The Clean Energy Finance Corporation is contemplating teaming up with ING Australia on a low-rate green home upgrade loan offer via the Household Energy Upgrades Fund.

The pair have signed a Memorandum of Understanding – and the understanding is the CEFC will *consider* investing up to $75 million towards ING’s $150 million Green Upgrade Loan program.

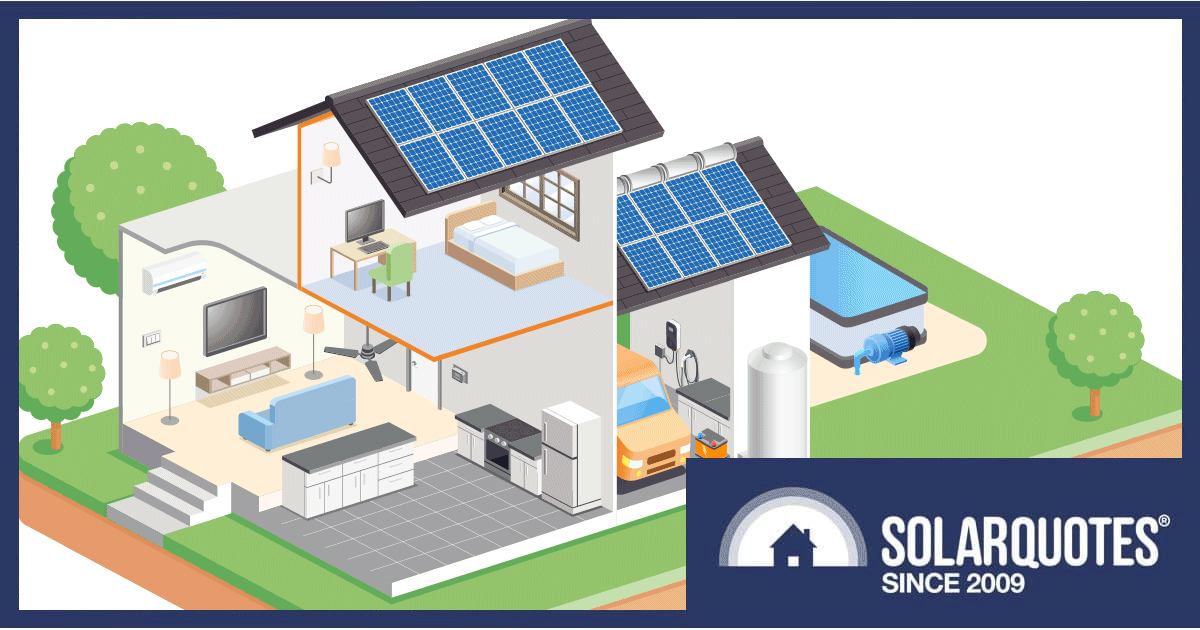

Assuming it all goes ahead (and when that might be is also TBA), the CEFC finance should help deliver a fixed interest rate of 3.74 per cent for the first 5 years on a loan of up to $50,000 for the purposes of installing clean-tech items such as “battery-ready” solar systems1 and home batteries.

This will be available to eligible ING mortgage customers, who will also have access to tools recommending appropriate clean energy technology upgrades.

“We’ve designed our Green Upgrade Loan following customer and mortgage broker feedback that the retrofitting process is complex and time consuming,” said ING CEO Melanie Evans. “If we want to accelerate decarbonisation, we need to remove the complexities and barriers that are stopping people from making their homes more energy efficient.”

According to the Department of Climate Change, Energy, the Environment and Water (DCCEW), residential buildings account for around 24% of overall electricity use and more than 10% of total carbon emissions in Australia.

About The HEUF

If/when the ING green upgrades loan with Clean Energy Finance Corporation backing eventuates, this would be the third investment by the CEFC from the Household Energy Upgrades Fund (HEUF). The Australian Government allocated $1 billion to the CEFC to create the HEUF, which provides discounted consumer finance to help households upgrade the energy efficiency of their homes.

The fund, which began its first year of operation in the 2023–24 financial year on 1 December 2023, is expected to assist more than 110,000 households.

More information on the HEUF can be found here.

There’s been significant interest from the finance sector in participating in the HEUF, with the CEFC receiving proposals worth more than $850 million in green loans to date. So far, $220 million has been earmarked and the organisation is continuing to work with various lenders on other programs. Further commitments (or perhaps quasi-commitments as with ING) are expected next year.

Westpac HEUF-Backed Loans Are Already Go

In August this year, Westpac announced it was launching Sustainable Upgrades home and investor loans – the first bank to be supported by the HEUF; for real this time. It’s offering a variable interest rate of 4.49% p.a. to eligible owner-occupier and investor home loan customers, who can apply to borrow up to $50,000 with a loan term of up to ten years.

Westpac’s research indicates 89% of Australians looking to renovate within five years would consider sustainable upgrades a part of that exercise. 38% would consider installing solar panels, 27% home batteries, 25% solar hot water, 23% installing insulation and 22% would consider double-glazed windows.

More On Solar Finance

Approached correctly, a solar system can save more money each month than it costs to finance; including interest. So, what’s the best way to finance a solar/battery installation? It requires some shopping around and will vary depending on your circumstances. We discuss the potential benefits and pitfalls of various forms of solar finance in more detail here.

Footnotes

- Technically speaking, just about every solar power system ever installed is “battery-ready” through the use AC coupling. ↩

RSS - Posts

RSS - Posts

The part that annoys me is gating them all behind being a existing home loan customer.

It wasn’t long ago i was looking into this for getting the system i wanted until my family ended up getting a good enough deal to make staying on the 44c until 2028 viable if not my preference.

The deal was only so good because they want a good rep at a family members workplace who she was pointed to them from “housing”.