Last year the International Energy Agency (IAE) published a report titled…

The Role of Critical Minerals In Clean Energy Transitions

I recently dived deep into its 260 pages to see if a shortage of critical minerals threatens the world’s transition to a renewable future.

After surfacing, I can say the report makes three points I concur with:

- There’s no shortage of required minerals. More than enough economically viable deposits to build a renewable future have been discovered.

- The production of some minerals will need to greatly increase to produce the solar panels, wind turbines, battery storage, and electric vehicles required to replace fossil fuels.

- Shortages of key minerals have the potential to slow our transition to renewable energy.

There are also two points I’d like to emphasize that are supported by the report but does not clearly state:

- Mining for lithium, copper, nickel, rare earth elements and potentially other materials will greatly increase — but the total amount of mining required by the energy sector will decrease due to reduced extraction of coal, oil, and natural gas.

- No shortage — or even concurrent multiple shortages — can reverse the transition to renewables. There’s no plausible scenario where it suddenly becomes profitable to build new coal power stations or shut down electric vehicle production and go back to building internal combustion engines cars. Shortages can only slow down the replacement of fossil fuel infrastructure and can’t stop it.

That really all you need to know about the report. But if you are keen for more details – or are currently shouting at your screen that I’m an imbecile and those conclusions can’t be right because they don’t line up with your view of the world, feel free to read the ~5,000 words of detailed analysis below.

260 Pages Of Fun

The report gives information on mineral use by different types of low emission generation and predictions on how much capacity will be installed. I’ll give details on what the report says about solar power, electricity networks and battery storage – both stationary and in EVs.

The report gives six recommendations on how mineral shortages can be avoided. I’ll list them all and go into one of them — increased recycling — in detail. I’ll then explain why I’m optimistic about the future supply of minerals and think they’ll be sufficient to allow a rapid transition to renewable energy.

You can read the 260-page report here. I recommend reading the whole thing — provided you’re a nerd of Brobdingnagian proportions. Which you definitely are if you know what the word Brobdingnagian means.

Two Scenarios — STEPS & SDS

The IEA gives predictions for two different scenarios:

- The first is the Stated Policies Scenario. They called this STEPS (they had an extra T and an E lying around). This scenario assumes the world only meets the minimum emission reduction commitments of the Paris Agreement.

- Predictions are also given for the Sustainable Development Scenario. They called this SDS because they used up their superfluous letters with STEPS. In this scenario, nations go beyond current commitments because of falling costs and/or increasing desire to slow climate change.

Renewable energy and battery storage costs will continue to fall, so I’m certain the world will do better than STEPS and definitely hope it will do better than SDS. Time will tell, but over the next 18 years if all we do is STEPS… it’s a tragedy.

Solar Power

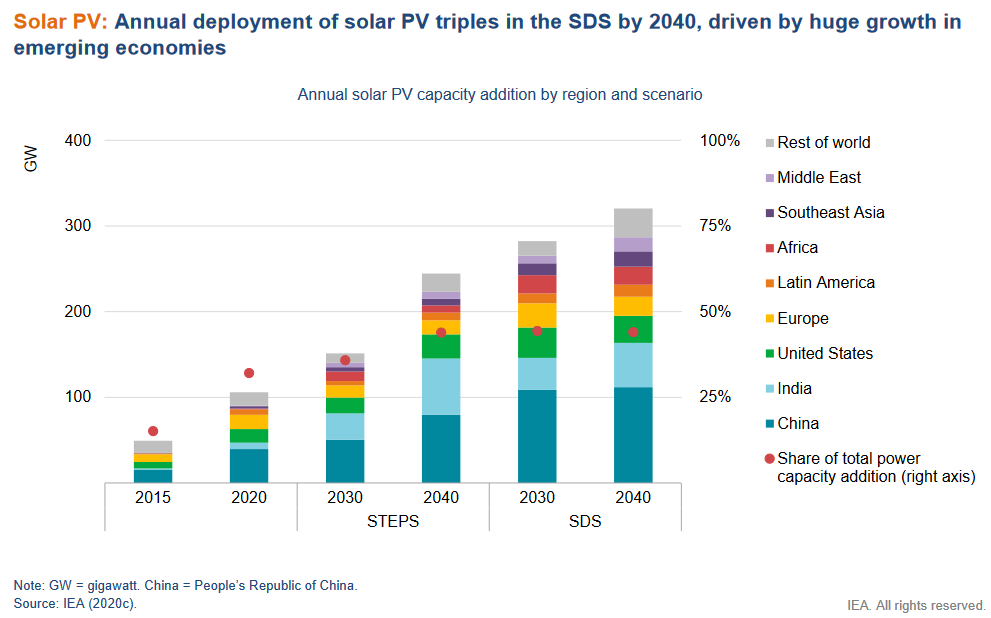

In their less optimistic STEPS prediction, the IEA report forecasts 240 gigawatts of solar power capacity added in 2040. That’s a 230% increase from what it was in 2020. Their SDS prediction, which assumes a faster transition to renewables, is 300% higher at around 315 gigawatts. This graph shows the estimate for both scenarios:

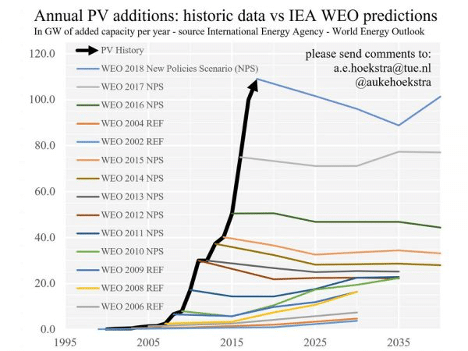

The IEA Predicts Large Decline In Solar Growth Rate

Even the report’s higher prediction of 315 gigawatts of solar PV installed annually by 2040 requires a large decline in the current rate of expansion of solar production. If its expansion continues at the rate it has over the past 20 years, by 2040 the world will be installing over 1,500 gigawatts per year. I don’t think it’s likely ever to get that high, but if expansion simply continues as it has, it will beat the IEA’s optimistic forecast by a factor of 5. There is clearly potential for solar power to do far better than the IEA expects.

Solar installations were 183 gigawatts in 2021 and are expected to exceed 200 gigawatts in 2022. More was installed in 2021 than the STEPS prediction for 2030, and 2021 was two-thirds the optimistic SDS forecast for 2030.

You can see why I’m confident we will do better than the IEA predicts. After all, the IEA’s record on solar forecasting has always been comically wrong:

Source

Materials Required Per Watt Of PV Is Decreasing

Silicon solar cells are used in 95% of solar panels produced in the world today. Not including the aluminium frames, the report says these panels are, by weight:

- 5% high purity silicon in solar cells. (Actually under 4%.)

- 1% copper in the panel’s wiring. (I never bothered to check how much copper is in a panel, so I got nothing here.)

- Less than 0.1% silver and other metals. (Yeah… I’m in the same boat as with copper.)

More materials will be required to meet the report’s forecasts, but the material solar requires per watt of capacity has steadily declined over time. This has been thanks to continual small improvements in design and production. A doubling of installed solar capacity won’t need double the materials.

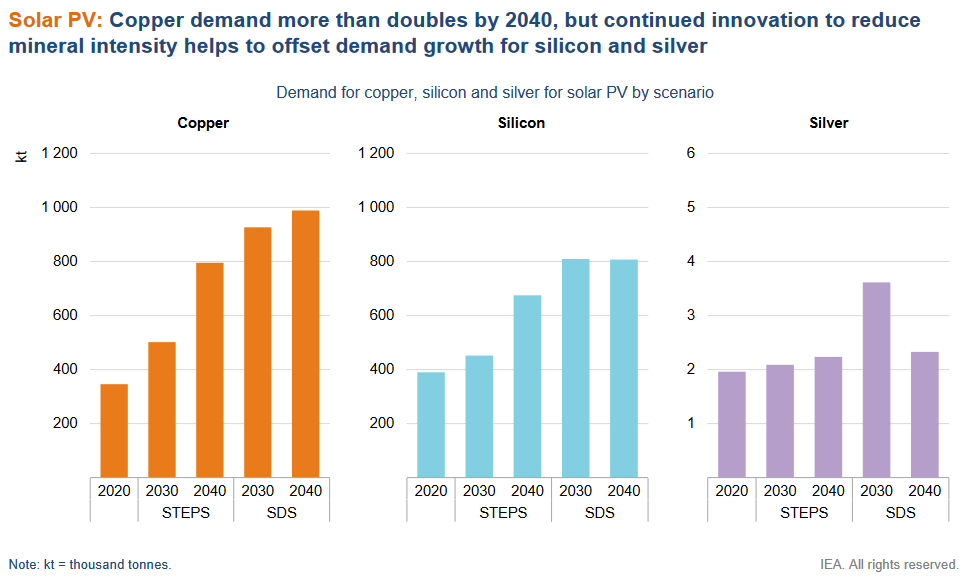

At the moment, it’s not clear how much more solar manufacturers can improve, but in the report’s optimistic SDS prediction, the amount of copper required per watt of solar PV by 2040 is around 50% of the 2020 amount, while silver is around 40%.

Copper Is Critical

Because it’s in demand by other renewable technologies and transmission, copper may be the most critical mineral for solar PV. It’s currently used for solar panel wiring, cables, and inverters1.

The graphs below show predictions for copper, silicon, and silver consumption by the solar industry for both scenarios. The more optimistic scenario clearly expects much more efficient use of these materials thanks to economies of scale.

Alternatives To Silicon

The IEA report predicts silicon PV will remain dominant through 2040 but mentions three competitors that may grow in importance and affect the amount and types of materials required for PV. The three alternatives are…

- Cadmium telluride (CdTe) thin-film PV

- Perovskite PV

- Gallium Arsenide (GaAs) and related PV

Cadmium Telluride Solar: Silicon PV is 95% of world production, and nearly all the rest is cadmium telluride thin-film panels produced by First Solar. While its share of production has been declining for a long time, if it can reduce costs faster than silicon, it could make a comeback. Despite being called “thin-film,” First Solar panels use more materials and weigh more per watt than silicon ones. But this may change.

Perovskite Solar: People have been working on perovskite solar for over a decade but haven’t yet developed ways to mass-produce long-lasting panels at competitive prices. If researchers crack the problem, the solution will almost certainly involve adding a perovskite layer to silicon panels to improve their efficiency while only slightly increasing the amount of material required. The IAE report is optimistic on perovskite and assumes over 25% of PV production will use it in 2040.

Gallium Arsenide (GaAs) PV: Highly efficient multi-junction solar cells can be made using materials such as gallium and indium. Their current drawback is high cost, but this could be reduced in the future. I don’t expect them to compete with silicon PV outside of special applications any time soon. Still, the IEA report is very inclusive and says they could be 5% of PV production in 2040 and consider 15% possible.

The report doesn’t consider other types of PV, and I’m not expecting any other type of PV to be competitive by 2040 outside of niche applications. But anything’s possible.

Electricity Grids Need Copper & Aluminium

Australia and countries worldwide are expanding transmission networks to integrate renewable generation. The more long-distance transmission capacity, the easier it is to send energy from where renewable generation is high to where electrical energy is most in demand.

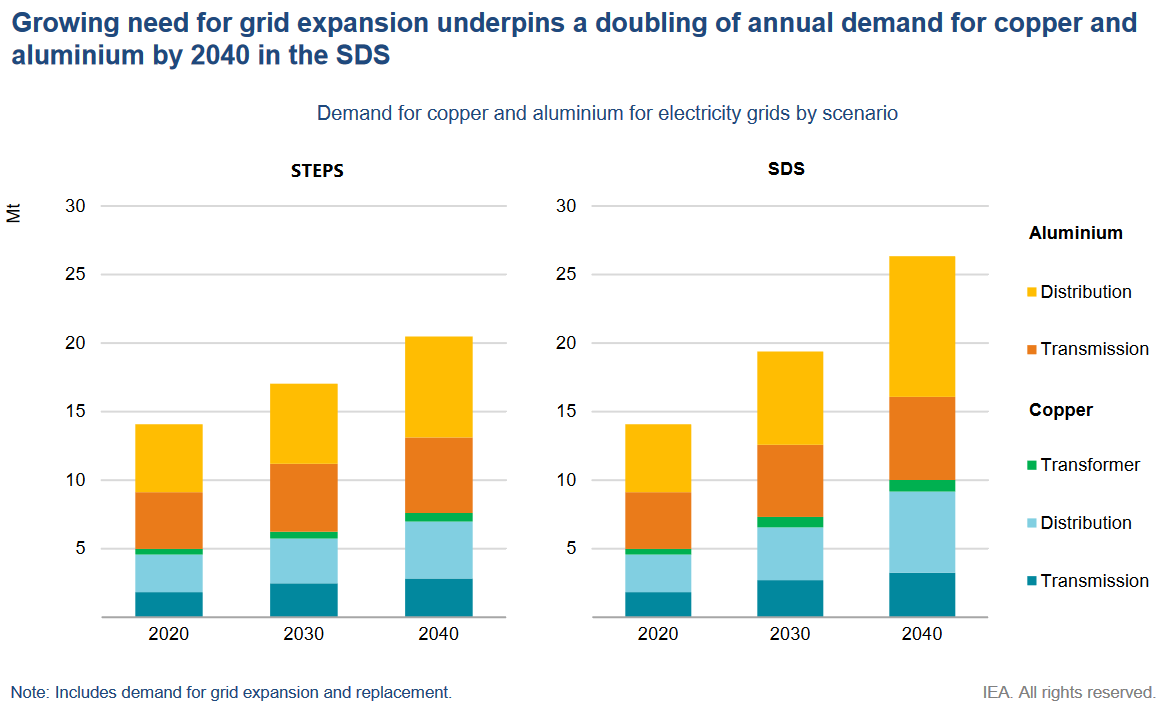

The IEA report says copper and aluminium used by electricity grids will double by 2040 in their SDS prediction, as this graph shows:

Exactly how much copper and aluminium grid expansion will require depends on:

- How much aluminium substitutes for copper.

- How much batteries and other technology make grids smarter and more flexible.

- How much High Voltage Direct Current (HVDC) transmission is used.

Aluminium Subsituted For Copper: The most conductive metal is silver, followed by copper, gold, and aluminium. Silver and gold are pricey, so power lines are made from copper or aluminium. Copper is mostly used underground, while aluminium lines are strung overhead because they’re lighter2. How much of each metal is used depends on their relative prices. As increasing renewable generation reduces the cost of electricity, the price of aluminium should also fall, freeing up copper for other purposes.

Smart Grids: Local battery storage can supply electricity during periods of high demand and reduce or eliminate the need for new transmission capacity. How much batteries will reduce the need for transmission upgrades will depend on how cheap they get. Energy management systems that shift energy use to less congested periods also get lumped into the smart grid category.

HVDC: High Voltage Direct Current power lines are rapidly becoming standard for new long-distance transmission. The longest in the world is planned to connect the Northern Territory with Indonesia, Singapore, and — through existing interconnectors — Malaysia. Because HVDC lines can carry a lot of energy with a narrow cable, they require far less copper or aluminium than traditional transmission lines.

EVs & Battery Storage

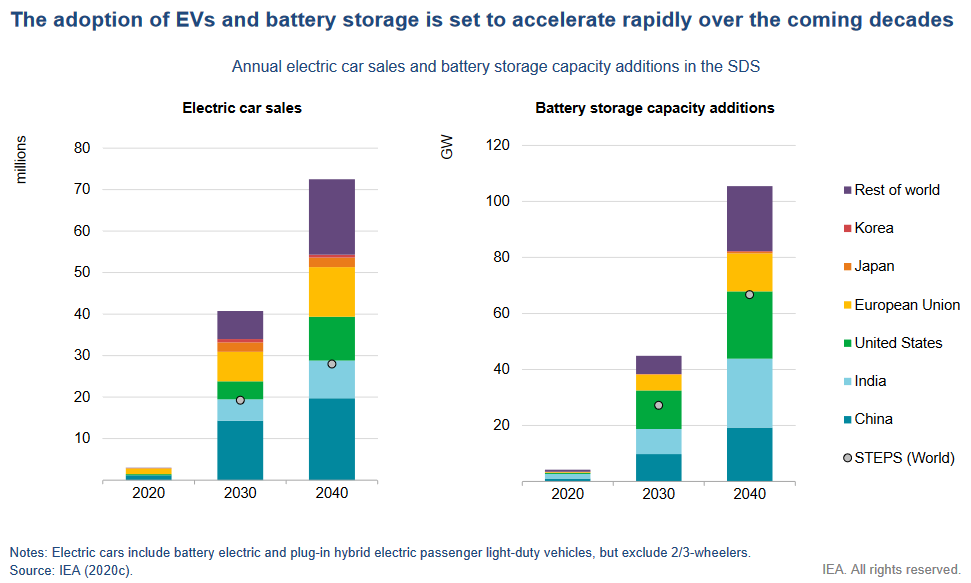

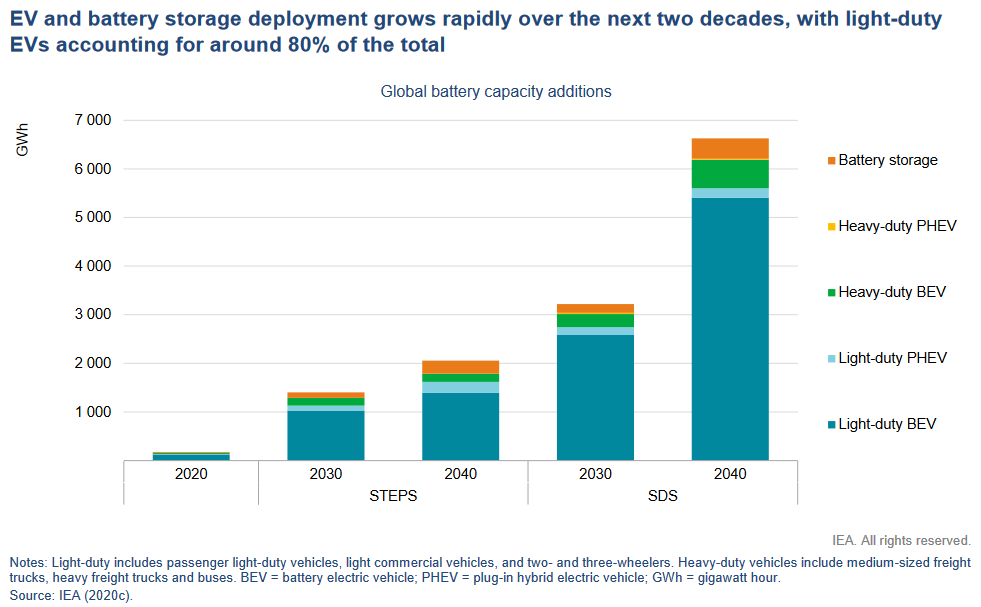

The report predicts a huge increase in the production of electric vehicles over the next two decades. According to this graph, in their more optimistic SDS prediction, the world will build around 780 million EVs from 2021 through 2040:

This graph is for the report’s SDS scenario. The grey circles in the columns show the less optimistic STEPS prediction.

By 2040 around 73 million EVs will be produced annually, and 50% of cars on the road will be electric by then. Current car production is around 73 million per year, so all car production should be electric by 2040. While the world population is still slowly growing in size and more rapidly growing in wealth, many people will never own a car because they live in cities with good public transport3, so this may be enough to eliminate internal combustion engine production.

The IEA Predicts Large Decline In EV & Battery Growth Rate

In 2021 the world produced about 4.8 million all-electric EVs. Including plug-in hybrids brings the total to 6.75 million, which was 8.3% of world vehicle production. As EV production In 2012 was only 125,000, this represents an annual growth rate of over 50%. If EV production continues to expand at this rate, in 2030 it will be more than three times as high as the report’s optimistic SDS prediction for 2040. This is not a realistic number of vehicles to produce, as we’d have to give licenses to toddlers and poodles to use them all, but it does suggest EV production could be much higher than the IEA suggests.

The situation for battery capacity growth is similar to that of EVs, and the IEA report also assumes growth in battery production will decline.

Big Increase In Total Battery Storage

The report predicts a huge increase in total battery storage by 2040 in their more optimistic scenario, with over 92% going into vehicles rather than stationary energy storage, as this graph shows:

Even if only stationary battery storage installed after 2030 is considered, this will come to 2.8 kilowatt-hours of stationary storage per person existing in the world at that time — provided we avoid World War Putin.

Big Battery Packs Are Assumed

We can determine the average size of EV battery packs by dividing the amount of battery storage the report says EVs will use by the number of EVs produced. This gives an average of 75 kilowatt-hours, but the world could get by with half that. This is because most people in this world are not Australian, and many consider that a two-hour car trip is like travelling to the dark side of the moon.

Also, we can expect the efficiency of electric cars to improve. While incredibly expensive at the moment, the Lightyear One EV can travel 10 km per kilowatt-hour of stored energy, which is 26% more than the most efficient Tesla Model 3. It also gets a good chunk of its energy from solar cells on the roof and bonnet.

V2G Is Not Mentioned

Using EVs to supply electricity to homes (V2H) or the grid (V2G) could dramatically increase the amount of storage capacity available to meet electricity demand. While it has problems, such as the current sky-high price of bi-directional EV chargers, there’s plenty of room for prices to fall. But the report makes no mention of V2G at all.

Minerals & Electric Motors

Modern EV motors use permanent magnets with Rare Earth Elements (REEs) like those used in offshore wind turbines. The report says a typical EV motor requires:

- Neodymium 0.25-0.5 kg

- Other REEs 0.06-0.35 kg

- Copper 2-6 kg

- Iron 0.9-2 kg

- Boron 0.01-0.03 kg

If you are wondering what boron is, it’s not rare or expensive. You’ve probably used it to kill ants. It has many industrial and medical uses, but unless you want ants, killing ants is the most important application.

To avoid using REEs, EVs can use induction motors that don’t require permanent magnets. These aren’t normally used because they weigh more and are less efficient. But as the cost of batteries fall, using the most efficient motors should become less important, so induction motors could be used if REEs rise in price.

Induction motors generally use three times as much copper as permanent magnet motors, but both can use aluminium instead. Hyundai uses aluminium in its Ioniq5 EV permanent magnet motor and says it’s better than copper. If they’re right, expect a shift to aluminium in EV motors.

Batteries & Minerals

Materials currently used in the manufacture of lithium batteries include…

- Lithium (Duh)

- Nickel

- Cobalt

- Manganese

- Copper

- Graphite (Slippery carbon can be mined or artificially made.)

Not all lithium batteries require these in the same concentrations. It’s even possible to eliminate the need for one or more entirely. For example, a lot of effort has gone into developing high-performance EV batteries that don’t require expensive cobalt. But these require more nickel. While nickel isn’t rare and around one-third the cost of cobalt, it’s still not cheap, and demand for cobalt will depend on how expensive nickel gets.

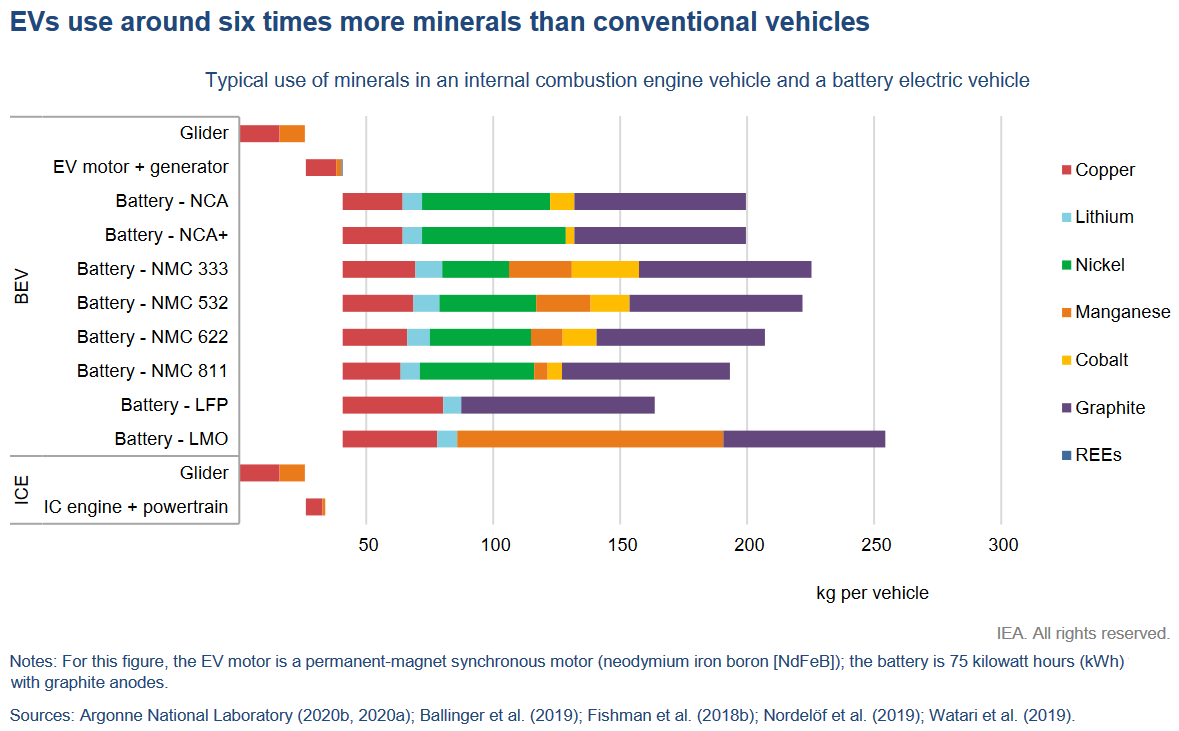

The report says when batteries and electric motors are considered, EVs require 6 times more minerals than conventional cars. But this is potentially misleading as they don’t count steel, glass, and plastic. The graph below shows mineral use by Battery Electric Vehicles (BEV) with different battery types versus an Internal Combustion Engine (ICE) vehicle:

If you’re wondering what a “glider” is, it’s an American term for a car without a powertrain, which is the engine plus everything that gets power from the engine to the wheels.

Battery Prices

Over the previous decade, the cost of lithium batteries fell by almost 90%. Bloomberg put the average price of batteries used in EVs at around $183 AUD per kilowatt-hour in 2021 but warned increasing material costs may cause battery prices to rise this year. They’ll get back to falling in the future, but how long that takes will depend on the supply of raw materials and the demand for batteries.

Solid-State Batteries

Technological innovation will reduce the cost of batteries and improve their reliability while reducing the materials required per kilowatt-hour. The IEA report is optimistic about solid-state batteries. These don’t require a flammable liquid electrolyte but do require more lithium. They provide the advantage of higher energy density and, because they can operate safely at higher temperatures, reduce the weight and expense of cooling systems.

The challenge is working out cost-effective ways to mass-produce them. The report says if this problem is solved over the next 5 years, they could start replacing conventional lithium batteries in EVs early next decade.

Self Driving Cars Aren’t Mentioned

One technological innovation with huge potential to reduce the resources required by road transport is self-driving cars. If people start using robo-taxis instead of owning their own cars, the number of vehicles could plummet. It’s difficult to say if or when self-driving cars will happen, but the report doesn’t even make a guess, and the possibility isn’t mentioned at all.

Obtaining Minerals For The Renewable Transition

For a rapid and uninterrupted transition to renewable energy, minerals will need to be found in sufficient quantities and mines rapidly developed. The report gives information on…

- Location of minerals.

- Time required for mine development.

- Quantity of minerals available in the world.

- Quality of deposits.

Where Will The Minerals Come From?

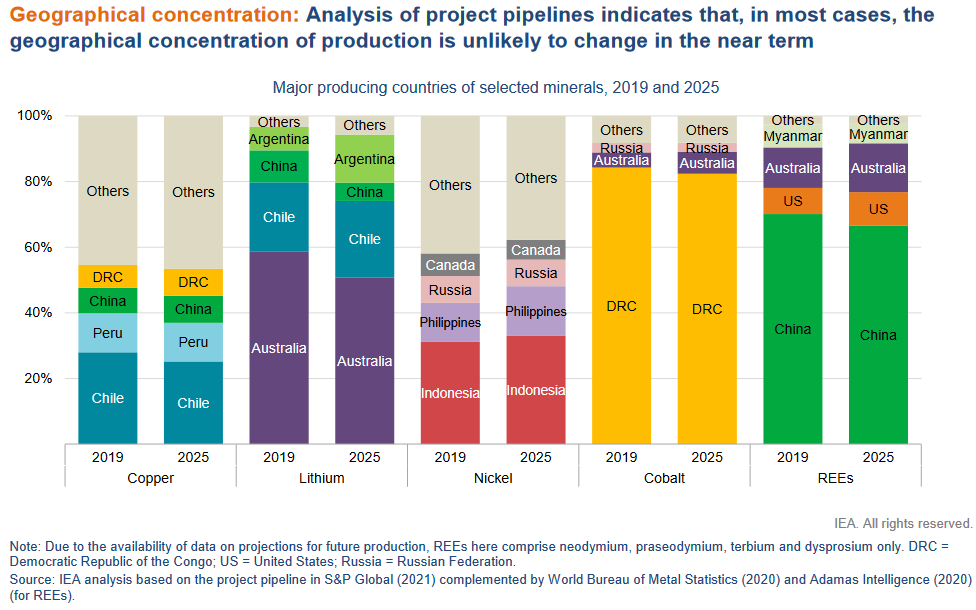

It’s impossible to accurately predict where mineral production will occur decades in the future. Still, the report has a graph showing how they expect the production locations of copper, lithium, nickel, cobalt, and REEs to change between 2019 and 2025:

Despite being around the world’s 6th largest producer of copper and 5th largest producer of nickel in 2019, Australia just gets lumped in with “others”. But you can see Australia is by far the largest producer of lithium. Australia is also expected to increase its share of cobalt and REE production.

At this time, companies have plans to increase the production of all these minerals in Australia, including a mostly solar and wind-powered nickel mine around the intersection of NT, WA, and SA.

Mine Development Time

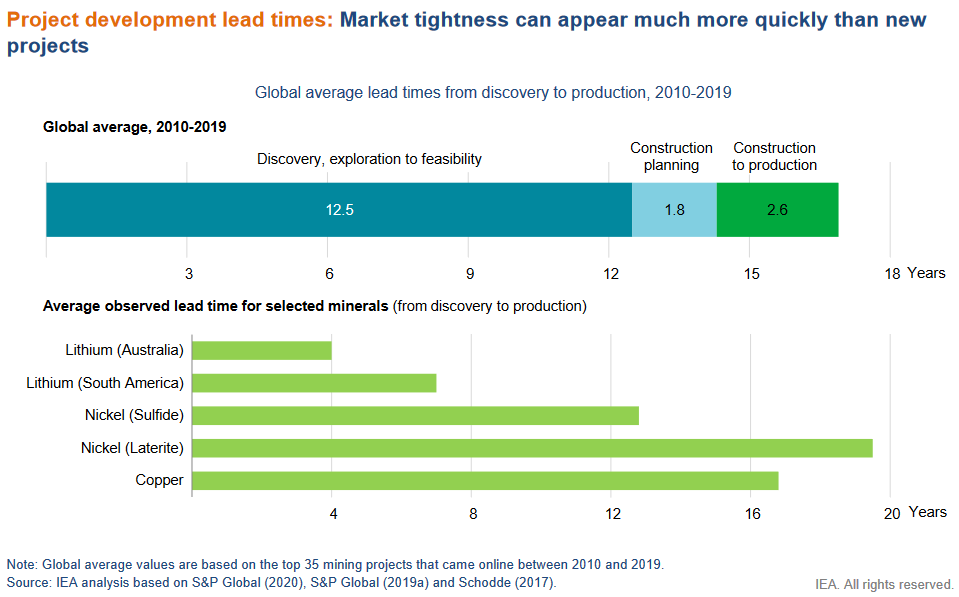

The graph below shows from 2010-2019, it took an average of 17 years for a mineral deposit to go from discovery to an operating mine:

This is supposed to show that production takes a very long time to respond to increased demand, and so shortages can last for a long time if mining companies don’t predict the market correctly. But I think it’s misleading because it doesn’t explain how a lot of the time, nothing is done about a newly discovered deposit because demand isn’t high enough or local infrastructure isn’t developed enough.

Companies can develop mines relatively quickly when the price is right, as the example of 4 years from deposit discovery to a functioning lithium mine in Australia shows.

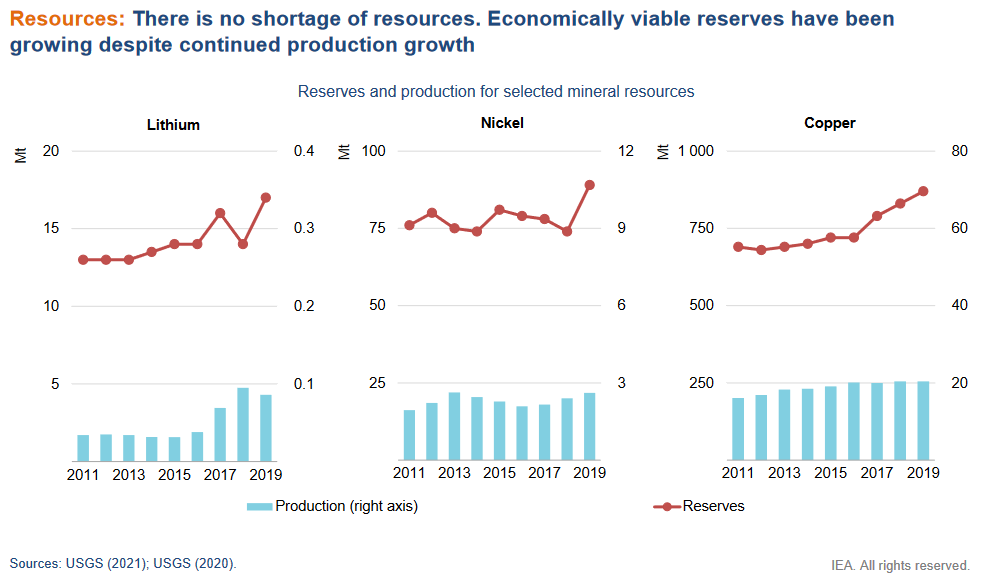

There’s More Than Enough Minerals

There’s no shortage of resources required for renewable energy. More than enough economically worthwhile mineral deposits have been found, and more remain to be discovered:

Quality Of Mineral Deposits Is Declining

The earth isn’t really running out of resources. In fact, apart from losing a little hydrogen and helium and the odd space probe, pretty much everything is still here. It’s just sometimes in a really inconvenient form.

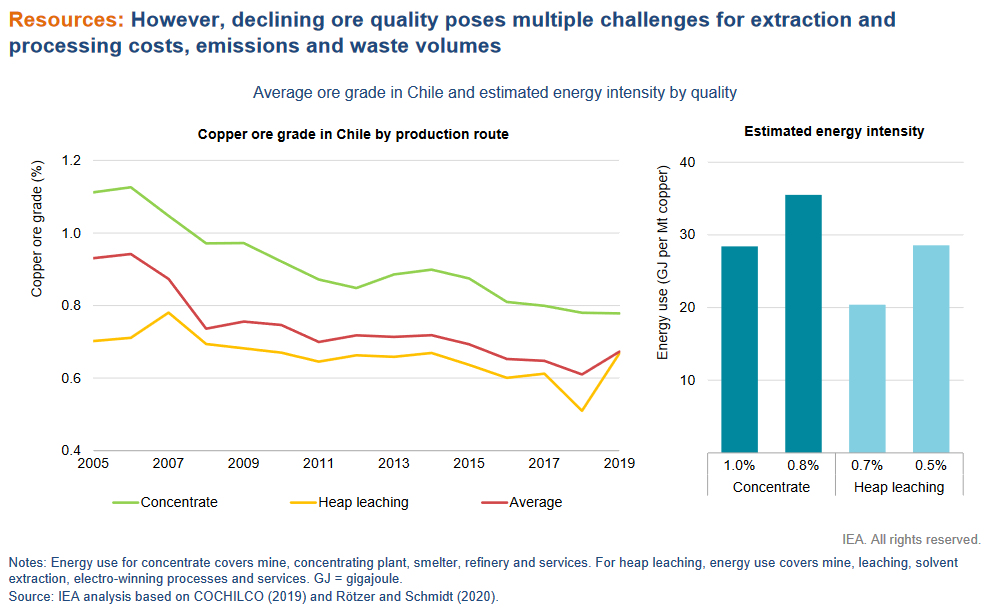

While the world still has plenty of high-quality deposits of minerals, they’re mostly in hard to reach places. Many of the more convenient high-quality deposits have already been mined, and their deposit quality is declining, as this example of Chilean copper extraction shows:

Declines in deposit quality means more tailings, which is unwanted material exacted along with desired minerals. If not managed properly, these can result in disasters such as the Brumadinho dam failure in Brazil, where hundreds were killed by a mine mud Tsunami.

Declining ore quality can also result in more energy needed to extract and refine minerals, increasing greenhouse gas emissions from resource extraction. This effect is gradually being offset by increasing amounts of renewable energy in mining operations.

The IEA’s 6 Recommendations

To ensure the supply of minerals is sufficient to allow a rapid transition to renewable energy, the IEA makes 6 recommendations:

#1. Ensure adequate investment in diversified sources of new supply: This recommendation is about making sure mining companies spend enough money to develop necessary mines and processing infrastructure before shortages occur. One way governments can do this is to provide credible commitments to zero net emissions and internal combustion engine phaseouts.

#2. Promote technology innovation at all points along the value chain: The better our resource extraction technology, the easier and cheaper it will be to provide minerals required by renewable energy while also reducing emissions from extraction. While not mentioned in the report, a carbon price is an economically efficient way of doing this.

#3. Scale-up recycling: This one’s pretty straightforward, and I’ll give details below.

#4. Enhance supply chain resilience and market transparency: There isn’t an open market for some minerals as most supply is handled through private contracts. Without prices that we can easily track, it’s difficult for companies to determine if new production capacity is likely to be profitable. Creating transparent markets increases the likelihood production will be brought online in time to meet demand.

Governments can also check if supply disruption from one region will have serious effects and take steps to mitigate this, such as encouraging diversified production and/or creating stockpiles.

#5. Mainstream higher environmental, social and governance standards: Don’t screw over people working in mines or living where mines are located. Also, don’t help governments screw over those they’re supposed to serve. Safe mines with good working conditions will encourage people to work there freely. At the same time, governments low on corruption are more reliable and make it safer for mining companies to invest there.

#6. Strengthen international collaboration between producers and consumers: The exchange of information and strengthening environmental and social performance standards encouraged by this recommendation is good. But I do get the impression it more or less boils down to, “Hey, the IEA should write more reports for and on everybody!”

Recycling

While most of the IEA’s recommendations above are written in an odd bureaucratese combination of obviousness and vagueness that leaves me without much to say about them, one thing I can comment on is recycling.

Recycling can reduce the quantities of new material we need for renewable infrastructure. While we will still require plenty of new material — not a lot of stuff used lithium in the past — some of it can come from recycled fossil fuel infrastructure such as steel and copper from scrapped coal power stations and oil-powered vehicles.

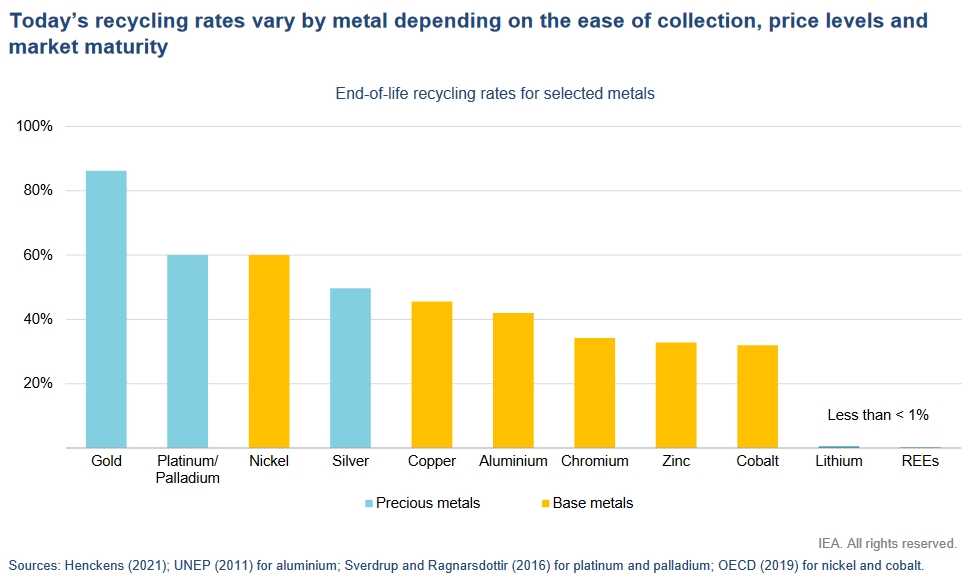

At the moment, recycling rates are not impressive. But it does leave plenty of room for improvement:

I was surprised to see the recycling rate for aluminium of only a little over 40% on the graph above. I checked, and it’s, unfortunately, correct. I guess not everywhere gives you 10 cents for handing over an empty tinnie like in South Australia.

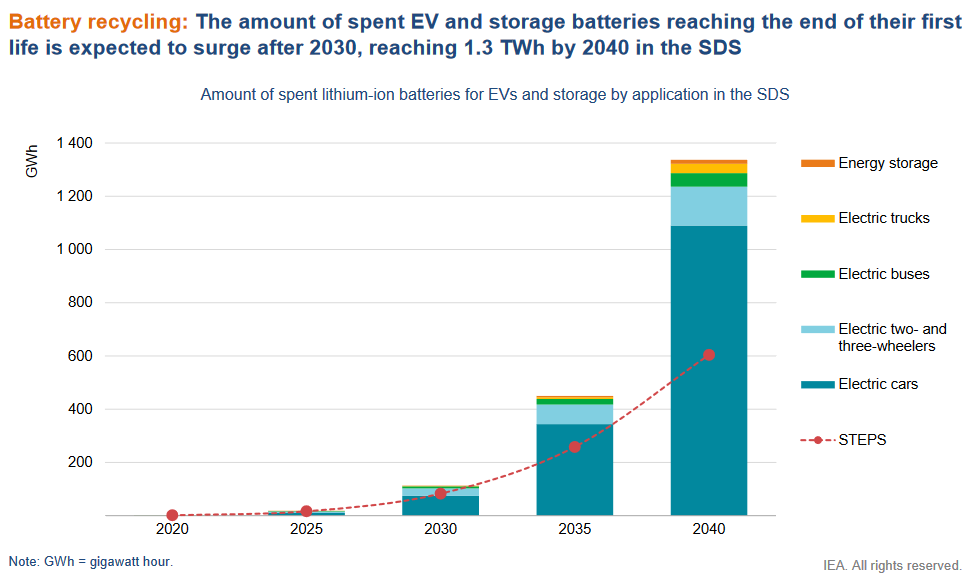

It will take time before lots of batteries and solar panels are available to recycle. The graph below shows how many old batteries the IEA report expects to become available in the future. Note it shows the total capacity of old batteries that can be recycled and not the amount that becomes available each year:

I’m optimistic we will recycle nearly all batteries in the future. One reason is manufacturers are creepily good at tracking everything that happens with EV battery packs and home batteries. More importantly, they contain valuable materials and so are worth recycling. At the moment, nearly all lead-acid batteries are recycled because you can get money for them no matter how beat up the battery may be.

The technology already exists to recycle batteries, and the Swedish company Northvolt claims they can take in one old battery cell and use the materials to produce one new one.

The materials in old solar panels aren’t worth nearly as much, so they don’t provide the same automatic incentive for recycling as lithium batteries. But, as processes improve, I expect recycling will become worthwhile. Researchers have already extracted and reused solar cell silicon from panels. But even if solar panel recycling never becomes cost-effective, disposal of old solar is a trivial problem compared to waste and pollution from coal power or even mobile phones and laptops.

Why I’m Optimistic

I’m optimistic sufficient materials will be available to allow a rapid transition to renewables with little disruption due to:

- Improving durability

- Substitution

- Human greed

Improving Durability

Almost everyone’s aware the cost of solar has fallen a long way, making it the cheapest source of electrical energy in many parts of the world. Far fewer are aware of how much it has also improved in durability. Solar panels with 25 year product warranties used to be rare, but now they’re easy to obtain, and you can now get ones with a 40 year warranty.

Battery durability is also improving, with Q CELLS recently launching a home battery with a 15 year warranty instead of the 10 years most large manufacturers offer. Also, large 100 kilowatt-hour Tesla EV battery packs have shown they still average around 89% of their original capacity after 320,000 km of driving. While we may need to wait for the mass production of solid-state batteries to see a large jump in lithium battery durability, further improvements are likely to be made before then.

Whether or not cars start driving themselves any time soon, they will come with increasing amounts of collision avoidance technology that will improve their average lifespans and save resources by reducing the number written off due to accidents. More durable batteries that we can rapidly charge without degradation can also save resources by making EVs with small battery packs more popular. A large battery pack will be seen as less important if it only takes a few minutes to charge a small one.

I expect there will continue to be impressive improvements in the reliability of renewable hardware. This will reduce the amount of materials required to transition to renewables while hastening its speed by reducing costs.

Substitution

Shortages are bound to happen in the future, but we will reduce their effects by substituting one material for another. There is a lot of capacity for aluminium to replace copper and vice versa in power lines and electric motors. Solar panel manufacturers have also experimented with replacing aluminium frames with steel and plastic. As plastic is likely to become cheaper in the future as demand for oil and natural gas falls, it could substitute for many materials used today.

As mentioned earlier, nickel can substitute for cobalt in batteries and vice versa. The same holds for every element currently used in lithium batteries, including lithium. The giant Chinese battery manufacturer, CATL, is now producing batteries that use sodium instead of lithium. While not technically as good as lithium, it is a hell of a lot cheaper. The salt you put on your chips is 40% sodium by weight. The rest is chlorine. If you’re out of salt, please do not try to add these two substances to your food separately. CATL says they will use their sodium batteries in EVs, but even if they’re only used for stationary storage, it will free up lithium for EVs.

One thing that’s often overlooked is that energy efficiency can reduce the need for materials across various areas such as generation, transmission, and energy storage. Electric cars that get 10 km per kilowatt-hour will require two-thirds the battery production of EVs that get a more typical 6.6 km per kilowatt-hour. The same applies to appliances of all kinds, and continuing improvements in efficiency will reduce the amount of materials required to transition away from fossil fuels.

Greed Is Not Good — But It Is Motivating

The main reason I think adequate supplies of minerals will become available is human greed. Greed is not good, but it is motivating. And, boy, are some people motivated. So long as those who love money can make it from extracting minerals — and so long as they are made to pay taxes and put in jail if they hurt, rob, or kill people — then adequate supplies of minerals are likely to be available. The industry will resolve shortages reasonably rapidly.

If not enough resources are available, we can forge them on the anvil of people’s greed.

This may not be the ideal way to run things, but it does work and is supplying burgeoning renewable industries right now. When properly harnessed with the right incentives, greed can allow a rapid transition to renewables. All you need to do is look at Norway, where almost every new car is electric, France with its rapidly expanding wind and solar capacity, or Australia where over 10% of electricity is now generated from rooftop solar. So long as care is taken to ensure greed remains a servant and does not become the master, we can rapidly eliminate fossil fuel use through market forces.

Shortages Won’t Stop Renewables

The IEA critical minerals report has forecast massive reductions in the growth rate of solar, wind, EV, and battery industries. While this is inevitable at some point, I doubt they will occur as soon or as fast as even the report’s more optimistic scenario suggests.

Big fat reports on the future of renewable energy, whether from private or government institutions, have a well-deserved reputation for consistently underestimating the future trajectory of renewables. I’m willing to bet they haven’t got it right this time.

Mineral shortages will occur in the future, as they have in the past. But as in the past, we will generally resolve them within three years. We’re in a period of high resource prices, but demand for new renewable generation, EVs and batteries remains strong. Once commodity prices fall and solar, wind and batteries become even cheaper, no one will be interested in using fossil fuels any longer than is absolutely necessary.

My prediction is, while shortages will continue to cause some pain as they always have, the transition to renewables will be fast.

Footnotes

- The report says rooftop solar requires 40% more copper per kilowatt-hour produced that commercial solar-farms, but this is slightly offset because it doesn’t need new transmission lines. ↩

- As my friends Pigdog and Spider can tell you, copper is worth 3 times as much as aluminium per kg and is three times as dense, making it 9 times easier to hide per dollar if the rozzers show up and you have to scarper. It’s amazing what you can learn from ardent recyclers. ↩

- There’s a Japanese TV show where a Tokyo detective has been getting to murder scenes all over the country for 26 years without owning a car. ↩

RSS - Posts

RSS - Posts

I used to work in the mining industry, particularly in nickel and gold (with cobalt, copper and ammonium sulphate as by-products). Back then, I had a theory that you would find a higher grade of gold per tonne of resource material in, say, an Olympic gold medal, than the 5 grams in a tonne of good gold ore.

Likewise, I have the idea that there would be a higher grade of rare earths and other metals in a pile of used batteries than in a tonne of rock from Greenbushes or Mount Weld.

Correct, Old Gregg! We can make steel and diesel out of old tires and many years back I watched a rubber-clad chap break batteries with a sledge hammer on top of a sand heap, but now they all go to China. Gold can be had out of old electronics, but my scrap yard no longer takes PCs.

It is all a matter of economics.

Currently, extraction and transport of minerals are dependent on petroleum fuels, particularly diesel. Until mining equipment and transport systems become substantially less dependent on petroleum fuels for operations, then adequate supplies of minerals needed for the low/zero-GHG emissions energy transition will likely be seriously disrupted in a post-‘peak oil’ supply world.

“…the coming oil crisis will seemingly come out of nowhere, taking much of the investment community by surprise.”

https://www.solarquotes.com.au/blog/real-world-ev-range/#comment-1392022

Unfortunately, IMO many people can’t imagine that happening until they personally experience it.

Wouldn’t a move to EVs automatically free up a lot of oil thus deferring any hypothetical peak oil? The problem in America for instance isn’t the lack of oil, but Biden cancelling pipelines and discouraging extraction in the US in favour of reliance on foreign oil – principally Canada, Mexico, Saudi Arabia, and Russia.

George Kaplan,

“Wouldn’t a move to EVs automatically free up a lot of oil thus deferring any hypothetical peak oil?”

I’d suggest global ‘peak oil’ supply is no longer “hypothetical”. Global oil production peaked in Nov 2018, and IMO it’s unlikely to bested. High oil prices are likely here to stay, increasing prices for nearly everything.

See Slide #3 at: https://www.artberman.com/wp-content/uploads/2022/01/WEALTHION-JAN-17-2022.pdf

“The problem in America for instance isn’t the lack of oil…”

Nope. The problem in America is the decline of cheap-to-produce oil. Cheaper-to-produce ‘conventional’ oil (in the lower 48 US states) is declining. Alaskan oil is declining. Offshore oil is expensive. Tight/shale oil is expensive and nearly all the ‘sweet spots’ have already been exploited.

See Slide #4.

“… but Biden cancelling pipelines and discouraging extraction in the US in favour of reliance on foreign oil – principally Canada, Mexico, Saudi Arabia, and Russia.”

?? Goodness gracious me!

Mexican oil production is in decline – ever fewer exports to US in future.

http://crudeoilpeak.info/mexico-peak

Saudi Arabia is at production peak. Saudi Arabia has only produced above 10 million barrels per day on two occasions and both times it was for only a brief period and the fields had to subsequently be rested. The world’s largest oil field, Ghawar, has been in decline since 2009.

http://crudeoilpeak.info/the-attacks-on-abqaiq-and-peak-oil-in-ghawar

Russian oil production appears to have peaked in 2019. Only 1% of Russian oil exports in 2020 went to USA.

http://crudeoilpeak.info/russian-oil-production-update-nov-2021

I’d suggest sanctions on Russia for invading the Ukraine will likely dramatically stifle investment in new Russian oil production projects, worsening the rate of production decline from now on.

George Kaplan,

ADDENDUM:

Per EIA data, for the month of Dec 2021, US Imports by Country of Crude Oil & Petroleum Products:

* All Countries: 265,228,000 barrels, equating to 8.56 Mb/d

* Canada was: 148,258,000 barrels, equating to 4.75 Mb/d (56%)

* Mexico was_ _ 19,989,000 barrels, equating to 0.64 Mb/d (7.5%)

* Saudi Arabia: _ 17,039,000 barrels, equating to 0.55 Mb/d (6.4%)

* Russia: _ _ _ _ 12,569,000 barrels, equating to 0.41 Mb/d (4.7%)

https://www.eia.gov/dnav/pet/pet_move_impcus_a2_nus_ep00_im0_mbbl_m.htm

Putting that in perspective, per EIA, US petroleum consumption in 2020 was an average of 18.12 million barrels per day.

https://www.eia.gov/energyexplained/oil-and-petroleum-products/imports-and-exports.php

Oil prices today (Mar 2) are currently around US$108 per barrel (WTI).

https://oilprice.com/oil-price-charts/

Sanctions from other NATO members are likely to preclude them from receiving oil from Russia too. Oil prices will rise further. Some analysts suggest the price will rise to nearly $150 a barrel.

IMO, the energy crisis has arrived – adapt!

Unfortunately, it will take time to deploy sufficient numbers of EVs to make a difference to reducing petroleum demand, but we have run out of time to avoid disruptions in the interim.

Perhaps I’m overlooking it but I can’t see any mention of the actual size of the reserves each nation is known to have, only that the DRC has a near monopoly on cobalt production, and China has a near monopoly on the production of REEs. Australia is credited with 50%-60% of Lithium production, but actual reserves tell a different story!

Chile is #2 for Lithium production, perhaps 20% of the global total, but their reserves are 9,200,000 MT. By contrast Australia – currently the largest producer, is only known to have 2,800,000 MT.

This is the complete inverse of Uranium for instance where Australia has 28% of the world’s reserves (1,692,700 tonnes) but is responsible for only a tiny share of the global total of exports, and this is raw ore not the refined valuable product. Interestingly enough, an ancient DFAT page states that in 1999 Australian uranium exports comprised “11% of the total carbon dioxide emissions avoided world-wide through generating electricity by nuclear”. Slight tangent there. Kazakhstan with only 15% of global reserves (906,800 tonnes) produces 56% of exported ore, Canada with only 9% of global reserves (564,900 tonnes) 33.6% of exports. When it comes to enriched uranium the Netherlands, Germany, and France export well over 80% of the global total.

Should Australia invest more heavily in the original Green energy? 😀

For Cobalt, while the DRC does produce the vast majority – the bar graph above suggests ~85%, it ‘only’ has about half the world’s reserves, with Australia having the next largest at about a sixth. Unlike the DRC, Australia does not use child labour.

When it comes to rare earth reserves, China is well and truly the leader – 4.4 million metric tons, roughly twice that available in Vietnam or Brazil, and their reserves are roughly twice that of Russia which is roughly twice that of India which is roughly a third greater than Australia’s. Random thought. Most of China’s production is from it Inner Mongolia province. Doesn’t it logically follow that (Free) Mongolia might have plentiful undiscovered reserves?

So materials are plentiful, the issue is monopolies, supply chains, economic viability, and of course environmental concerns.

George Kaplan,

“So materials are plentiful, the issue is monopolies, supply chains, economic viability, and of course environmental concerns.”

Energy is key – everything else is secondary.

The YouTube video titled EXTRACTED – How the Quest for Mineral Wealth Is Plundering the Planet, published by The Club of Rome on 10 Jun 2014, previews a book with the same title by Ugo Bardi. The video includes from time interval 0:03:48:

“We will never run out of minerals, but we will run out of cheap fossil fuels and high-grade ores.

The limits to mineral extraction are not limits of quantity, but of energy.

Extracting minerals takes energy, and the more dispersed the minerals are, the more energy is needed.

Technology can mitigate the depletion problem, but cannot solve it.

The depletion of fossil fuels is already becoming a serious problem. The peak of conventional oil production may have passed between 2005 and 2008, while all other oil and gas resources could peak within the next ten years. Coal production could increase for several years, but at a tremendous cost to the environment.

Production from uranium mines is likely to decline during this decade.

Metals such as copper, zinc, nickel, gold, silver and others, are expected to reach their productive peak within less than two decades.

As cheap minerals start to disappear, the mineral industry will begin extracting ever costlier and dirtier minerals, such as shale gas and shale oil.”

I suggest you look at RethinkX report on Energy 2020-2030. It gives another viewpoint on how fast solar may be taken up worldwide and maybe requires a lot of rethinking.