Joining Amber Electric a year ago, I began an exciting journey with 6.6kW of solar and a 10kWh SolarEdge battery on my Adelaide townhouse. The promise of sky-high prices for exported energy was irresistible.

But did the reality live up to the expectation? Let’s dive into my year-long adventure with dynamic pricing, solar and batteries.

I switched to Amber Electric, intrigued by their unique model of selling electricity at wholesale prices. Connecting my solar system and home battery, I was drawn in by the prospect of being paid up to $15 per kWh for exported energy, more than 100 times the standard feed-in tariff.

Regular electricity retailers make money by buying electricity from power stations, adding a margin to cover costs, earning a profit, and staying competitive without alienating customers.

Amber, however, only makes money through a monthly membership fee of $19. They then pass on wholesale pricing to you, which can change every 30 minutes.

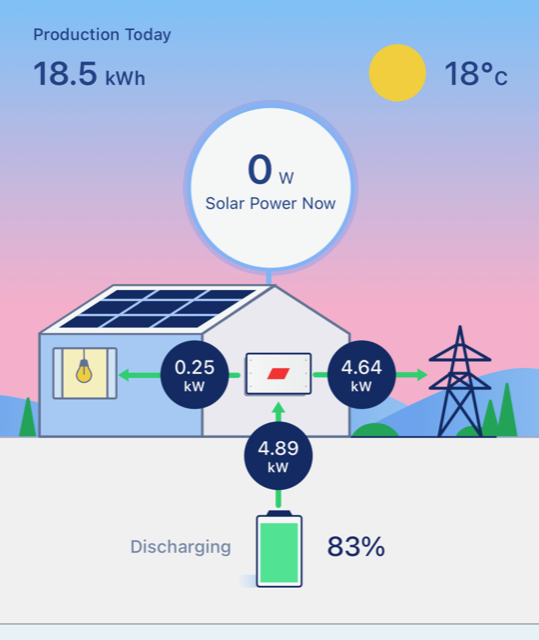

The idea is that the Amber SmartShift App takes control of your battery and solar:

- avoiding using the grid during moderately high prices by using battery power

- using as much electricity as possible during negative prices (you get paid to use energy with negative prices)

- curtailing the solar to ‘zero-export’ when prices are negative

- discharging into the grid from the battery and solar panels when prices are really high

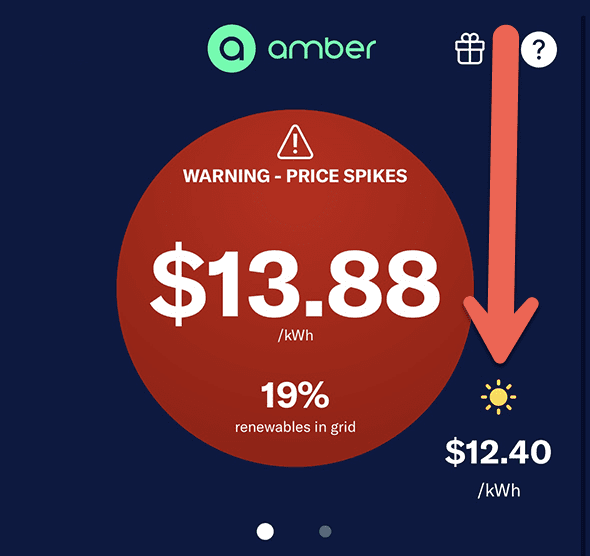

A $12.40 feed-in tariff for the next 30 mins.

Household members also play a role in managing appliance usage to reduce energy consumption during peak times.

This level of volatility means I wouldn’t recommend Amber to my grandma.

And you shouldn’t consider Amber without a home battery to buffer against price spikes or if you have a large solar array that can’t be curtailed.

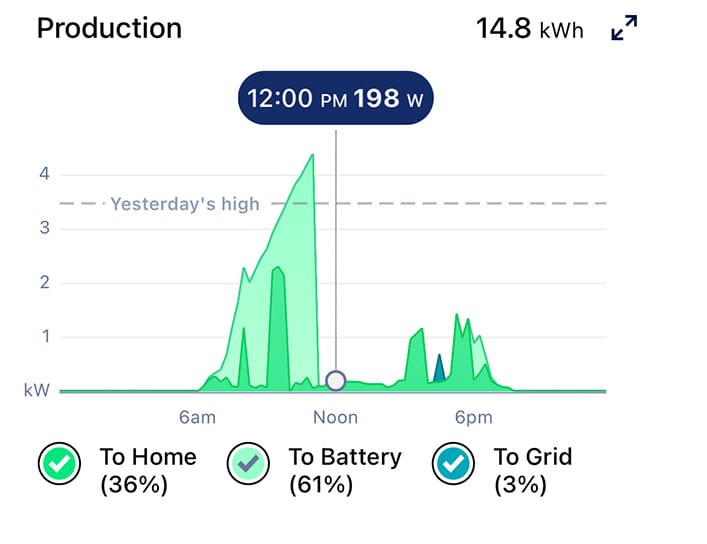

When my feed-in tariff goes negative, Amber ramps down my inverter to stop solar exporting to the grid – as shown by the light green area suddenly dropping.

Amber Supported Batteries

Amber supports these brands for battery control and solar curtailment:

Coming soon:

- Fronius (with BYD batteries)

- Enphase inverters and batteries

Amber’s priority is implementing solar curtailing first, then battery control.

Cash Rebates For Amber In SA

The SA government’s Retailer Energy Productivity Scheme (REPS) allows eligible energy retailers to provide ‘incentives’ to homes or businesses that use their services.

Amber is eligible, and you can apply for a straight cash rebate after signing up.

The dollar amount varies from about $100 to $1,600 depending on the size of your battery and whether you’re in a ‘priority group’. For example, if I joined Amber today with my SolarEdge 10 kWh battery, I’d get a $570 cash rebate.

You must claim the REPS within the same calendar year you join Amber. And sadly – it’s only available to new customers from July 2023 onwards. So, I missed out.

Amber has hinted similar schemes might be on the cards for other states in 2024.

Six-Month Results

I joined Amber in August 2022 and wrote my initial review 6-months later.

6 month summary: I was no better off with Amber for the first 6 months (Sept-Feb) than with my previous retailer, Origin.

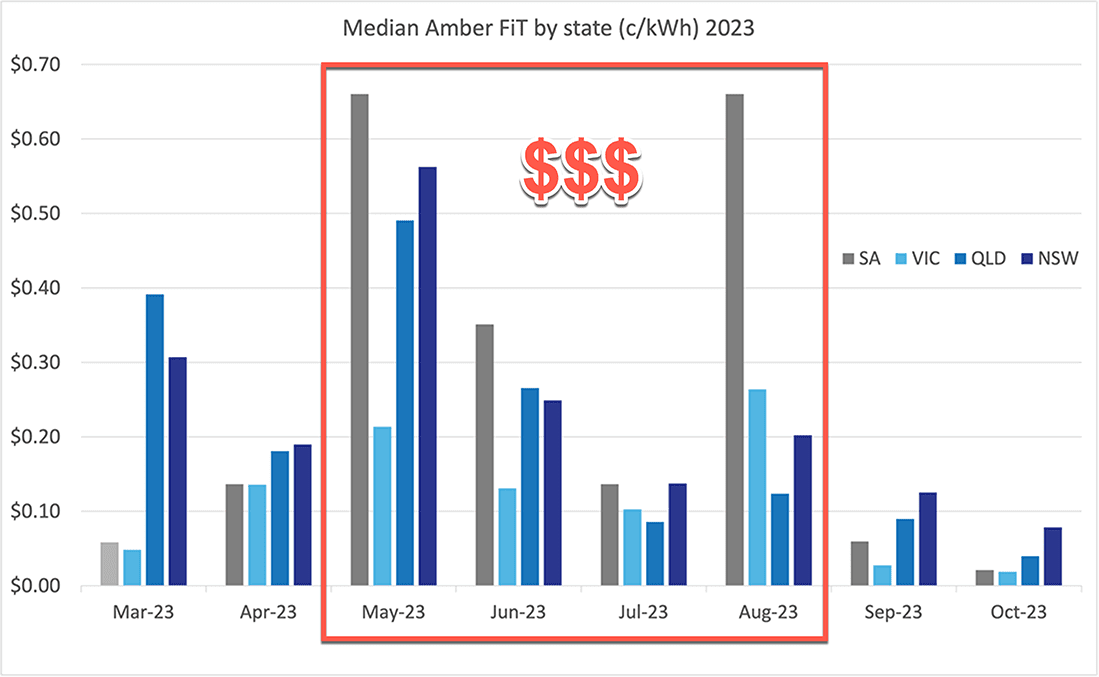

But I predicted the next six months (March-August) would be more lucrative as, historically, Winter/Autumn gives Amber customers the highest average feed-in tariffs.

Amber’s internal data shows their customers did well in autumn/winter 2023, with the average FiTs in SA averaging 50c per kWh from May to August.

The May-August period was lucrative for SA.

Unfortunately, I couldn’t take full advantage of those feed-in rates because my battery was faulty.

SolarEdge Battery Problems

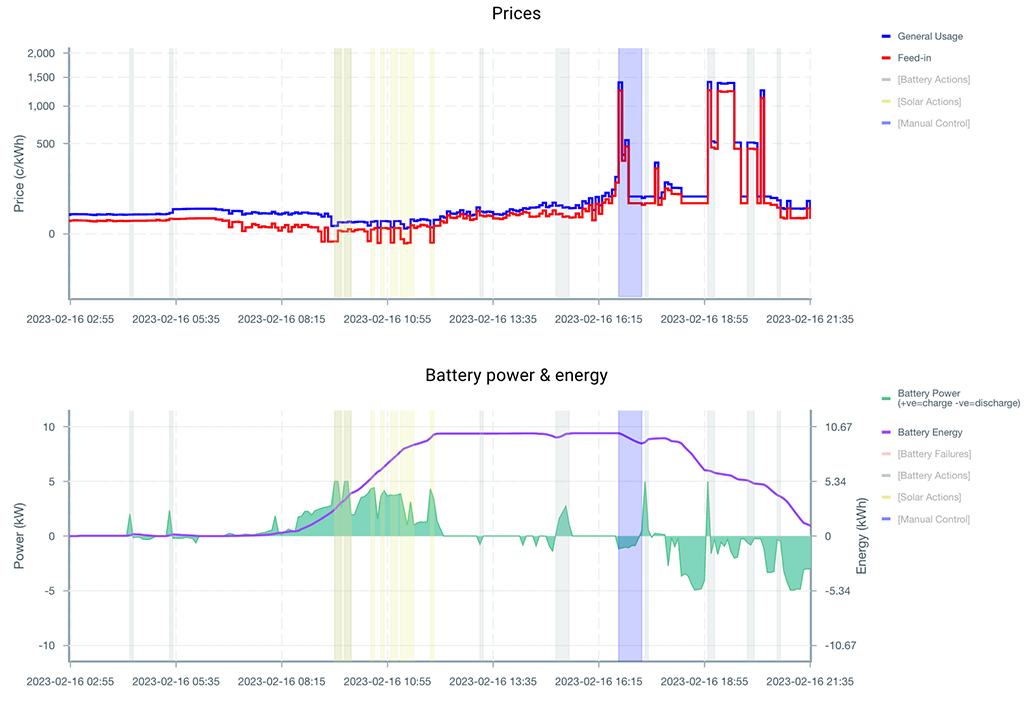

In March, I noticed my battery was refusing to export at full throttle (5kW):

The bottom blue section shows a peak pricing period when discharge (green curve under the line) should have been -5kW but barely hit 1kW.

Despite the battery happily discharging into my house at 5kW, it refused to discharge at more than 2kW (usually less) into the grid during ‘grid events’, crippling my earnings.

Sky-high prices typically persist for 30-60 minutes, making it essential to rapidly discharge your battery when the opportunity is there. So I worked with Amber and SolarEdge to get it fixed.

A Six-Month SolarEdge Support Saga

Mid-March: Support ticket raised with SolarEdge.

Early April: SolarEdge sent out a technician to check my installation. They identified a few minor issues but didn’t fix the weak discharge issue.

May: SolarEdge remotely disconnected my battery from Amber while they ‘ran some tests’. After ten days, they reported ‘we have made some changes remotely, battery is doing good, please check and confirm’. Which I told them I couldn’t do – until they reconnected me to Amber.

June: After waiting weeks for a reply, SolarEdge claimed they had reconnected my battery to Amber – but my Amber app said otherwise. Reaching out to my contact at Amber – they advised I had to re-apply for connection.

Reconnection took two weeks. I tested my export functionality – and the issue still wasn’t fixed. Frustrating.

July: With a support ticket still open with SolarEdge, I hadn’t heard anything from them. My contact at Amber was prodding them constantly.

August: Amber asks me to test my export rate again. Huzzah:

Sweet, sweet discharge

So – after raising the issue in March, it took a full six months to fix. I missed out on my most lucrative earnings period.

The silver lining is that other Amber users with SolarEdge batteries should now suffer less. As Amber told me:

Your experience has led to better troubleshooting for others. There’s now quicker tech support responses and more local tech experts working with [Australia’s] unique energy market. A new dedicated contact person has been added for quicker problem-solving. In cases of battery issues, there are now specialized battery engineers available for support. This team is gaining more knowledge about Amber and Virtual Power Plants (VPPs). While SolarEdge is slow to change, there are signs of improvement. Your challenges have contributed to enhancing services for others, and efforts are ongoing to further improve them.

I’m glad my SolarEdge frustrations weren’t all for nothing.

My 12-Month Savings With Amber

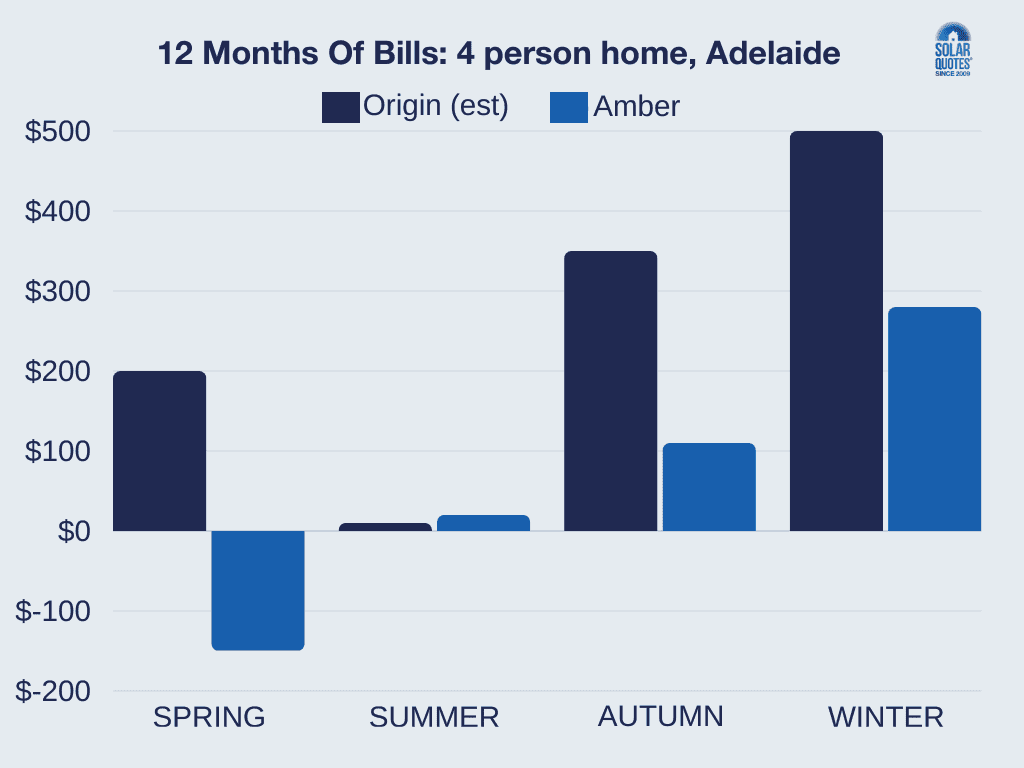

Despite the hamstrung battery, spring with Amber was great. Comparing Amber with my bill the previous year, I was $200 better off. But over the summer, I was almost $200 worse off, wiping out the gains. I then got slightly lower bills in Autumn and Winter with Amber.

Overall, I spent about $80 less with Amber over 12 months than with Origin in the previous 12 months.

But in Amber’s defence, over those 12 months, Origin hiked its prices and slashed its Feed-in Tariff.

If I estimate what my bills would have been with Origin’s new tariffs (dark blue below) and compare that with my Amber bills (light blue), Amber starts to look much better:

By my calculations, Amber was $500 cheaper over 12 months than if I’d stayed with Origin.

Will I Stay With Amber?

I’ve decided to stay with Amber for five reasons:

- They were cheaper.

- They’re good guys who sell electricity at no margin to customers – all their money comes from their $19 monthly membership fee. I’ve found their customer support helpful and their app easy to use and interpret.

- My battery issues are now fixed. So, I hope to earn hundreds of dollars more next year.

- A hot summer is predicted – and a stressed grid means more peak pricing events.

- Trading electricity and taking advantage of low pricing periods feels futuristic and cool.

But Amber is not for everyone. Many people don’t want to think about how and when they use electricity – if they want to blast their aircon at 5 pm on a summer day, they do it.

But for people like me, shifting usage habits to take advantage of high or low-price windows is fun.

Bottom line – I have no complaints with Amber and would recommend them to my more adventurous friends.

RSS - Posts

RSS - Posts

Been waiting for your 12-month write up, a shame about your battery playing up.

How hard does it tend to hit the battery of an evening, does it drain it most days?

Every day is unique in terms of wholesale pricing, so it’s hard to give a blanket answer. In terms of probabilities, it’s most likely that it’ll be in the evening. Yesterday, for example, wholesale prices were lower so my battery was full at 6pm.

Thank you. It’d be good if there was a way to run simulations using the data, like some of the other SolarQuotes calculators and tools, to give people an idea of the savings (or not) they might experience in a given years, based on historical data, what battery they have etc. I’ve looked through the wholesale data and found it highly variable (of course), so it’s difficult to get a sense of whether it might save me money or even make me money. I’m with Origin and get a FIT of 12c/kWh for the first 14 kWh exported each day, 7 c/kWh thereafter. So making reasonable dollars, enough to offset winter usage.

How about it SolarQuotes, a simulator?

I’m with Amber. My setup includes a Sungrow 10kW inverter, 19.2kWH Sungrow battery, 14.3kW in 3 strings x 11 panels and a 3phase connection.

I have not tried another provider. I was already with Amber when I put solar on.

Their automation is impressive, but its also not 100% reliable. Sometimes it just won’t discharge the battery at peak times, even though the app is sitting there for 1.5h telling me it’s discharging. I know this because the sungrow app is also telling me what’s going on.

I have tried to raise this with Amber but so far I’ve got crickets. They occasionally email me to say their customer service team is overwhelmed.

The automated curtailment feature with Amber is a definite plus. You really don’t want to be exporting when the feed-in tarrif is negative. However support is still experimental, make sure your inverter support s automated curtailment if you switch to Amber.

I signed up in June 2023, so I’m still quite early on my journey with Amber. There are other issues I’ve had, but I don’t want to bash them too much publicly.

thank you, it’s so valuable to hear peoples’ stories when making decisions. With a relatively large system and battery, it does sound like a retailer with a decent FiT is still an easier option.

Hey Stephen, did you get your Battery issues sorted? Like yourself I have a Sungrow 10KW Inverter and 22.4kw Sungrow battery, only recently increased from16kw. Since the addition of the extra 2 modules I cannot consume battery energy to supply the house, at times when the house power requirements are greater than solar generation, when this occurs Grid power starts feeding the house. I also cannot use the CONTROL MY BATTERY element with the Amber App to consume battery energy.

Like yourself I have also heard nothing but crickets trying to communicate the issues with Amber.

TIA

I have a friend who is playing a similar game. His next move will be to obtain an electric vehicle, the battery of which can provide extra storage that can be fed back in when the price is right. I am unsure whether the technology is available yet.

I am new to the game. I have a battery-ready inverter, but at the moment do not see a huge advantage in installing a battery. According to the modelling provided by quotes from several installers for both PV and PV + battery systems, the pay-off time for PV-only was around four years. Over double that for a PV + battery system.

The unknown variable is the longevity of the system. If it takes eight years to pay off the battery, and the life of the battery is say ten years, there is not enough potential benefit for me to take the gamble. If battery prices come down and/or battery technology significantly improves, I will be on board.

What I would like to know more about is how discharging the battery at full power affects its longevity. I really have no idea about that.

Thank you for sharing your experience. I look forward to updates, and I would love to have more insight into the questions around expected longevity of the battery you are using. I would also be interested in knowing if the various brands have different track records.

Cheers.

I saw in this video https://m.youtube.com/watch?v=mUJ3iIKuHZg at 2:00 mention of a paper published by Battery University which explores charge/discharge rate impacts on longevity.

If you look into what is required to command a battery to do something over a network connection, you’ll understand the difficulty Amber faces in controlling thousands of batteries all at the same time when a spike happens or when anything happens.

I know with my battery a REST API POST command takes some time to complete the full cycle.

https://images.app.goo.gl/U7HGTombjKkxPPuV9

This sometimes fails on my local network between my home server and my battery which are directly connected to each other via a high-speed switch. Usually, it is because the battery is busy doing something else and rejects the POST. They don’t have the quickest of microcontrollers in them. I have written code to detect this and send the command again after a short period.

So, I can imagine if you are relying on a distant server located at Amber’s data centre to do this you won’t get that sort of personal or local network service.

I wonder how long it will take before Amber realise this and start to offer a local server box to plug into your home network to sit between their data centre and the home battery as a go-between.

I remember the Amber CEO saying that they don’t want to rely on “the worst data centres in the world” meaning the home network but they must realise that they can’t get to the battery any other way.

And these little servers don’t have to be that complicated and probably only cost about $100 but may take some effort to develop. I know mine did.

Great write-up, thanks very much.

Your paragraph “And you shouldn’t consider Amber without a home battery to buffer against price spikes or if you have a large solar array that can’t be curtailed.” is very important.

If I had a battery, or able to curtail solar, I can see Amber would be great. I really admire what they are doing.

My experience:

Amber sent me 12 months of 30min pricing data for my NMI, I spreadsheeted against my AGL usage (also in 30min chunks). I found Amber would have cost $250 more +membership fee.

$100 of that from 1 evening in March 2023 (wholesale cost $15k / MWh due to an event on the grid). Some of the rest from negative FIT.

Keep in mind, my calcs are based on no behavioural changes – bringing your prior paragraph into focus “I wouldn’t recommend Amber to my grandma.” – The same may apply to 3 young children who somehow turn on bathroom heat lamps at 7pm!

Take the heat lamps out! Problem solved…

I took out the heat lamps for the exact same issue. Since then, there have been a few days where I have turned on every appliance in the house (including the oven, air con and steam cleaner) because I don’t have curtailment on my battery, and I have thought about putting those heat lamps back in.

I wish the app had some kind of alarm you could set up to tell you when you are pumping out solar to the grid when the FIT is in negative, or when you are using a huge amount of extra energy. For now I will just have to keep obsessively checking it.

I have also found as someone wrote above that it doesn’t respond sometimes. It’s really frustrating esp between 7 and 8pm when the FIT is the highest and you can’t get it out, or after 8 when it is merrily selling your power for a small price leaving you having to buy more overnight.

Our first bill for 2 weeks was -$56 compared to GloBird which was -$3 for a month, and right before they increased all the prices and lowered the FIT, so I am happy, even if I can’t dial it in as much as I would like 😀

I think the caveat with Tesla is that it needs a specific solar inverter to support curtailment.

Enphase solar and Tesla together can’t curtail, but other combos can.

Correct – but Amber is working on Enphase curtailment as we speak

I have this issue but I have Fronius inverters with my Powerwall 2

a lot of customers are using Home Assistant to take the values from the Powerwalls sensors and then dynamically curtail the inverters.

If your a non coder ChatGPT is the best way to put something together.

Works pretty well but the powerwall sensors only update every 8 seconds so if you have on and off loads like an AC or a dryer during the day, you will see some – FIT loss.

You can then also shut your inverters down using the same system if your grid price goes negative , whichs happens in SA

You can curtail an Enphase system but you have to really want to and need installer access to the system or a friendly installer who’ll do the (trivial) programming change. There are some relay inputs on the Envoy, and these can be programmed to reduce production to a % of nominal production or reduce export by a %. A simple and cheap device to run the relays (heck, an extra breaker if you want to do it manually) and you’re off and running (yes, I did this, no, my installer wouldn’t help, and yes, I’m a geek with too much time on his hands.

I’m going down this track at the moment only due to an unforeseen bit of solar greed on my behalf trying to future proof by maxing out all available roof space.

I have 10kw of panels and the Enphase can’t currently cap its charge limit to 5kw in an outage.

There was an addendum to the Enphase installer guide just after I got my system installed so no one on the supplier or installer side saw the excess kW as an issue.

There is a relay on the powerwall that triggers in an off grid scenario, and that gets connected to the DREM contacts on the Enphase Envoy, then once wired up the installer tells Enphase to modify the DRM circuits to limit power to 5kW instead of shutting down.

Theoretically I can then leverage the “off-grid” setting in the powerwall at any time to curtail the usage to the grid and the powerwall will in turn then temper the Enphase gear.

Currently I believe that the setup I have cannot work without grid power as the Powerwall would pre-emptively shutdown the solar as it would exceed the 5kW charging limit, or maybe damage would occur, so its fortunate we’ve not had any major outages while the battery was fully charged.

I don’t know if that needs to be in place for Amber to run its curtailment as I’m not seeing any practical way with my current setup for that to work.

At the moment its not possible to trigger off grid with the Powerwall when the solar is generating in excess of 5kw.

Similar to Peter above, I have the full Home Assistant setup, but Enphase has next to no configurations unless you can get full installer access, which currently I’ve not been able to do.

Interesting discussion, Jonathon. I have looked carefully at Amber (I like their operation) but we have lots of solar (20 kW) and a SE battery and we don’t use a lot of power in summer (no air cons!). So I think we would lose money exporting when prices go negative. So I am trying to be clever using Apple’s HomeAssistant instead. At least I can automate it to capture what would be clipped power since we have an inverter that has excess power going it to it. Interested to hear other’s views.

Depending on your inverter, Amber will simply curtail your exports if the FiT goes negative (I have SolarEdge and curtailment works)

Can/Has anyone produced a list of Invert/battery combinations that support FIT curtailment? I’m seriously looking at joining Amber and have a Tesla PW2 and a Solax (yes I know) 5kw inverter.

Hi Colin,

Most inverters have a connection that enables what they call DRM (demand response mode) so if you have an external device that closes a relay/contact then it will put the inverter into idle, or zero export if you have the appropriate consumption meter.

Fronius offer really flexible controls via modbus and many others have similar functionality but if you join Amber then you need an inverter they have an integration for.

Amber have a list on their website of compatible batteries with SmartShift. However only SolarEdge and some Sungrow with hybrid inverters can support automatic negative FiT curtailment. PW2 requires manual intervention, but the new PW3 with built in inverter may change all this.

Had Solar Edge since 2000. Upgraded to SE HUB (hybrid) inverter and battery in Jan 2023. Added 2nd SE battery June 2024.

We had negative FiT event yesterday (sunny day in Sydney) . Less common in winter. Less common now with 20kWh of SE battery to fill… But as we head into summer negative FiT will be daily.

Don’t you just use zero export, and all problems solved?

No. Simply setting a permanent Zero Export limit on your inverter means you lose the ability to export when the price is high.

I think the key thing for Amber is going to be the ability to pass the 5 minute cost on to customers if, and when the smart meters are set up that way, so that the 30 minute average can be avoided.

I have seen that prices can dip into the major negatives on the 5 minute interval, but by the time the whole half hour is up and the six 5 minute periods are averages, the price could be positive (in both consumption and feed-in).

Once we can be billed by Amber on the 5 minute intervals, we can trust what the Amber pricing API is telling us and we can truly know, in real time, what we’re going to be paying for/being paid for our electricity.

Thanks good report! I just put in a 7kw system here on Kangaroo Island with a Powerwall coupled to a new Polestar 2 long-ranger in the garage.

I have always been on OVO’s renewable energy plan and wanted to stick with them but was disappointed they only offered me 6 cents. I haggled and they offered 7 cents. I went away to think about it and when I called back after a few days, the new person says, “You don’t own an EV do you? You can get 10 cents” – excellent, but why didn’t they ask that before!

Anyway pays to do your research as they say – as much as I dislike Tesla as a brand the Powerwall, and Fronius inverter, are preforming well and I love the app. The Polestar meanwhile is a next-level driving experience and is charged by my smart Fronius Wattpilot Go – I’m convinced there’s a flux capacitor somewhere involved, as I feel I have catapulted into the next century while living in a renovated 1920s workers cottage on Australia’s best and third biggest island.

So not suited to those without batteries, and not suited to those with large solar systems. Seems like it’s more an attempt to promote battery use than a real electricity retailer.

Like Wedges’ grandma I don’t want to be bothered by a lot of volatility, or fiddling. Someone on SQ did actually recommend Amber, but the quote I got from them was offering about 2.7c per kWh and recommended using other retailers.

My current arrangement – large solar, no battery, means I export a lot – 9 times my usage this last power bill, and I’m basically breaking even. Daily supply charges are almost as much as actual usage fees. Amber’s quote (I quickly reran the figures) suggests $102/month in charges – basically what I’m already paying, but only $30/month in FiT – way worse than other retailers!!!

Given Amber offer wholesale prices, you get charged for exporting power when solar goes negative, and some months have a negative average FiT, what’s to prevent Amber from charging thousands of dollars akin to the old Texas horror story (https://www.solarquotes.com.au/blog/texas-electricity-prices/)?

Obviously it works for some, but it looks to be a niche provider. : – (

Hello George

You may have missed my point about Amber. It wasn’t a recommendation to get a smaller bill.

I was trying to point out that anyone who feels their retailer is getting rich off them by only offering 5c feed-in could go try their luck on the spot market and see what their daytime electricity is actually worth – good ol’ free-market economics. Amber doesn’t take a cut from your sales, so you get to see what’s really happening. As you discovered, 5c is above the odds.

Amber has a bill guarantee (hedge) to deal with Texas-style prices. But some pain was definitely felt by Qld customers when Callide C4 lived up to its name and exploded.

If Amber does not work out cheaper, it seems like a lot of trouble just to stick it to the retailers. If time and money were no object, I would just go off-grid.

At roughly $1 a day to be connected to the grid, you are up for $365 per year, if you do not use any grid power at all. I remember when I paid $100 a quarter for good, clean, coal-fired power from Energy Australia.

The government ought to own the the network; it is a natural monopoly. Supply taxpayer-funded no-fee connection to grid. If that were the case, I would probably be happy just to give my excess to my neighbours who cannot afford to go solar…

Oh I absolutely missed your point if it was meant to offer Amber as an alternative for those who feel electricity retailers are getting rich off them. Off grid seems a simpler solution to me.

So long as solar remains a break even option, or mildly profitable, a grid connection is justifiable. Or if power prices and FiTs jump, but not connection charges, well then a grid + battery option might make economic sense.

I’ve been with Amber for 5 months even though I have a Sonnen battery which is not supported by Amber’s SmartShift technology so I have to manage my energy flow myself.

First bill was $148 for June (I was used to the sonnen VPP rate of $50 per month) This was with me trying to manage the battery manually and switch loads like heating and washing to better times of the day.

Second bill was $107 for July. Still way above Sonnen VPP. But it was winter and I expected the Amber bills would not be like the year round flat rate you get with a VPP.

Third bill $73 for August. By now I’d implemented some automations with my home aitomation system (home assistant) and started to understand how to control my battery with REST commands.

Fourth bill for Sept was $4. Much better after I discovered add-on software for Home Assistant called EMHASS that used forecast data of FiT, ST, PV every 60 seconds to calculate what to do next with the battery and could manage charging my Tesla and pool pump etc (whatever loads I could control from my Home Assistant system)

Fifth bill was -$17 after concering the complex config of EMHASS (not for the light hearted)

This month so far I’m in $60 credit (they have to take their $19 out of that yet) and thats with charging my Tesla Model Y performance most days for 3 or 4 hours (between 8am and 2pm) at about 3 cents per kWh.

And this is with only 5kWp of PV and a 9kWh sonnen battery that only has 3.3 kW inpout/output. If you have a Tesla battery you do much better except amber is having some issues with so many new customers with Tesla’s using their SmartShift system so I’d go with Home Assistant and EMHASS if you can.

I’m hoping that Amber will one day allow SmartShift control from their API and not just the app, then we tap into that with Home Assistant.

I still find that at least once a week I am overriding SmartShift and either charging or discharging to make the best of the prices.

EMHASS is quite brilliant but only seemed to suit if you had the larger shiftable loads like a pool, solar boosted hot water or the car charging each day.

My EMHASS is configured to ignore deferrable loads if price is not low or it’s cloudy etc. I prefer to charge down then local shopping centre if it’s above 3c. Free at woollies if you can get in with all the new EVs on the road.

Also don’t pump the pool every days.

Still do about the same if not better when not deferring.

Hey Robert, have you got any repo for the REST commands you’re using or you using the same commands as the EMHASS blog?

Can you set it up so you only buy when cheap, use your battery at other times?

You can do full manual control if you like.

That’s the idea, arbitrage. This graph in this link is a typical day:

https://cruikshank-my.sharepoint.com/:i:/g/personal/robert_cruikshank_onmicrosoft_com/ERTBwJAZOjtEllv4c_BBy60B4deQee0jqd0m-OCLbLmZZw?e=jTdh6p

The green area below the line is buy or charge from the sun and green above is use or sell back to the grid. The orange line is the buy price and the blue line is the sell price. at 10 AM the buy and sell price drop becuase of the abundance of solar energy on the grid. The sell price on a sunny day is typically negative so you need to soak up the energy from your solar cells with charging your batteries (home and EV) and deferrable loads like hot water, aircon, poolpump or curtailment (I don’t do that). Otherwise you get charged for putting energy out on the grid when they don’t want it. It can even go negative for the supply tariff which means you get paid to charge your car. I’ve only seen it as low as 2cents which means $1.50 to fully charge a 75kWh EV like a Tesla Y Perf with 510km range. But its more common to see 3cents on sunny days between about 10 and 2.

Then in the evening the price goes up to 30 to 60 cents per kWh and you sell. Sometimes you get a spike. I’ve seen it up to $16 per kWh and you run around the house turning everything off so you can sell as much as possible. But its the area under the curve that matters and a good steady difference of 30 or 40 cents is what you want. Charge at 3 sell at 30. The power output of the battery matters.

Also in NSW Ausgrid have a two way tariff which adds something like 26c to the price between 2pm and 8pm but also subtracts 2c from the FiT between 10am and 2pm so that makes it much better. Some states are very flat (not as much area under the curve). I think that two way tariff is a trial and will not be as good after June next year.

The biggest thing to consider with Amber is that the value very much depends on whether you can shift some of your usage patterns and most importantly of all, your grid operator. I’m on the AusGrid network with a special two-way tariff and I made an average of $130 profit per month during spring, increasing to over $200 in October and will be even higher through summer. That with 8kW of solar and a single PowerWall 2. I had to figure out my own way to curtail my Enphase system as Enphase are complete turds when it comes to being able to control your system, but there is a way to do it.

Your system sounds great. I suppose you are a fairly light energy user. If you can get say on average $150 per month PROFIT you can pay of a PowerWall in just over five years whilst incurring no ongoing electricity costs. That is an attractive proposition indeed.

I have a bit of a different experience. Moved to a new house 3 months ago, solar not currently installed (December), chose Amber anyway with that in mind. So my experience so far has no FiT involved at all or solar offsetting the grid.

The thing with Amber seems to be that it will vary depending on who your distributor is. I’m with AusNet in Victoria. Largest I’ve ever seen price wise for a 30 minute block was around 60c. I’ve rarely if ever seen a negative and if I do it’s something like -1c to use power. So there’s never really a time (so far) where I’d be paying some completely insane price to use power on Amber, which makes it easier to get savings.

The new house is mostly electricity, only gas for boosting hot water (which I regret), so my usage has increased a lot (2-3x), but my bills have stayed the same. I’m paying on average 17.5c per kwh most weeks vs 35-40c for a normal retailer. Reverse cycle A/C for heating and cooling throughout the house that is on most of the time.

I work from home, and I try to do high power things during the day or middle of the night. I don’t actively stare at the Amber app, but knowing that it will be cheap during the day drives me to target usage for then. If I’m thinking about putting the dishwasher on I’ll glance quickly and delay the start until the forecasted cheap period.

Very interested to see how it will turn out with my solar and battery coming next month. One thing I noticed was the FiT is primarily negative, so I’m not expecting huge returns, but maybe that will change as the summer goes on or autumn/winter kick in.

I recently had a 13.2kw solar and 13.3 battery installed and went with Amber for the promise of wholesale pricing. I think the business model and concept of buying at wholesale prices is great, but it didn’t work for me. I had a number of questions early on and trying to get an answer from Amber was like pulling teeth…they don’t answer the phone and you get an email response they will get back to you within 5 working days…what business can survive on that logic? Nevertheless, my system works well and being a fairly large system exports anything up to 50kw per day. I was constantly exporting at negative price and the “Solar Curtailment” didn’t appear to be working as it should, so a ticket was raised with their technical team. After some investigation it was discovered curtailment wouldn’t work for me as I have a 5kw Alpha inverter and a 5kw Sungrow and they won’t work when used in tandem, so all my exports were going to waste. I decided to go to Energy Australia who are currently offering the best FIT of $12c kwh for the first 15kwh and $.66 thereafter. So, doing the maths, I should be considerably better off going the traditional route.

I had a similar experience and realisation. They don’t respond quickly enough and their answer to negative FiT is curtailment so it’s not well suited for systems with large/3-phase PV and limited ability to time shift.

Same here…keep getting emails to review the onboarding process (which is still not complete, waiting on SolarEdge curtailment to be implemented), but still only 22 days in…

When it works, SmartShift works well…for those 22 days I’m $105 in credit. However when it doesn’t work Amber seems to be MIA. My first 2 Friday nights I’ve a full battery which is trickle discharging (~144W), high prices and I’m buying from the grid. I also seem to have no ability to manually control things. Issue reported and followed up, but just auto-replies from Amber. Expecting the same this Friday.

I guess they’ll be getting a “poor” onboarding review and/or a complaint.

“the Solar Curtailment didn’t appear to be working as it should, so a ticket was raised with their technical team. After some investigation it was discovered curtailment wouldn’t work for me as I have a 5kw Alpha inverter and a 5kw Sungrow and they won’t work when used in tandem”

I assume you were not able to curtail the output from the Sungrow?

If you could reconfigure more of your solar panels to be directly attached to the AlphaESS inverter (I think the SMILE5 allows 7.5kW), you might have a higher degree of curtailment?

Great review – thanks,

I have 13.3 kw in two 6.6kw systems so it’s easy for me to curtail one system when there is too much renewable in the market and FIT becomes negative. I also have EV, so where possible I charge that selectively to make best use cheap prices or to curtail energy to the grid. Our 10kwh Alpha battery is a good buffer.

I am only with Amber for 6 weeks, so hard to tell about the economics. Current indications are that I will be better off, The $19 monthly fee is not applied for first 6 months for Commonwealth bank customers, so that’s handy.

I went to Amber without a battery, after my previous choice was thrown out of the market and the substitute major started billing me as if I was an aluminium smelter!

Just got the first bill. Just on 70% of what the prior retailer had been hitting me with for the prior 4 months.

I have 6.6Kw of panels on the roof, a 5Kw Fronius inverter, and a device that limits me to exporting 4Kw at most.

I am actively retired so at home a lot of the time. By monitoring the Amber app, I can see when export prices are punitive, so for those periods, I simply turn off the inverter and run on the grid – sometimes at negative rices. The panels are off most of the time between 9 am and 5pm on the weekend,

With a little tuning, I think I can get my daily cost down to around $1.50 plus supply charge.

We’ve had a very positive experience with Amber over the last 10 months.

Our bills for this period will total about $40. This means our exports have covered almost all our connection fee, Amber”s monthly subscription and usage from the grid.

We have 6.6 kw solar, enphase inverters and a powerwall.

I’m in Sydney and 2 others live in the house. There’s usually someone working from home during the week and like to run the air conditioner to be comfortable.

Prior to our solar system we had bills averaging $140 per month. Installing solar with our prior retailers Solar Saver plan with fixed export pricing reduced our bills to about $80 per month. With Amber our bills have varied from $90 in the middle of winter, to this month (November) likely to be a credit of around $100.

Having the real-time prices in the Amber app, means we’re more aware of shifting our usage to times when we use the electricity we’ve generated or when grid prices are cheap. It’s a good feeling that our grid usage usually corresponds to when the % renewables in the grid is highest.

The smart shift functionality to automate buying cheap and selling at the highest prices is fantastic. The selling usually corresponds to when the grid needs support most and is another feel good. I’ve learned to trust smart shift and let it do it’s thing. I haven’t got time to monitor it and probably couldn’t do as good a job anyway.

I’m pleased Amber are working on integration with Enphase inverters. Curtailing exports when prices go negative has not been a big issue so far, as negative feed in rates are rare and haven’t lasted long. It would be more of a worry if didn’t have a battery.

Next is an EV, then getting rid of gas cooktop and hot water. We will take this one step at a time, monitor the impact on our usage and bills. Especially since we can”t easily or cheaply add more solar capacity.

Interesting to see how Jonathon went after 12 months….

I joined Amber in September 2022. Switching from AGL. At that stage I had a modest solar only system (5.5kw array with 5kw SolarEdge inverter). At that stage Amber worked as my solar exports were modest and I was actually buying power. Amber was better than AGL.

In January 2023 we upgraded the solar and added the Solar Edge battery. 11kw array with 8.25kw SE inverter plus 10kwh SE battery). Have to say the new SE battery and inverter have been great, hard working from day one…. faultless.

In January we transitioned to Amber SmartShift for batteries. SE seemed to work well (unlike Jonathan’s experience). Curtailment during negative FiT is an automatic feature for SE. But we soon realised that with a bigger solar system and battery we were no longer buying any electricity only exporting. The export earnings were effected by the regular negative FiT. Sure there were bonus earnings during Surge Events. But our average FiT was 9c.

Have to say the SmartShift software is a bit clunky and needs fine tuning. Also during a 30 minute export window it’s only the last 5 minutes that counts. So the ‘advertised’ $85 FiT is often reduced to a modest 30c (or even negative) as the big utilities cash in and flood the session at the last minute. The biggest FiT we achieved was 89c.

In the end we decided it was too stressful wondering if and when SmartShift would drain the battery. Have switched to Powershop (since March 2023) with a 12c FIT. House has been 95% self powered all year and currently have $200.85 credit from PS.

I think the Amber wholesale electricity model will be the future. But for now conventional retail power with a high FiT makes sense for larger solar system with battery.

Such great feedback, our system has a similar capacity and I had wondered if this would be how the numbers might pan out. Great to hear it tested by somebody, much appreciated.

Thanks Nick,

From your earlier post it looks like you are with Origin Energy. Like Powershop they pay 12c FiT. But Origin have a step down FiT to 7c after 14kwh export. While PS is unlimited. We exported on average 30.7kwh per day last month. So the step down would be unwelcome.

Here is the PS referral link (get $75 joining discount) . Might be worthwhile if PS available in your area. https://secure.powershop.com.au/r/alexanderm-9Zr7Lfh?p=987

That only applies in NSW – all others states Powershop operate are 5c/kWh. They also have a system limit size of 10 kWh but whether that’s PV size or inverter size is unclear.

Thank you, will check it out!

Yep, I had looked at Powershop before, the only plans they seem to have available in my area both have 5c/kWh FiT. Plans seem to vary considerably depending on network provider (Endeavour in our case). But thanks again.

When will Fronius with BYD be compatible with SmartShift?

No timeline was given to me by Amber unfortunately.

Hi @Jonathon – wondering …

(1) will the savings with Amber make the business case for the purchase of your battery financially positive within the lifetime of your battery?

(2) if you had solar PV (with curtailment), load management (to avoid peaks) and possibly an EV (to soak up excess solar) – is there much Amber value left to still financially justify the cost of the battery? In other words should households be doing all these things first, before considering a home battery investment?

Chrs, Peter

Hi Peter,

Great questions.

1) Yes

2) The biggest thing on Amber is to avoid price spikes. The next thing is to profit from them. This is why I wouldn’t personally be on Amber without a battery. Having an EV gives you a great opportunity to soak up low pricing, but does nothing for you when prices are spiking.

Thank you, but still wondering …

1) some details if possible please – what were the 12 month $ savings, and how much did you pay for your battery?

2) My fear is if you do everything else first, there’s little excess generation value left unless your solar system was oversized (and maybe over capitalised). Is spending on a larger solar PV system justifiable just to charge/discharge a battery where ultimately these extra costs still need to be financially recovered?

3) bonus question, I also have a fear with greater amounts of Big battery being installed, price volatility will be reduced in amplitude and frequency. In which case, is a battery investment covering 10 to 15 years potentially risky?

Hi Peter,

Re qn2. Are you trying to decide whether to buy a battery, or whether to sign up to Amber?

Overwhelmingly, the value of a battery lies in its ability to shift consumption. IMHO that should be the basis for a purchase decision.

Amber makes a marginal addition by increasing the differential of that shift.

Consider a battery install without solar: With a flat rate provider, you charge the battery from the grid at any time for 35c/kWh and use the battery at any time, when the (import) price is still 35c/kWh. With Amber, you can charge your battery while the price is 0c/kWh and consume from battery when the equivalent import price would be 70c/kWh.

Given enough battery capacity to run your home *at peak times*, Amber can zero your bill with battery alone. Start with this calculation to right-size and financially justify your system.

The extreme opportunities to sell your electricity at $15kWh are few: prices are high because demand is high, and, at these times, your home will be in peak consumption, and you will be looking for a source of electricity to run it: use your battery or buy at $17kWh. 😉

Hi James – Thanks for the considered response.

I’ve done all the other stuff I mentioned above (curtailment, load-mgmt, EV-soak) and am with Amber (saving about $200 pa vs Powershop).

I’m still struggling to understand whether there’s any financial justification/benefit to buying a home battery (beyond power outage protection). At $11,000 battery purchase cost and saving $500 pa, it would seem not. I’ve thought for some time that batteries need to halve+ in price ($/stored-kWh) to be financially worthwhile; it seems that’s still the case.

Further, if you’re doing the other stuff as mentioned above, the financial justification is even less.

Short answer seems to be no; batteries are (still) not financially worthwhile.

Chrs, Peter

Peter,

1) Did you read the sub-heading “My 12-Month Savings With Amber”? Answers contained within. However – my battery cost $11,000 at time of installation, but that included a state government rebate that no longer exists.

2) Bigger solar system is no issue *if* you have an inverter compatible with Amber’s solar curtailment in the event of a negative feed-in tariff. Remember that having a bigger solar system means you can export solar during high grid prices as well – you don’t just need to rely on your battery.

3) A heck of a lot more battery storage would need to be installed to smooth out volatility curves – I wouldn’t be too concerned. It’s also very hard to predict what would happen that far in the future.

Thank you to all posters here. Lots of good info.

I have considered Amber’s set-up for while now. I have panels, a battery and, thanks to Kim’s excellent Heat Pump Or Conventional Hot Water + Solar analysis – a heat pump.

We, thanks to Covid, work from home (working in the CBD comes at quite a cost!) and so are able to practise load shifting to maximise self-use. (That has been instructive.) We are also familiar with the market and the arbitrage concept.

As a Solar Citizen member, I’m very aware of how the entire FIT system may change after the recently announced Capacity Investment scheme and this government’s lukewarm support for the entire DER/small scale solar system does not fill me with confidence that solar owners, who have done a lot of the emissions “heavy lifting”; are not about to be ripped off. Again.

To the chase. By maximising Self Use and minimising Feed-in, my bill with Powershop is on track to be well below $100 this year. Watching my battery app; I see for 8 months of the year I have a battery at 60-65% SOC when the sun comes up. So there is a saleable surplus there. June/July is shite.

Could I do better with Amber, after covering their $228 annual fee without being tied to a trader’s desk12 hours a day. Its not really about a few bob here or there but I just hate giving the gouging bastards a zac.

I have a 10kw system, no battery, I live in Lake Macquarie. I had Clean Power knock on my door, they have an offer where you pay $23,000 for a 20 kwh AlphaESS battery plus inverter, paid over 6 years interest free. The deal involves being linked to Amber. I’m not sure whether to just buy a battery outright and go to Amber, go with the Clean Power deal which is supposed to pay itself off over 6 years while also reducing my bill, go to Amber with my 10kw panels and no battery or to just leave it because I’m only paying about $200 a quarter now.

$23,000 is a lot of money, especially to reduce a bill that is ‘only’ $200/quarter, in my opinion.

Hi Jonathon. I tend to agree. It may well be possible to turn a profit with 10 kW of panels and a 20 kW battery. But on the face of it, $200 a quarter is $800 per year. And this includes around $300 in connection fees. (Does Amber have those?) Making a profit contributing to the grid notwithstanding, $500 a year is going to pay off a $23,000 battery in 46 years. Of course, my estimate is very rough. It would be interesting to see the model, but I would be suspicious. $23,000 is an expensive battery and 20kW-hr seems huge to me. I use around 8kW-hr from the grid, and I run a spa and A/C (mainly during the day). I am in no rush to connect a battery.

I just installed a 10kW solar system a few weeks ago, and I expect to nearly break even at least in summer. I have a spa and A/C to balance load. My FIT with Origin is locked in at .10 per kW-hr for the year. I will see how I go this winter. It may be worthwhile to switch my HWS to solar electric instead of controlled load to save nearly a couple of hundred a year. I will probably do that and install a heat pump when the current HWS carks it.

I would be wary of battery longevity and guarantees. The wholesale price is hard to predict. Guarantees are only last as long as the vendor stays in business. “Interest-free” is never interest-free; the interest is included in the price.

Sorry, Jonathon. Most of my comments are directed at Cathy J. I made the comment below yours because I was just amplifying what you said…

Very interesting. 20kwh is a lot of battery, and probably more than you really need. I have 10kwh and that covers us most days, though in winter (Canberra) we have to dip into the grid to manage the late evening to morning load.

To be honest, I can’t see you with Amber paying for a $23k system in 6 years, but you would have to go through the numbers. My Amber experience is that the benefits are marginal as most summer days the FIT is either very low or even negative, even if there are occasional peaks to $10+ that might happen once every 3 or 4 weeks.

One advantage of the bigger battery with Amber, is that you can discharge a couple of times a day to grid to take advantage of good FIT and still have enough to manage your home needs. All the best with working it out.

I think there’s a temptation when getting solar (and in the non-solar-owning public) to think something is wrong if anything is being bought from the grid at all. A lot of ‘off-gridders’ out there. The grid is a vital tool, I do my sums across a whole year to figure out performance. Everything we buy from the grid on winter nights or on days it rains all day in winter, we more than make up for in exports in the other 3 seasons.

Doing the sums I realised we could easily fill a second battery every day, even on most winter days. But there’s not really much point, the little we draw from the grid again is more than covered by surpluses in the rest of the year.

For me, on a typical day I buy energy off the grid at between 2 and 20 cents per kWh to charge the car at a rate of 7 kW for about 3 to 4 hours. This costs about 7 x 10 x 6 = $4.20. (lucky my car is at home most days between 10am and 2pm).

At the same time my 5kWp of PV charges the 10kWh battery to 100%.

Then at 2pm I stop buying energy from the grid becuase the price goes up by 20 to 30 cents per kWh (Ausgrid two way tariff helps this). So I sit tight until the feed-in tariff starts to go up then I dump the battery charge as fast as I can and sell all the 10kWh at the best price I can get between 2pm and 8pm (say 40 cents per kWh).

This seems to result in about $2 to $3 per day after I’ve covered charging the car and running the pool pump and all the other household consumption.

Out of the $2 to $3 profit I have to pay Amber their 63 cent daily fee and the grid connection fee which I think is about 80 or 90 cents. This leave a bit over $1 a day profit so my electricity bill is in credit by $30 every month (so far in spring and summer, we’ll see how it goes over winter).

If there’s a spike in feed-in tariff in the eventing I might make $10 for the day but that doesn’t happen very often.

But who know how long those prices will persist. Could change anytime and the two way tariff will be relpaced with a new plan that won’t be as good. But getting paid by my electricity company feels great.

Really interesting to hear the different strategies people use. Do you think about how the car battery might become another element in this, when vehicle/home charging become better integrated?

EV to grid will be a game changer. Imagine 60 kWh available for home use and charged by your solar! And when EV batteries finish their car-life they will still have 80% left to make an ideal home battery.

Absolutely. But I need the right sort of car for that. I think V2G is only possible with a Nissan at the moment and $10k worth of bidirectional charger. I have a Tesla Model Y (my second Tesla). I understand the only Tesla that V2G is possible with is the Cyber Truck. But things may change.

My house battery is a 5 year old Sonnen 10kWh, 9 usable and upgradable to 15. It has a +-3.3kW power rating which limits is ability to feed the grid at speed when the FiT is high. My car has a 75kWh battery and probably a power rating of hundreds of kW. It would run the house for 3 or 4 days without recharging.

I could make a killing on the NEM spot trading with the car battery. Dump the car battery at 7kW (the limit of a 32amp 230v circuit while the FiT hits a peek of $16 for an hour (which happens every couple of months) I’d make $112 for the day and probably $50 on an ordinary day. But I do prefer to keep the car battery between 40% and 70% charged. This will extend the battery life to 15/20 years. I only stretch it on long trips.

Amber is much better when you have deferrable loads you can use to soak up the low/negative FiT. Alternatively you can curtail solar energy when FiT is negative if you have the right setup. Then you make money out of Amber. I have a 10kWh battery (3.3 kW power in/out) and 5kWp solar and I make about $20 per month so far. But I’m managing deferrable loads like pool pump and EV charging. Also in NSW I’m on the two way tariff which helps greatly but may not always be available as is.

As for 20kWh battery Perhaps if you’re American (high kWh per day, household, no clothesline etc), and then I’d look at solar hot water as well.

Thanks, yes I suspected the glowing FITs described by the Clean Power rep weren’t necessarily accurate. He said I’d be a couple of thousand a year better off from the profit so it’s good to hear feedback from an actual Amber customer

Hi folks,

After 5 years I am very close to going electric and abolishing my gas meter.

I want to review my energy provider then. I’m currently with tango and rate is 18.7c kWh.

I don’t have a battery but have solar and an EV.

Would you still recommend Amber or any other provider? I’m based in Melbourne.

I’m not with Amber, but hear such mixed things. I think their technology is pretty good now, and the idea is fantastic. But when I did the sums I still come out ahead going with a retailer. For example I pay nothing for electricity (or supply) every year right now. We make money. With Amber I think I’d be paying about $250 a year just to be part of their system, their monthly fee.

FITs aren’t that interesting to me, I didn’t install solar and battery to ever make much money with tariffs. The big saving is what we use in the home that we don’t have to buy off the grid. But we get enough FIT to cover any winter grid usage, for heating. If that were to change, I may look at a wholesale option again.

Thanks Nick. The main driver like alot of people was not cost but to reduce our carbon footprint. I talked about our journey recently with solar VIC here if you are interested -> https://www.solar.vic.gov.au/home-electrification-long-rewarding-journey

We just got rid of our gas heater and upgraded our split aircon in the living room. The last step is the induction cooktop which fingers crossed will be next week.

I thought this is a good time to revisit our energy provider when I abolish the gas meter. Will do a bit more research and see whats out there.

You can’t really predict or “do the sums” with amber because you can’t predict what wholesale prices are going to do. The money comes in when the FiT hits $18/kWh (AKA spike) and you empty your battery.

This happens every now and then so you never know if or when you might cover your costs. Spikes can be as little as 60 cents and up to about $18 but they all add up.

When a spike does occure you can make enough money to cover the month or more. It all comes down to how powerfull your battery is. Mine will only export at 3.3kW so a more powerfull battery is better at spot trading.

For example a battery with 10kW output will make $180 in one hour if the FiT is spiking to $18/kWh. Two hours and you have $360 in one night.

You never know when this is going to happen but so far it’s happened enough for me to make a small profit this last year with my mesly 3.3kW output. My battery is 15 kWh capacity so it can esport at full speed for over 4 hour but I haven’t seen a spike last that long.

So far this spring it’s been very flat due to the coal fired powerstations deciding to keep generating even at a loss. But summer will come and people will come home and turn their aircons on and that’s when they can’t keep up and the peeker stations have to come in at great cost and up goes the FiT and in comes the $.

So the big difference between normal battery operation and spot trading is you no long only consume battery storage to run the house (AKA self consumption), you consume battery storage to export as fast as you can when the price is at its highest.

Your software has to do this and I use my own I don’t use ambers app. My system also predicts when to charge the car and run the pool pump etc. to get the most of the the predicted tariffs for the day. Its a bit of a science but its what everybody will have to conquer when V2G becomes a thing.

The main advantage of Amber is load shifting if all you have is solar.

If you can consume all your solar energy through the day and/or curtail solar when the FiT goes negative then it may be cost effective.

Hot water system is good for avoiding negative FiT.

Also important to reduce consumption at night when ST is high.

At present we are seeing negative FiT of about -7 cents through the day and even -1 cent supply tariff for a few hours. Great to charge the EV at 7kW and get paid for it.

But nobody can tell you if you are going to be better off as it’s like the stock market.

With a battery you can take advantage of the duck curve and usually come out in the black every year by selling your battery energy at a high price in the evening.

I suspect as more and more batteries are installed the less duck curve benefit we will see. But there are a few years to go before that will happen.

Thanks Robert. Definitely agree with self consumption. We have changed our behaviours in our house over the past few years and look to do most things during the day.

We dont have a battery currently as I was waiting to see what would happen with V2G technology in AU.

Once we abolish the gas meter I will do some research online and see whats out there.

Cheers,

Self consumption is where you use your battery to run the home and don’t export to the grid from the battery for profit (spot trading on the NEM).

People may think that self consumption is ecological and spot trading is profiteering but spot trading or selling your stored energy when the price is high is basically making the NEM unprofitable for coal and gas.

Every dollar you make is a dollar the coal and gas plants don’t make. And that’s what will flatten the price of electricity to the lowest for all.

Hi,

I’m considering moving to Amber with SolarEdge inveter and battery.

Would be great to have a further follow up on your experience in 2024, particularly with the price spikes in Feb and August?

Total 2024 bill was around $900 – which was higher than 2023, but isn’t bad for a family of 4!

Thanks for this. We’ve been with Amber for 12 months with Sungrow inverter & battery & 7.9kw of panels. Moved from gas hw to heat pump 3 months ago & installed our first aircon in December. No gas at all now. We’re currently $130 in credit, but that’s with the $300 govt supplement included.

We moved to Amber 6 months before installing our solar & saved Heaps just by shifting time of use. For retired folks with no solar this is a great option.

In our first month with Amber we made $150 in 30 minutes during a grid melt down. As more renewables enter the grid & wholesale prices continue to fall, these opportunities become fewer. These days when the grid feels shaky I prefer to keep the battery at at least 50% overnight so that if the grid fails we’re covered until solar kicks in again.

I feel that we’d be financially better off with a retail provider & the highest FiT we can find (in Vic), but have found it impossible to compare anticipated costs of an uncurtailed retail system when the only data I have is from a system that has been heavily curtailed to avoid negative FiT.

When you figure out a way to compare an automated Amber system with standard retail I will be very happy!

Meanwhile am happy to maybe spend a little more $ to opt out of the retail system.

Will follow this discussion with interest. Thanks all.

Hi there,

Thanks for all the interesting inputs. I am new to Amber with SmartShift and am a bit puzzled at how this thing works (note I have a Fronius Inverter and a Powerwall2).

Questions:

1) I feel that the max output of my system is somewhat less than it was before joining Amber (I sometimes had up to 5.6 kw/h and now max 4.9)

2) Automatic curtailment when FIT goes negative works but it shuts the system down entirely and not charging the battery or making solar available for house consumption, is that right?

3) I do not get the manual controls in the app, only automated SmartShift Earnings Optimiser and Battery Booster options. Is that a matter of time being with Amber while the system learns about my usage patterns?

Thanks for any input or guidance.

If you can go the next step and take control of not only you battery and EV charging but also control the pool pump and hot water and cloths dryer and dishwasher etc you may be able to get to profit. I use home assistant + EMHASS to do that and haven’t paid anything for energy for two years.

Thought I’d add my own case study living with Amber for over six months, with NO SOLAR and NO BATTERY!! Crazy yes? No actually. Amber have a price cap which maxes out at about 40 something cents per kWh, so no matter how bad the wholesale prices go, you won’t be any worse off than with some retail offerings.

The TLDR is our average consumption charge was 23.1 c/kWh from October 2023 to June 2024. Network connection and Amber fees are about $75 a month. I think Amber deserves a bit more loving from Solar Quotes!

We had an easier time avoiding peak prices by using gas for cooking and hot water during that period, it would be pricier without gas, and we didn’t use much aircon that summer. ABC news touched on how much the retailers add to electricity costs. I wouldn’t be scared of Amber, they just introduce you to the real cost of electricity and give you a chance to work the system.

https://www.abc.net.au/news/2025-02-15/brt-energy-agl-origin-profit-allanfels-electricty-gas-/104938270