The Tesla VPP in South Australia networks thousands of residential Powerwall batteries to work together, support the grid and make money. How did it go in its first 12 months? Pretty good.

South Australia’s Virtual Power Plant isn’t just delivering electricity to consumers in that state – it’s also proven successful at helping the SA grid respond to grid-scale events. And that grid-response is a profitable sideline for the VPP.

That’s the conclusion offered in this AEMO paper, an analysis of the VPP’s performance when the SA grid was under stress.

The five events in question happened between April 2019 and January 2020. Three required emergency Frequency Control Ancillary Service (FCAS) responses to keep the grid’s frequency within spec, while the other two were events which, in the AEMO’s language,

“required an energy response”

(the VPP had to respond to energy market signals – price rises and falls).

The analysis focuses on the Energy Locals / Tesla VPP, and it found grid stabilisation was a handy revenue generator for the project, with $132,000 revenue from large contingency FCAS events, and $126,000 from lower contingency FCAS events.

Where Does A VPP Fit In The Grid?

There are currently three VPPs in operation in Australia’s grid, all in South Australia (we’ve listed them here). As we explained when we first published our VPP comparison table, the idea is pretty simple: participants allow the VPP operator to take over control of their battery, in exchange for the chance to buy and sell grid electricity at wholesale, rather than retail, prices.

The operator then gets to charge or discharge the batteries in response to what’s going on in the grid. If there’s a power shortage, the batteries discharge; if there’s an excess on the grid, the operator feeds the cheap power into the batteries.

That makes a VPP potentially important in an increasingly renewable world in which the grid has less “big spinning iron” to help stabilise grid frequency, and in which there can be big changes in supply with increases or falls in sunshine or wind.

VPP And Frequency Stabilisation

The three times SA’s grid needed FCAS were when:

- Queensland’s Kogan Creek generator tripped in October 2019 taking 748MW out of the power system (the grid went below frequency);

- when the interconnect between Victoria and South Australia was disconnected in November 2019 (the grid frequency rose); and

- over- and under-frequency events in December 2019.

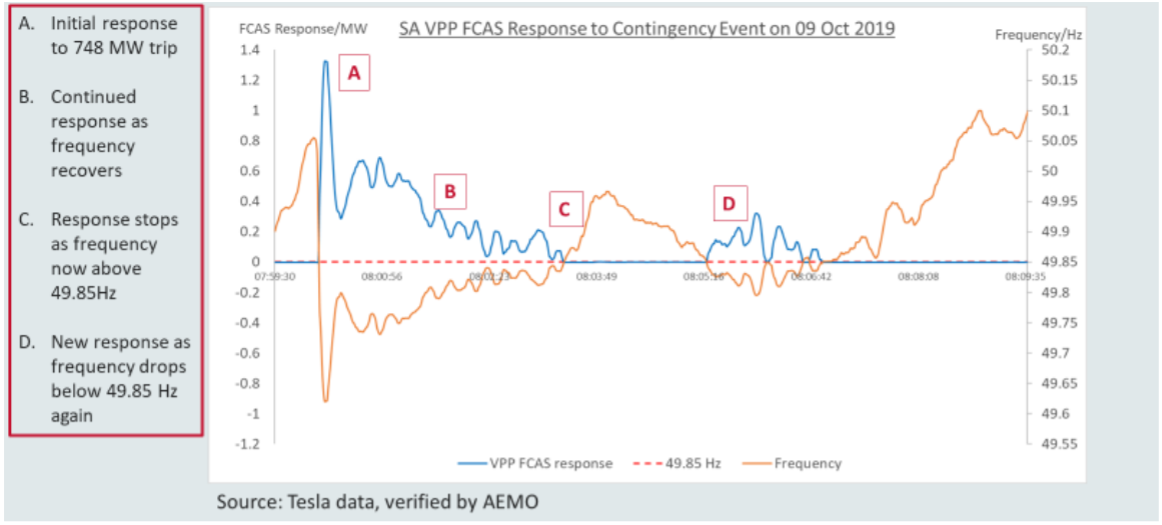

The VPP wasn’t perfect – it only met the grid’s requirement in two out of the three events. In the October 2019 Kogan Creek event, and in the over-and-under frequency event in January 2020, the VPP exchanged power with the grid as required. The image below, for example, shows the VPP pumping power into the grid whenever the frequency dropped below 49.85Hz.

VPP performance during the Kogan Creek outage. Source: AEMO

Things didn’t go as well in November 2019, when what AEMO calls

“a non-credible contingency event resulted in the electrical disconnection of the South Australian region from the rest of the NEM power system for nearly five hours”.

What non-credible contingency event? In this AEMO report, it’s attributed to the

“maloperation of a communication multiplexer which caused the X unit protections on both of the affected transmission lines to erroneously detect faults and cause the opening of circuit breakers at each terminal”.

The transmission lines affected were both 500kV links from Heywood – one headed for Mortake, the other to Tarrone.

AEMO describes the VPP’s response like this: “The initial separation resulted in the power system’s frequency reaching 50.85 Hz3, which meant the SA VPP was required to deliver its full amount enabled, 1 MW lower contingency FCAS. In this example, the SA VPP under-delivered FCAS.”

This was not, however, a failure of the VPP as a concept – it was a configuration issue. Quite simply, not all the Tesla batteries in the Energy Locals VPP “had the appropriate frequency support settings enabled”, so instead of having 1MW available to provide FCAS, there was only 828kW. Because the batteries are under the provider’s control, Energy Locals was able to remotely reconfigure the “non-compliant systems”, and since then Tesla has been checking systems daily to make sure they will respond to future events.

Market Signals

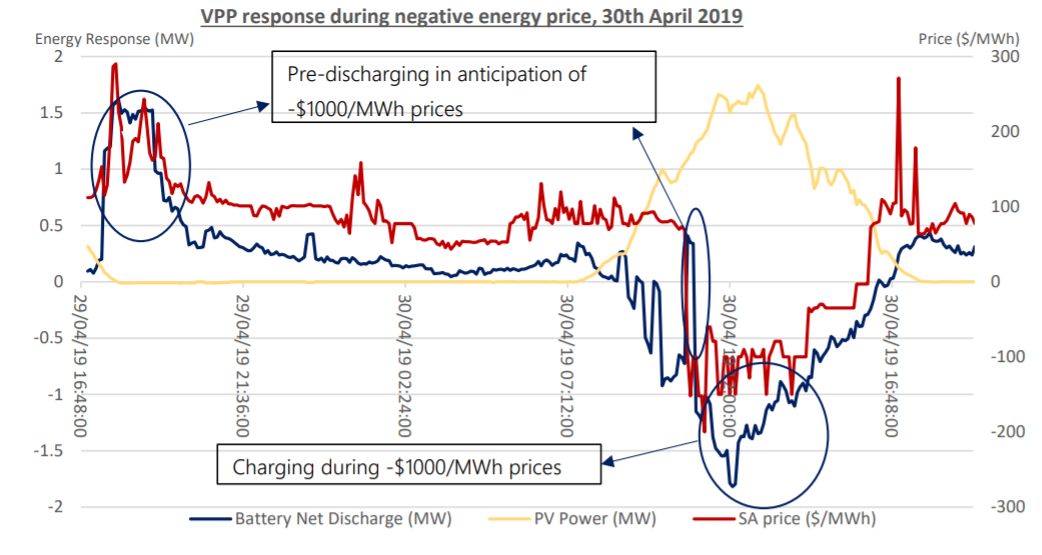

The two energy market events in the analysis were in 30 April 2019, a negative pricing event; and a week of fluctuating prices starting on 9 January 2020.

The April negative price event happened before the VPP Demonstration formally began operation. The price dipped below zero twice, on 29 and 30 April, and AEMO’s chart shows the batteries responding to the events. The VPP offered a similar response in January, stabilising prices by charging when electricity is cheap, and discharging when prices spiked.

The VPP responding to January’s price fluctuations. Source: AEMO

RSS - Posts

RSS - Posts

VPP’s make a profit from the unintended consequences of technology systems that fail.

Medical suppliers make a profit from patients suffering from the unintended consequences of motor vehicle collisions.

Both seem to be good candidates as potential revenue generating business models for savvy investors and business entrepreneurs.

Not much info around about the most appropriate business growth strategies we should all get behind and encourage though.

Lawrence Coomber

And was it good deal for the consumer? That is not at all clear.

Hi Richard:

As you mentioned two of the FCAS, VPP reacted, the problem I understand is all the batteries in the VPP all discharged at that time? AEMO will pay for this with this fomula: MWE X CP/12 to the VPP company?

Further could you please explain how VPP company charge batteries when the electricity price is negative? all of their batteries? at the same time? they get the information from AEMO E-hub platform?

Thanks