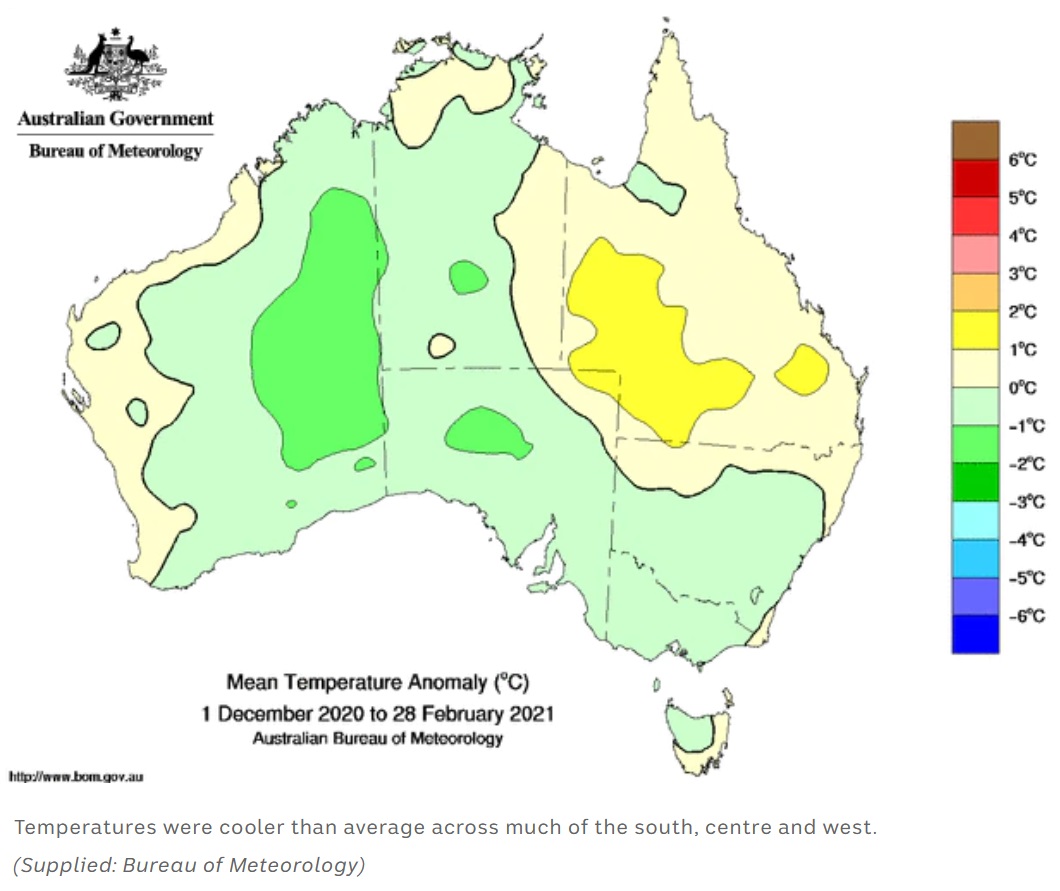

I mentioned we had a cool summer, but Queensland wasn’t as cool as the rest of Australia, as this map shows:

I acquired this map from ABC news who snagged it from the Bureau of Meteorology. It shows that not even La Nina and the Tonga eruption working together could make Queensland cooler than other states…

As you can see, Queensland and the most populated parts of WA were hotter than the rest of the nation. But the map is a little hard to read. Over the past 10 years, the temperature anomaly for Australia has averaged over 1 degree, so the light yellow parts were still cooler than usual for summer these days.

A big reason for the large increase in Queensland wholesale electricity prices was an explosion at the black coal Callide Power Station 80 km from Gladstone in May last year. A 405-megawatt generator decided to blow itself up. It’s not known if it was depressed or, in the race to destroy the planet, it simply decided to come first.

Despite coal being on the way out, $200 million is being spent to repair it4. This is not money well spent, given coal’s significant negative externalities. This is a fancy way of saying it pollutes the air and contributes to global roasting.

Here’s the generator at Callide Power Station that exploded. Clearly, it did a good job of it. Thank god no one was killed. On the bright side, maybe a few more people in Bangladesh will live as a result. (Image: CS Energy)

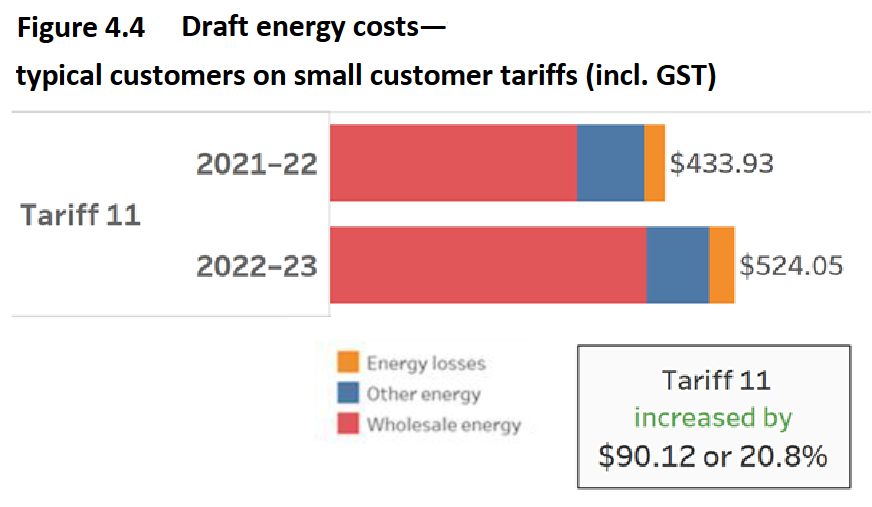

This increased spot prices in all the NEM states, but the main effect was in Queensland. The Queensland Competition Authority (QCA) has said tariff 11, the most common flat retail tariff in regional QLD will rise by about 20.8% in July. This is an increase of 5 cents — very close to the increase in the average wholesale electricity spot price so far this year:

This is a part of figure 4.4 ripped from the Queensland Competition Authority draft determination report: Regulated retail electricity prices in regional Queensland 2022-23.

Because almost all the increase has been due to higher wholesale electricity prices, I expect an increase in Queensland solar feed-in tariffs of 4 cents or more. This will make Queensland’s the highest in the nation. Despite the increase in electricity prices, most homes with large solar systems will come out ahead. Rooftop solar in Queensland is about to go from a great investment to a superb one.

This graph of the monthly average wholesale electricity spot price shows them shooting up in May last year with the loss of 405 megawatts of coal generating capacity at Callide Power Station.

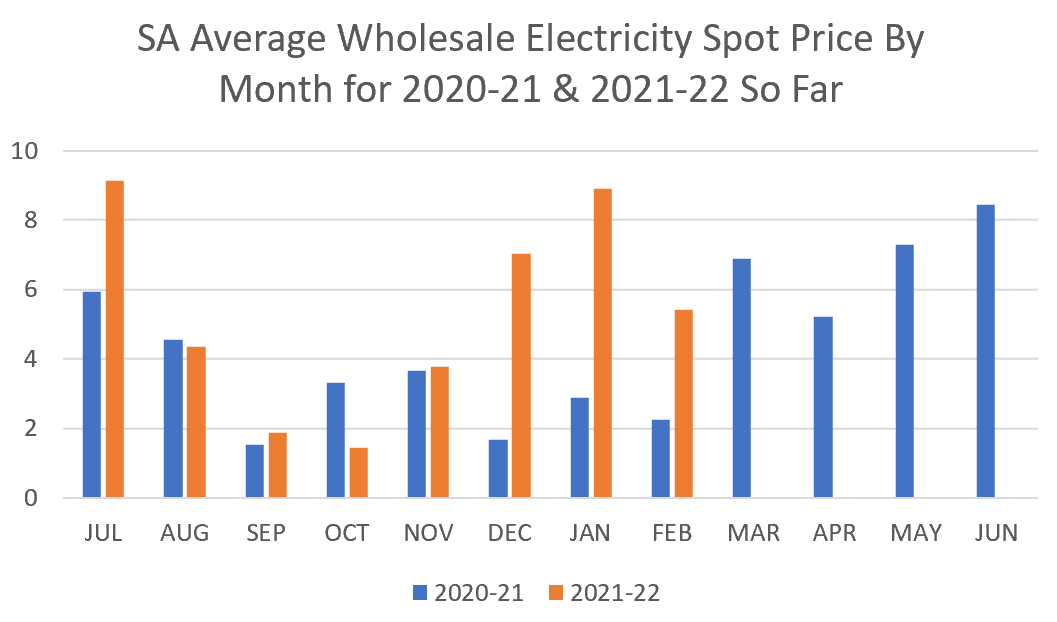

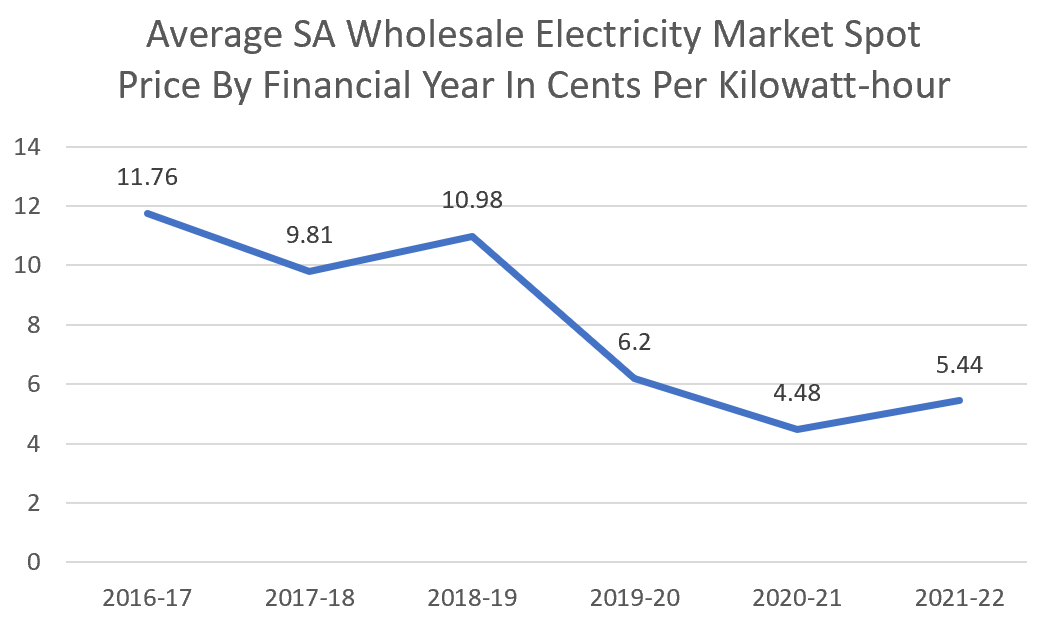

South Australia Will See A Modest Increase

South Australia has a small population of 1.8 million, little industry, inadequate competition in the electricity market, and extremely high electricity consumption in summer heatwaves. This means the average annual wholesale electricity spot price can vary greatly from year to year:

Fortunately, South Australia has invested a lot in wind and solar energy generation, with most of the solar installed by households. Because these renewable sources of generation have zero fuel cost, they are very good at pushing down electricity prices. They have reduced South Australia’s from the highest in the nation to the middlest.

Because SA generates more electricity from gas than any other, it is more vulnerable to invasion related gas price increases..

Compared to the previous financial year, wholesale spot prices have increased by 0.9 cents. All else equal, I’d expect to see electricity prices increase by around that much, with solar feed-in tariffs in SA increasing by close to that amount.

This graph shows average spot prices by month were much higher in summer this financial year than the one before, but they would have been higher still with a hotter summer. SA also had the lowest monthly average of any state. This occurred in October due to solar and wind capacity’s ability to push wholesale prices down.

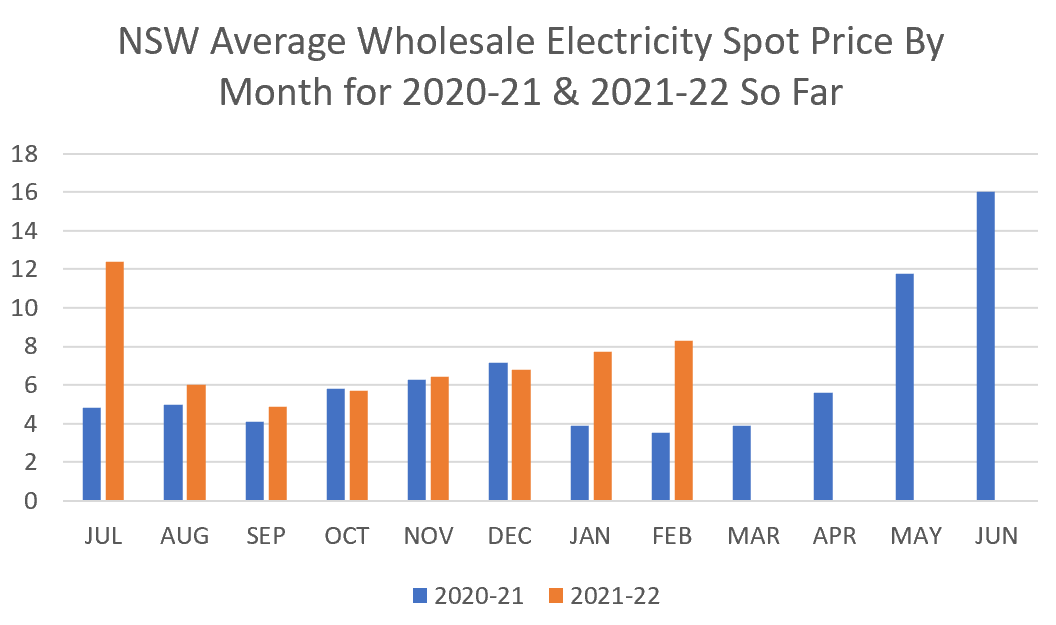

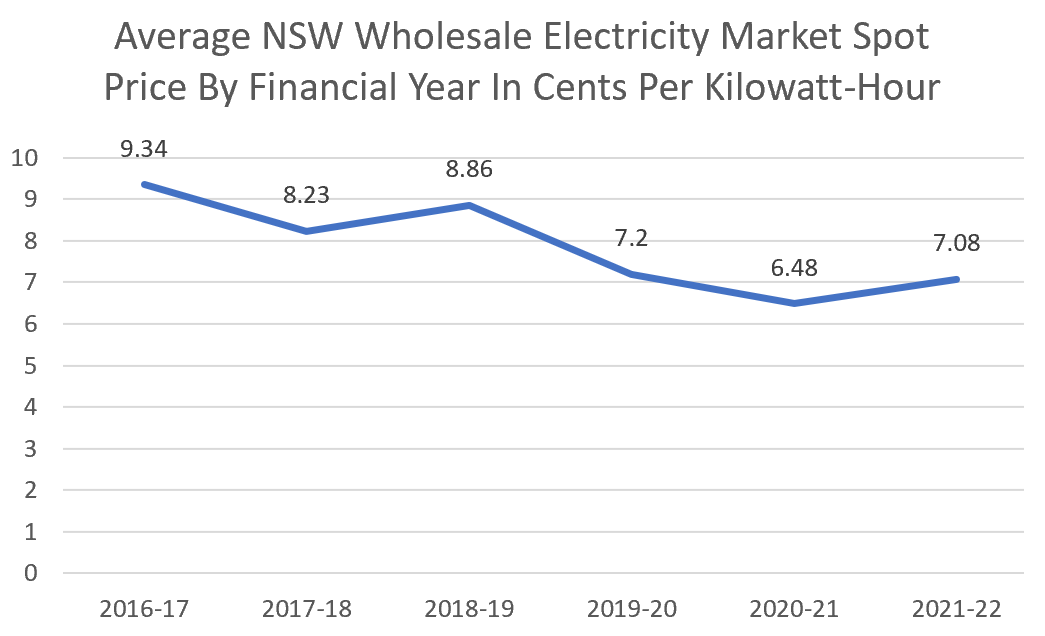

NSW Retail Prices To See A Small Increase

NSW is the largest state by population, has plenty of industry by Australian standards, and — most importantly — the majority of inhabitants live in a climatic cheat zone of beautiful weather. This makes their wholesale electricity prices the steadiest in Australia. They generally change by under one cent per year:

So far, the state’s wholesale electricity market spot prices are up 0.6 cents over the previous financial year. Assuming other components of electricity bills remain the same, electricity prices are likely to rise by around this amount and solar feed-in tariffs in NSW by almost the same.

You can clearly see the NSW monthly average spot price rising in May as prices were pushed up in neighbouring Queensland because of the Callide coal power kablooey .

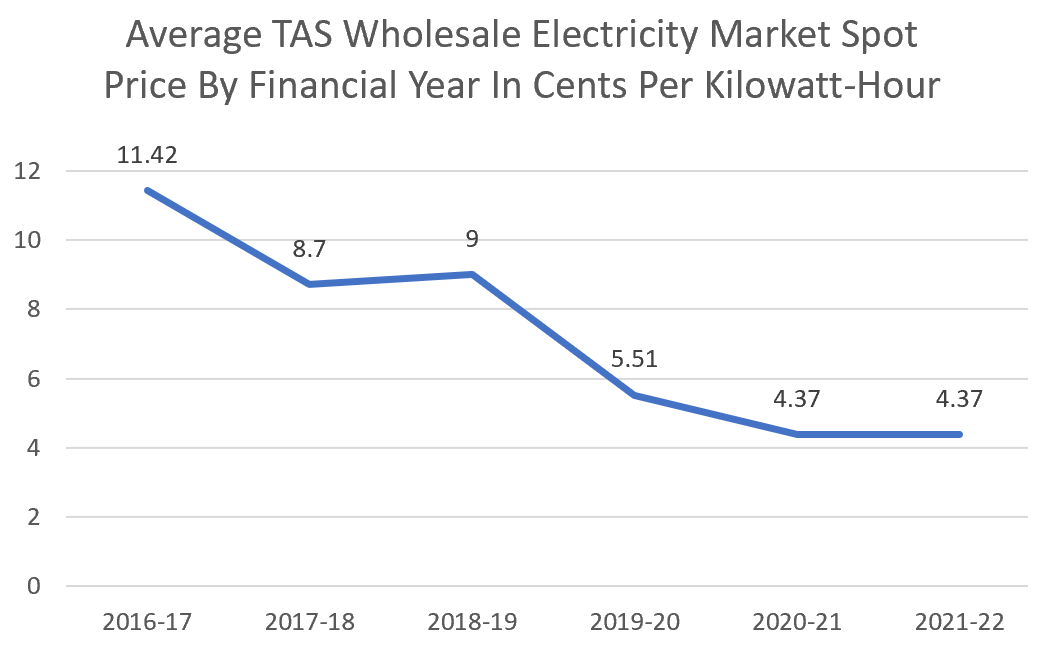

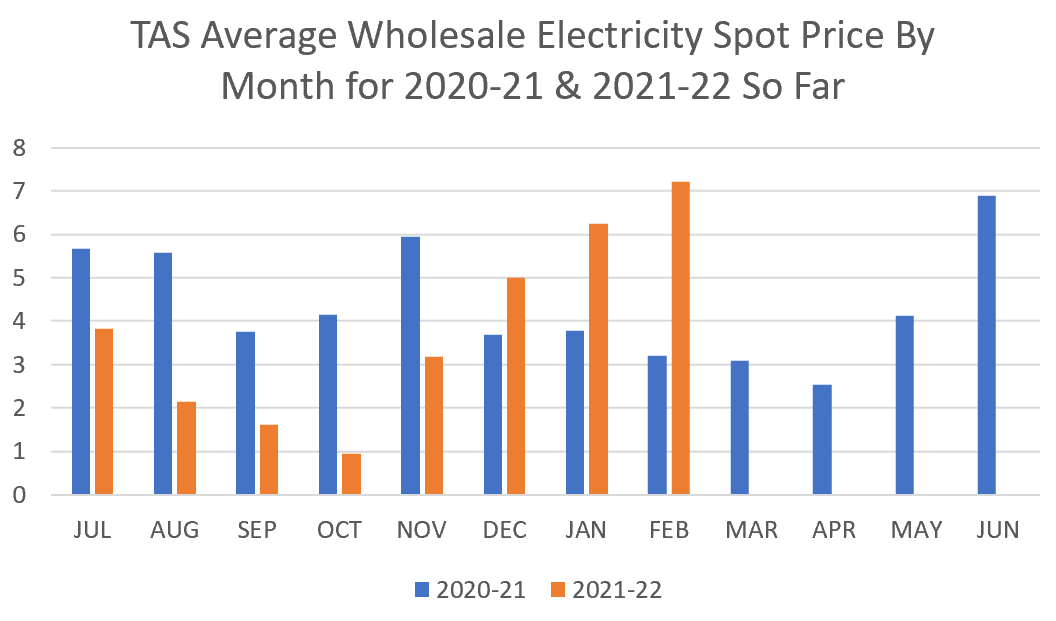

Tasmania — Meh…

Tasmania’s electricity prices can show a lot of variation from year to year:

Factors affecting Tasmanian wholesale prices are:

- Prices in Victoria.

- How much rain has filled the state’s hydroelectric dams that supply, on average, around 85% of electricity generated in the state.

- Whether or not the Basslink High Voltage Direct Current (HVDC) cable to the mainland is working.

The Basslink interconnector conked out in December 2015 and was repaired in June 2016. High prices in the 2016-17 financial year were mostly because they were high in Victoria.

So far this financial year, mainly by chance, average wholesale spot prices are the same as they were the previous financial year. This may change over the next few months, but I don’t expect any real shift in Tasmanian electricity prices and no significant change in feed-in tariffs in TAS.

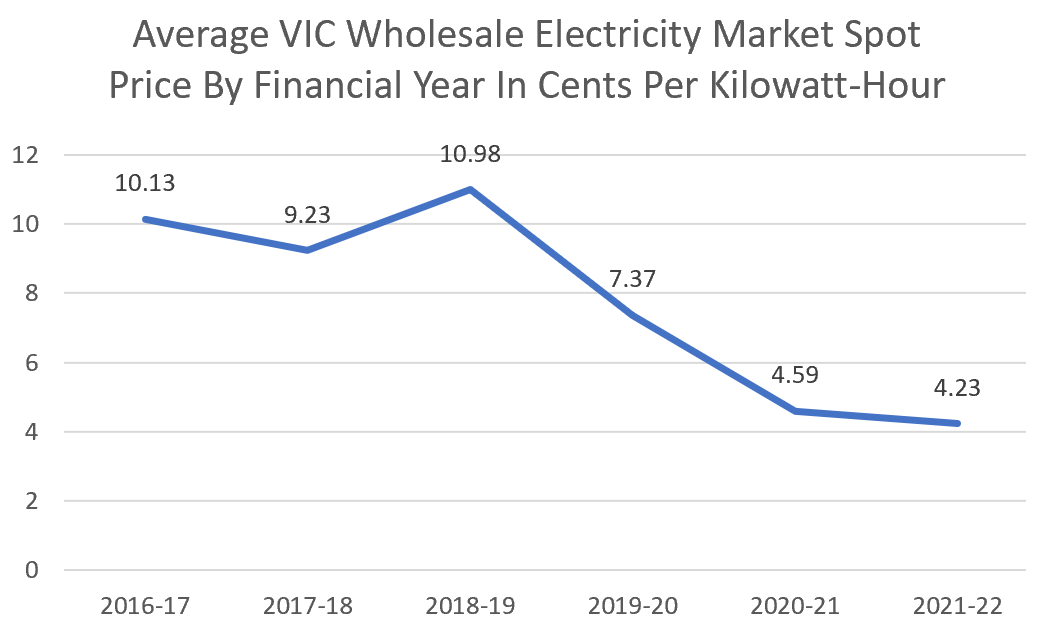

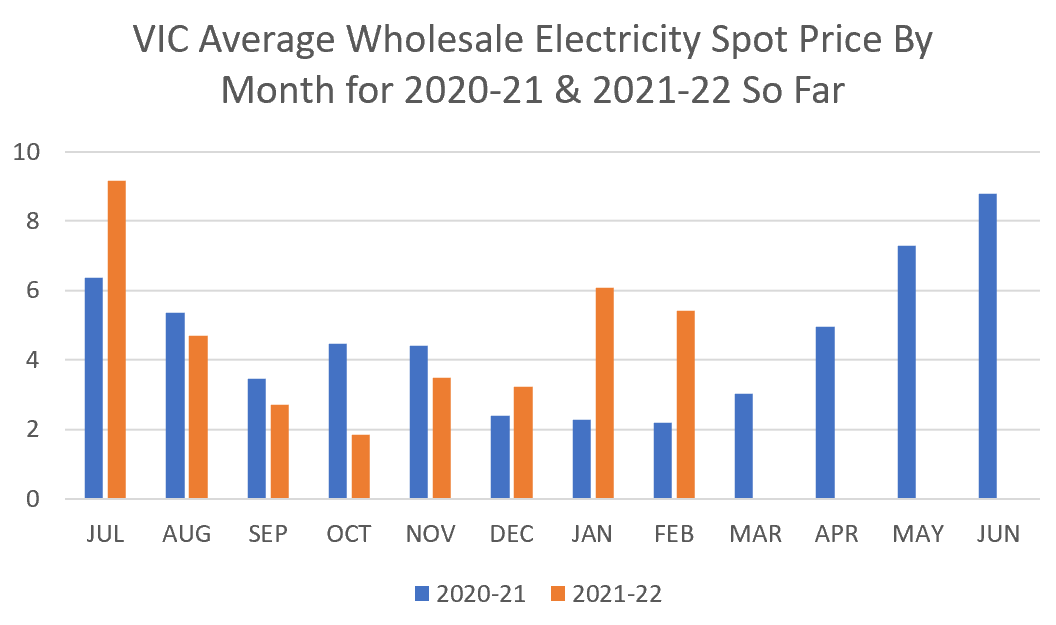

Victoria Will Get A Small Decrease

With the second-largest population, a considerable amount of industry, and a climate that isn’t extreme5, you might expect Victoria to have fairly steady average annual wholesale electricity spot prices like NSW. But this hasn’t been the case lately:

Victorian wholesale electricity prices were high five years ago because the brown coal Hazelwood Power Station closed down with only a few months’ warning. The horribly polluting power station was simply too unsafe to operate. I’d say this applies to every coal power station but in this instance, it applied to the people inside the power station, not outside it.

Between COVID, a cool summer, and a little help from increasing renewable generation, Victoria had a slight fall in its average wholesale electricity spot price. So far it has fallen 0.36 cents from last financial year. This decrease won’t be very noticeable on bills, but Victoria’s Essential Services Commission has announced a significant cut in the state’s minimum feed-in tariff from 6.7 cents to 5.2 cents in July. The reasons given for the 1.5 cent drop were low daytime wholesale prices and expected low wholesale prices next financial year. But this is only the minimum feed-in tariff. Some retailers are offering more.

Despite the coming fall in the minimum feed-in tariff in VIC and the least sunshine of any mainland state, solar can still make excellent financial sense in Victoria. This can be especially true with the $1,400 Victorian Solar rebate. This amount is available for most homes that don’t already have solar until the 30th of June. After this, it shouldn’t disappear but it will be reduced.

Future Trends

I know I said prediction is hard, but If economic growth is as strong as predicted in February, I’d expect further wholesale price increases in the 2023-24 financial year. But with Russia starting a land war in Eurasia, what the world economy will be like in a year is anybody’s guess6. I’m going to cross my fingers and hope for peace and a healthy world economy.

La Niña should end around July, so I expect next summer will be hot but still cooler than average for the 21st century. After that, summers are likely to go back to being stupid hot. The hotter the summer, the higher wholesale electricity prices will be.

The decommissioning of NSW’s black coal Liddell power station will be completed in April next year and will be followed by the huge black coal Eraring Power Station, also in NSW, in August 2025. The rate of coal power station closures is only going to accelerate.

It’s impossible to be certain what will happen, but with a stronger economy, hotter summers, and coal power stations lining up to be allowed to shut down, my guess is — despite increasing solar, wind, and battery capacity — both wholesale electricity prices and solar feed-in tariffs will generally be higher for the next two to three financial years compared to this financial year. But note I don’t expect the high prices coming to Queensland to last, as the Callide Power Station may be repaired by the end of this year.

I am sure that there will be more problems with coal power stations failing in Australia before they’re all closed. If you have solar panels, you’re protected against coal power failures because any increase in wholesale prices caused by coal’s unreliability should also push up solar feed-in tariffs. Except in WA. It seems everyone gets screwed out west.

Footnotes

- Last year natural gas only provided 7.7% of Australia’s electricity, but it plays an important role in setting prices. This will decrease as more battery storage is built. ↩

- Those rumours about me being born in a paleolithic ice age are substantially untrue. ↩

- If you think the 70s were bad, back in 1796 there was over 100% inflation in France. So I’ve been told. I wasn’t alive then because those stories about me being born in the Paleolithic are just rumours. ↩

- it’s one of Australia’s younger coal Power Stations at “only” 21 years old ↩

- The weather in Melbourne has no idea what it’s doing, but that’s not the same thing. ↩

- If Putin detonates enough atomic bombs in one location it can create a nuclear winter as cold as a Paleolithic glacial period. Not that I personally know what they were like, because I wasn’t born then. ↩

RSS - Posts

RSS - Posts

Interesting, and depressing.

$200m just for one blown up turbine. Ouch. We lucky taxpayers are going to have one hell of a lot of debt coming out of Covid, floods, and whatever else is going to hit us.

Please don’t joke about Putin Ronald.

It’s entirely possible that he could press the Nuclear button.

Sadly, he is certainly mad enough to do it.

I’m afraid that laughing at the madness is all that’s keeping me insane these days. (Certainly wouldn’t want to be sane nowadays.)

I was asked the question, of whether or not home solar will protect against coal power station failures. Here’s the answer: If there is a major failure at a coal power station that causes an immediate blackout, your rooftop solar won’t prevent that unless you’ve shelled out a considerable amount for battery storage. But it will help protect you from big increases in your electricity bill. Firstly because you will use less grid electricity if you have solar and secondly because a prolonged problem with a coal generator will raise wholesale electricity prices and thus solar feed-in tariffs. (Outside of WA because they don’t get treated fairly when it comes to feed-in tariffs.)

“The rate of coal power station closures is only going to accelerate.”

Yep, possibly even faster now petroleum fuel prices are rapidly rising. Rising fuel prices increase extraction and transport costs for coal, which consequently increase recurring operating costs for coal-fired power stations.

“La Niña should end around July, so I expect next summer will be hot but still cooler than average for the 21st century.”

James Hansen (and team) write in their January Temperature Update: The New Horse Race, published Feb 14, included (bold text my emphasis):

http://www.columbia.edu/~jeh1/mailings/2022/JanuaryTempUpdate.14February2022.pdf

https://www.mauldineconomics.com/frontlinethoughts/change-squared

Where did you get the wholesale power prices. I have recently collated prices from AEMO website that indicates that prices in all states except QLD dropped from 20/21 to 21/22 ytd.

They are not wholesale prices, they are wholesale market spot prices from the AEMO:

https://aemo.com.au/Energy-systems/Electricity/National-Electricity-Market-NEM/Data-NEM/Data-Dashboard-NEM

(Now I have to go check someone hasn’t edited out all the times I wrote “spot price” to try to make my article seem less wordy…)

I meant the same thing. I used the monthly numbers provided by AEMO – and then averaged the monthly prices (taking into account the different days in each month) to calculate the yearly average prices. Based on prices to 28 Feb 22, I calculate the spot market average prices (July1, 2021 to Feb 28 2022) are, $/MWh:

QLD 103.79

NSW 72.85

VIC 45.91

TAS 37.42

SA 52.56

Which are not the same as the AEMO annual prices so I have to assume that AEMO also weight average the prices using the power consumption each month in each state. AEMO prices listed

I once checked if the monthly averages added up to the yearly average to see if the AEMO was presenting the information correctly myself. It does appear to be the true yearly average which will be affected by more electricity being used in winter and summer and less in autumn and spring.

I have never understood why we don’t have parity when it comes to pricing, when I went to school taking something from someone else and charging them more for the same thing was called stealing. On top of this my nsw provider has just reduced my feed in tariff by 12 cents a klw.

Can I offer a one word reason? Capitalism.

Longer answer is the power networks of most states were sold off to private owners, all of whom have a vested interest in making a profit. Buy low, sell high.

Retailers are just part of the issue.

I note that up until last year (which is the last time I looked), the Northern Territory paid 22c FIT and charged 22c retail for PAWA customers. I only looked because I used to live up there.

Brian,

What we buy does not mean we get the same for what we sell because there are at least 5 components of electricity retail prices of which only 1 maybe 2 affect Feed-in-tariff.

The wholesale price has a direct impact on FiT. DLFs and carbon price may have a small impact on FiT.

The rest of the kWh retail price is made up distributor’s cost (DUOS) – absolutely nothing to with FiT at all. GST obviously, you can not charge 10% GST and collect it. Then there’s the transmission costs (TUOS). And there’s market schemes run by federal/state governments for energy saving schemes, so FiT does not pay for that either.

Then there’s the retailer margin, you can’t collect that either because domestic/residential consumers are not registered retailers.

I’ll put it another way.

Say you can create your own biodiesel fuel (a basic machine costs about $2500) and you need to collect the waste cooking oil. It’s doable, but a lot of effort.

Now, let’s say you produce too much biodiesel and need to offload it. You can either self consume it (like solar generation). The most effective way to maximise the $ value. Or, sell it to someone….

We can buy diesel for about $1.50-$2/litre from a retailer. Do you think for a moment you will get that same price? Pfftt…..

Let’s work on $1.50/litre

The retailer has to deduct 10% of the price for GST, so that’s 13.6c/litre GST, so that brings the price down to $1.36/litre.

Then retailer has to remove the fuel excise tax from that price, so that’s 44.2c/litre.

So, the pre-excise/GST price is now $0.918/litre. Will you get this price? Pfft.

The retailer needs to make a profit, say 5%? 4.7c/litre maybe?

Price is now $0.871/litre. Will you get this? Nope.

Retailer has to pay distributor of the fuel to be delivered and pumped in.

Wholesale price of diesel is about $0.65 thereabouts give or take a few cents.

The distributor must be collecting about $0.22/litre.

The best you could sell your excess diesel would be about at best between $0.65 – $0.87. Not $1.50.

You then have to deliver the diesel to the retail servo at your cost and manage all the administrative work etc, etc.

So, who’s stealing now?

It’s no different with the electricity market but good luck trying to achieve retail prices for your excess solar electricity. You will never get it, not possible. The retailer will not pay more than what they can get on the NEM/AEMO market.

This argument about “I pay more than I export for” is getting a bit old now and people still don’t understand how the electricity market works in Australia. It applies to other things like the fruit, meat and appliances. The farmer does not get the same price per apple what Woolies would sell it for. The dairy farmer does get the same price per litre that’s sold in the shop.

That’s the nature of a wholesaler-distributor-retailer system. Each layer adds to the cost, and some of those costs has no component that affects the price you will receive.

Electricity distributors don’t generate electricity, they don’t care what the FiT is set to, they neither collect it or pay for it. Only the retailers pay the FiT as a substitute from wholesale large scale generators. The FF generators don’t pay it nor do the Transmission companies pay it. Some distributors are still retailers (like in Qld, Ergon) and do pay FiT but that’s because Ergon has to buy wholesale electricity, they need to pay FiT as avoided cost from excess PV electricity that would have been sourced from FF generators or other big generators like utility scaled PV solar farms or wind farms.

If the retailers are forced to pay 1:1 FiT, they will simply refuse to connect solar customers, Plain and simple. Why would they when they can source cheaper sources of electricity being generated elsewhere on the market.

Sure, you can compete with the big generators, but good luck trying to bid your paltry kWh against the MWh bids every 5 mins. You will never win a bid. But to participate directly in a bidding market, you need to establish an account with AMEO and then bid every 5 mins.. good luck with that workload……

Which is why the likes of Amber Electric and Powerclub offer customers to use wholesale pricing. But even then, Amber and Powerclub still have to add on top of the wholesale price, all the other things that I mentioned. All they’ve done is removed the retailer margin and add a monthly account fee. Your FiT- will be solely determined by the wholesale market every 5mins or 30mins (depending on the meter). In fact, Amber Electric and Powerclub has clearly demonstrated why we don’t get 1:1 FiT and I’m glad that they did because it exposes exactly how the price of electricity is determined. As there are at least 4 players – generator – transmission – distribution – retailer, each of them wanting to make money on shifting electricity. Not one of them can be accused of stealing. It’s an accumulation of fees added on each player that creates the large margin between wholesale and retail prices. But the wholesaler doesn’t get the whole margin, only part of it.

It’s not much different to our government system, we have at least 3 levels.

A federal government, a state government and then local councils. Over- governance and that cost money.

Take a look at Amber, they will have examples how a retail price is made up.

Home PV with batteries on microgrids is the only foreseeable option for us at the moment for nearly all of this continent, and it has some quite tasty side effects: zero-marginal-cost energy, cessation of energy dependence, ultra-reliable (ie. practically uninterruptible) domestic energy supply, better quality electricity, less vulnerable generation, an inexhaustible supply, and so on.

Batteries are at the same affordability and availability place that PV systems were 15 years ago, and the same type of incentives would accelerate their installation. I’m not talking about daytime FiT – an incentive for householders to install battery capacity would be a relatively high FiT during the night. That’s what I’m currently attempting to promote to NT government (I live in Darwin).

Coal power stations may not close here in Australia as quickly as we might think,. Scomo seems to believe that he can shore up LNP support and get the coalition re-elected by keeping them open

To quote from a Guardian article:

“Scott Morrison says coal power stations should ‘run as long as they possibly can’

Prime minister says it would be ‘fine’ for private sector to build new coal power plants if commercially viable”

https://www.theguardian.com/australia-news/2022/mar/14/scott-morrison-says-coal-power-stations-should-run-as-long-as-they-possibly-can

When you examine his reported words carefully though, he’s not really committing to anything at all, just implying to his audience. that he is on ‘their side’.

Well just got an email from my supplier. My solar FIT is going from 10 cents to 5.5 cents. And my general usage cents/kw has just dropped .7 cents. Live in southeast QLD

Hopefully, you’ll be able to find a better deal now if you shop around, but July is when you should see an increase in both the cost of grid electricity and solar feed-in tariffs. (But note only time will tell for certain what will happen.)

Hi Ronald

Thanks for the reply. There are some better deals out there but with me having a 15 kw solar system a lot of them do not apply for me. And in the past when I was checking around a couple of suppliers would not take me on because of the size of my system. It seems that they do not like systems over 10 kw. On non cloudy days I put back into the grid over 100 kw of power. And am in credit with each bill. As with the current supplier the CEO had to give approval before I could change over to them.

How much did it cost to convert to 3 phase power? I’ve been quoted ~$12K in metro brisbane.

I’m also looking at getting a 15kW system with a future view to battery backup and possible EV charging (at the rate of current fuel prices – this seems to be much more viable). I’d also like to have a functioning system when the grid goes down.

I may be misremembering but I thought a relative of mine only paid a couple thousand to convert to 3 phase.

While an ancient thread this: https://forums.whirlpool.net.au/archive/2451985 suggests ~$12,000 is ridiculously high unless your driveway is a mile or so from the road – unlikely in a metro area.

I always had three phase power. So for the cost I can not tell you. Also my system is ground mount so it could be cyclone rated. Also some insurance companies under writers will not insure you if you have more then 50% of your roof covered in solar panels. And some will not insure a ground mount system.

I’m going to be in a similar boat in the not so distant future – the FiT on offer has plunged to a third of what I’m on. According to https://wattever.com.au/retailer-solar-feed-in-tariffs-by-state-and-territory/ most QLD offerings are capped at stupidly low kWh – often 5 kWh or less per day, size limited, or offering terrible FiTs. AGL for instance offer a 12c FiT, but that’s limited to 10 kW or less PV systems.

1st Energy appear to be one of the rare companies with a decent offering – 11c per kWh for 10 kW and under systems, but you said 15 kW. Never heard of them so don’t know if they’re reliable or not. A quick bit of looking around suggests they could be better than AGL (who’re PV size limited), but not as good as Origin (who are inverter limited plus export capped for their higher rate).

Of the roughly 40 options listed 6 cap exports (3.28-10kWh per day), 3 have a 10 kW of PV cap, 1 a 5 kW inverter cap, and 1 a 10 kW inverter cap. Of the remaining options that don’t specify caps or limits, 10 offer 5c or less as a FiT! :-C

At least July will be something to look forward to I guess?

Noice. you’re getting nearly 700% efficiency out of that PV system.

😉

Hi Ronald

When looking at probable trends with FITs, shouldn’t you be looking at just daytime wholesale spot price trends rather than wholesale prices overall? It’s daytime prices which matter most for FITs.

And also consider there will be another 3GW or thereabouts of rooftop solar PV supply to be added again this year to the daytime supply helping to keep daytime network demand low.

Yep, it is the daytime wholesale electricity prices weighted for solar production that counts. Under the subheading “Solar Power Reduces Daytime Prices” there’s 187 words on this.

Yes, you wrote 187 words on it, then plotted overall wholesale price trends rather than daytime wholesale price trends.

Your article is suggesting FITs will rise in 2022 but the data presented in support of that assertion isn’t necessarily supportive of that conclusion.

Here’s the daytime wholesale price comparison between 10AM to 3PM for NSW.

Have a look at how different the picture it paints is compared with the chart you show.

It’s all over the place – and I don’t think we can actually pick a trend upon which to assume FITs, in NSW at least, will go up.

https://i.imgur.com/I9GQ4Sn.png

Cool! Where did you get the information?

All the data for each NEM state is available to download from the AEMO website. Has interval time stamp (end of interval), total demand and wholesale price ($/MWh).

https://www.aemo.com.au/energy-systems/electricity/national-electricity-market-nem/data-nem/aggregated-data

You have to download the data one month at a time but it’s not hard to consolidate it. The downloads are quick.

Note that from 1 Oct 2021 the data changed from 30-min intervals to 5-min intervals, so take a little care when doing the inevitable calculations.

Thank you very much!

BTW – my chart shows a straight price average for that 5 hour block (10am-3pm). I didn’t calculate the energy weighted average price. It’s not a particularly difficult calculation and I don’t expect it will make much difference to the plot. But the energy weighted average price would be a better indicator of the value of energy during the time of day most people’s rooftop PV systems are exporting energy.

Great info Alex. Is this publicly available? Also, do you know where I can access actual energy use data (daily, monthly, annual)?

See my post above John

Cheers, Alex

HI all

I moved to 1st Energy in September 2021 and at that time, they were offering 13 c/kWh for FiT, regardless of system size. My system is 21 kW

Lol electricity price per kW has not really changed much in Queensland over the past 10 years, but the daily supply charge which is the biggest killer has gone from 20c per day up as high as $1.70 and they also claim that the price per kW hasn’t increased, and in reality it hasn’t but the total cost of electricity bill has significantly. And we can thank narrow minded policy makers for setting feed-in tarriffs for this.

WHAT IS AUSSIES THINK. They give the other cheek to be smacked by Fed Govt and Energy Company. When I spent $6000 from my pocket to have Solar on my roof and save the environment then I expect Energy company pay me the fair price for my export. They pay $0.05c per k/w and sell them for $0.28c k/w. They charge $1.00 per day for grid connect. $365.00 per house per year grid connection fee. AUSSIES must notice that the power pole on the street hasnt been changed for ages. Land Developers have to connect new land release to grid and pay their fair share in contributions. The energy companies do slap the AUSSIES in face and yet AUSSIES remain down under and accept the slap. It is time to have a big protest throw the Government and CREATE A CHANGE FOR ONCE AND ALL

Those with out Solar panels are being charged more by the energy companies to offset the feed in tariff scheme the Government lumbered them with. I guess that means the people that could not afford to have panels fitted the have nots (the poor as usual) are being fleeced to keep the energy bills of the haves really low.

Generators would need to be paid if electricity did not come from rooftop solar, so there is no free lunch for non-solar owners. Rooftop solar is an overall benefit for non-solar owners. This is because:

1. In addition to avoiding generation costs, when used locally distributed solar generation avoids long-distance transmission costs and some distribution costs.

2. Solar provides free ancillary services to the grid which help keep the grid stable.

3. Distributed solar does not bid in prices to the wholesale electricity market and so helps drive prices down for everyone — including non-solar owners.

4. There are large health and environmental benefits from using solar energy compared to coal, gas, or oil.

I’ll also mention that the lower income half of Australians install solar more often than the higher income half. I still favour eliminating poverty here, as this will reduce all distributional fairness issues, which is something you obviously care deeply about.